DEF 14A: Definitive proxy statements

Published on April 26, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material under §240.14a-12

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

i

3814 Route 44

Millbrook, New York 12545

www.GLOBALSELFSTORAGE.us

Millbrook, New York

April 26, 2024

Dear Fellow Stockholders,

In 2023, we delivered the highest total revenues in our history despite a competitive move-in rate environment and weakened demand due to a slowdown in the housing market and general economic headwinds. Our operational excellence enabled our team to finish the year strong, with a record-high same-store revenue per leased square foot, solid occupancy, and a peer leading average tenant duration of stay. Key milestones we achieved in 2023 include:

It is our pleasure to invite you to the Annual Meeting (“Meeting”) of Stockholders of Global Self Storage, Inc., a Maryland corporation (the “Company”), to be held on June 5, 2024 at 11:00 a.m. ET via a live audio webcast only at www.virtualshareholdermeeting.com/SELF2024. Formal notice of the Meeting appears on the next pages and is followed by the Proxy Statement for the Meeting.

At the Meeting, you will be asked to: elect six directors (Proposal 1); ratify the appointment of RSM US LLP (“RSM”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2); and approve, on a non-binding, advisory basis, the Company’s executive compensation (Proposal 3).

THE BOARD OF DIRECTORS, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

EACH OF THE NOMINEES IN PROPOSAL 1 AND “FOR” PROPOSALS 2 AND 3.

Your vote is important. Whether or not you plan to attend the Meeting, I urge you to authorize a proxy to vote your shares electronically through the Internet, by telephone, or, if you have requested and received a paper copy of the Proxy Statement, by completing, signing, and returning the paper proxy card enclosed with the Proxy Statement according to the instructions.

How to Vote

You may authorize a proxy to vote your shares by proxy in one of three ways:

ii

On behalf of the board of directors and management of the Company, I thank you for your continued support.

Sincerely,

Mark C. Winmill

President and CEO

iii

Notice of Annual Meeting of Stockholders

To Be Held on June 5, 2024

Millbrook, New York

April 26, 2024

To the Stockholders:

Notice is hereby given that the 2024 Annual Meeting of Stockholders (the “Meeting”) of Global Self Storage, Inc., a Maryland corporation (the “Company,” “we,” “our,” or “us”), will be held on June 5, 2024 at 11:00 a.m. ET via a live audio webcast only at www.virtualshareholdermeeting.com/SELF2024. As always, we encourage you to authorize a proxy to vote your shares prior to the Meeting. The Proxy Statement for the Meeting appears on the next pages. At the Meeting stockholders will consider and vote upon the following matters:

Each of the proposals is discussed in the Proxy Statement attached to this Notice. THE BOARD OF DIRECTORS, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES IN PROPOSAL 1 AND “FOR” PROPOSALS 2 AND 3. The board of directors of the Company has fixed the close of business on March 20, 2024 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Meeting or any postponements or adjournments thereof.

Important Notice regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 5, 2024: This Proxy Statement and our 2023 Annual Report to Stockholders are available at https://ir.globalselfstorage.us/sec-filings/all-sec-filings.

The Meeting will be held in a virtual meeting format only. Stockholders must use the following link to access the virtual meeting on the meeting date: www.virtualshareholdermeeting.com/SELF2024.

Upon accessing the link, stockholders must enter the control number found on their proxy card, voting instruction form or notice; otherwise, admittance to the Meeting will not be approved. There will be no physical meeting location established.

It is not necessary to attend the Meeting to vote your shares. To authorize a proxy to vote your shares by telephone or electronically using a smartphone, a tablet or the internet, follow the instructions on the proxy card. To authorize a proxy to vote your shares by mail, mark your vote on the proxy card and follow the mailing directions on the card. The proxy holders will vote your shares according to your directions. If you sign and return your proxy card but do not mark any selections, your shares represented by that proxy will be voted as recommended by the board of directors. Whether or not you expect to attend the virtual meeting, we encourage you to authorize a proxy to vote your shares as soon as possible, in case you later decide not to attend the Meeting. Admittance to the Meeting will be limited to stockholders as of the close of business on the record date. If you hold your shares in “street name” through a brokerage firm, bank, broker-dealer or other intermediary, a notice was forwarded to you by such intermediary and you must follow the instructions provided by such intermediary regarding how to instruct such intermediary to vote your shares. If your shares are held

iv

in “street name” and you desire to vote online during the virtual meeting, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the Meeting.

To authorize a proxy to vote your shares via the Internet, go to www.proxyvote.com and enter the control number found on the enclosed proxy card. You may also authorize a proxy to vote your shares by phone by calling toll free at (800) 690-6903. To authorize a proxy to vote your shares by mail, please complete, sign, and date the enclosed proxy card. You may use the enclosed postage-paid envelope to mail your proxy card or you may attend the Meeting virtually. Instructions for the proper execution of proxies are set forth inside the Proxy Statement. We ask for your cooperation in completing and returning your proxy promptly. The enclosed proxy is being solicited on behalf of the board of directors of the Company.

Sincerely,

Donald Klimoski II

Senior Vice President - Operations, General Counsel, Secretary, and

Chief Compliance Officer

v

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid the time and expense to the Company involved in validating your vote if you fail to sign your proxy card properly.

For example:

Registration |

Valid Signature |

|

Corporate Accounts |

|

(1) ABC Corp. |

ABC Corp., by [title of authorized officer] |

(2) ABC Corp., c/o John Doe Treasurer |

John Doe |

(3) ABC Corp. Profit Sharing Plan |

John Doe, Director |

|

Trust Accounts |

|

(1) ABC Trust |

Jane B. Doe, Director |

(2) Jane B. Doe, Director, u/t/d 12/28/78 |

Jane B. Doe |

|

Custodian or Estate Accounts |

|

(1) John B. Smith, Cust., |

John B. Smith |

|

f/b/o John B. Smith, Jr. UGMA or UTMA |

|

|

(2) Estate of John Doe, John B. Smith, Jr., Executor |

John B. Smith, Jr., Executor |

vi

STATEMENT ON FORWARD LOOKING INFORMATION

Certain information presented in this Proxy Statement may contain “forward-looking statements” within the meaning of the federal securities laws including the Private Securities Litigation Reform Act of 1995. Forward looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward looking statements can be identified by terminology such as “believes,” “plans,” “intends,” “expects,” “estimates,” “may,” “will,” “should,” or “anticipates,” or the negative of such terms or other comparable terminology, or by discussions of strategy. All forward-looking statements made by us involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results to be materially different from those expressed or implied by such statements. We may also make additional forward looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements. All forward-looking statements, including without limitation, our examination of historical operating trends and estimates of future earnings, are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and our belief there is a reasonable basis for them, but there can be no assurance that our expectations, beliefs and projections will result or be achieved.

All forward looking statements apply only as of the date made. Except as required by law, we undertake no obligation to publicly update or revise forward looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this Proxy Statement. Any forward-looking statements should be considered in light of the risks referenced in “Item 1A. Risk Factors” included in our most recent annual report on Form 10-K and in our other filings with the Securities and Exchange Commission (the “SEC”). Such factors include, but are not limited to:

vii

viii

TABLE OF CONTENTS

1 |

|

2 |

|

4 |

|

6 |

|

8 |

|

9 |

|

10 |

|

13 |

|

PROPOSAL 3: to approve, ON A NON-BINDING, ADVISORY BASIS, the Company’s executive compensation. |

14 |

15 |

|

Security Ownership of Certain Beneficial Owners and Management |

23 |

25 |

|

26 |

ix

o

_________________________

PROXY STATEMENT

_________________________

Annual Meeting of Stockholders

To Be Held on June 5, 2024

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Global Self Storage, Inc., a Maryland corporation (the “Company,” “we,” “our,” or “us”), to be voted at the Annual Meeting of Stockholders of the Company to be held on June 5, 2024 at 11:00 a.m. ET (such meeting and any adjournment(s) or postponement(s) thereof are referred to collectively as the “Meeting”) via a live audio webcast only at www.virtualshareholdermeeting.com/SELF2024. As always, we encourage you to authorize a proxy to vote your shares prior to the Meeting.

We will not hold a physical, in-person Meeting. Instead, the Meeting will be held in a virtual meeting format only using an audio webcast.

It is not necessary to attend the Meeting to vote your shares. To authorize a proxy to vote your shares by mail, mark your vote on the proxy card and follow the mailing directions on the card. To authorize a proxy to vote your shares by telephone or electronically using a smartphone, a tablet or the internet, follow the instructions on the proxy card. Whether or not you expect to attend the Meeting, we encourage you to authorize a proxy to vote your shares as soon as possible, in case you later decide not to attend the Meeting. Stockholders of record as of the close of business on the record date for the Meeting who wish to attend the virtual meeting must use the following link on the day of the Meeting:

www.virtualshareholdermeeting.com/SELF2024.

Upon accessing the link, stockholders must enter the control number found on their proxy card, voting instruction form or notice. Otherwise, admittance to the Meeting will not be approved.

The Board has fixed the close of business on March 20, 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting and at any postponements or adjournments thereof (the “Record Date”). It is estimated that proxy materials will be mailed to stockholders of record as of the Record Date on or about April 26, 2024.

On the Record Date, 11,146,179 shares of the Company’s common stock were outstanding. Each outstanding share is entitled to one vote on each of the matters to be voted on at the Meeting. All properly executed and timely received proxies will be voted at the Meeting in accordance with the directions marked thereon or otherwise provided therein. If you properly execute and return your proxies but do not indicate any voting instructions, your shares will be voted “FOR” each of the nominees in Proposal 1 and “FOR” Proposals 2 and 3. Any stockholder may revoke a proxy at any time prior to the exercise thereof by giving written notice to the Secretary of the Company at the Company’s principal executive offices at 3814 Route 44, Millbrook, New York 12545, by properly executing another proxy of a later date, or by personally voting at the Meeting. If your shares are held in "street name" and you desire to change your vote, you should contact the nominee holding shares for you (i.e., a brokerage firm, bank, broker-dealer or other intermediary) for instructions on how to do so.

A COPY OF OUR ANNUAL REPORT ON FORM 10-K (FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”), WHICH CONTAINS ADDITIONAL INFORMATION ABOUT US, IS AVAILABLE FREE OF CHARGE TO ANY STOCKHOLDER AT HTTPS://IR.GLOBALSELFSTORAGE.US/SEC-FILINGS/ALL-SEC-FILINGS. REQUESTS FOR A HARD COPY SHOULD BE DIRECTED TO THE COMPANY AT 3814 ROUTE 44, MILLBROOK, NEW YORK 12545 OR BY TELEPHONE TOLL-FREE AT 1-800-579-1639. OUR ANNUAL REPORT IS NOT TO BE REGARDED AS PROXY SOLICITING MATERIAL.

1

QUESTIONS AND ANSWERS REGARDING THE PROPOSALS

While we strongly encourage you to read the full text of this Proxy Statement, we also are providing the following brief overview of the proposals in “Question and Answer” format. If you have any questions about how to vote your shares, please call toll-free (800) 690-6903.

Question: What proposals will be acted upon at the Meeting?

Question: How does the Board recommend that I vote?

A. After careful consideration of the proposals, the Board, including all those members who are nonemployee independent directors, as defined under the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder and exemptions granted therefrom, both as amended from time to time (the “Exchange Act”), and The Nasdaq Stock Market LLC (“Nasdaq”) Listing Rules (the “Independent Directors”), unanimously approved each proposal and recommends that you vote “FOR” each of the nominees in Proposal 1 and “FOR” Proposals 2 and 3. The reasons for the Board’s recommendations are discussed in more detail in this Proxy Statement.

Question: What are stockholders being asked to approve in Proposal 1?

William C. Zachary has served on the Board and as the chairman of the Board’s audit committee (the “Audit Committee”) since 2016. Zachary is Chief Development Officer at SunLight General Capital, an owner and developer of solar energy systems located at schools, municipal buildings, and other small, institutional users. Prior to that, Zachary was the head of Municipal Finance at Société Générale. Zachary previously served as a director of Tuxis Corporation from 2014 to 2016. Zachary was selected to serve on the Board because of his prior experience serving on the board of another self storage company and his experience in underwriting finance.

Thomas B. Winmill, Esq. has served on the Board since 1997. T. Winmill is a member of the New York State Bar and the SEC Rules Committee and Principal Underwriters Working Group of the Investment Company Institute. T. Winmill also serves as a member of the Town of Walpole Zoning Board of Adjustment. T. Winmill was selected to serve on the Board because of his experience and extensive knowledge of finance, accounting, regulatory, investment, and board operational matters.

George B. Langa has served on the Board and as the chairman of the Board’s nominating & governance committee (the “Nominating & Governance Committee”) since 2016. Langa is a Luxury Collection Specialist, Senior Global Advisor at Berkshire Hathaway Homeservices in New York City and Houlihan Lawrence in Millbrook NY, and a licensed real estate agent in New York State since 2004. Prior to that, Langa served as Executive Vice President of Millbrook Real Estate, LLC, licensed real estate brokers in New York and Connecticut. Langa specializes in premium estates, development, land, commercial and agricultural properties. Langa was selected to serve on the Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

Mark C. Winmill has served as a director, Chief Executive Officer, President, and Chairman of the Board of the Company and its subsidiaries since 2012. M. Winmill manages all aspects of the Company’s self storage facility businesses including, among other things, the formation of business objectives and strategies, identification of potential acquisition targets, development of project plans, retention of employees, establishment of compensation and compensation incentives, negotiation and closing of property acquisitions,

2

obtaining zoning approvals, overseeing construction, and development of leasing and tenant acquisition strategies. M. Winmill was selected to serve on the Board because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations.

Russell E. Burke III has served on the Board and as the chairman of the Board’s compensation committee (the “Compensation Committee”) since 2016. Burke is President of Ninigret Trading Corporation, an art investment and appraisal company. Burke is also a Board Member of the New Britain Museum of American Art. Previously, Burke served as an auction house president and partner with responsibility for storage and disposal in connection with large estates. Burke previously served as a director of Tuxis Corporation from 1997 to 2016. Burke was selected to serve on the Board because of his prior experience serving on the board of a self storage company and his experience and extensive knowledge of the self storage industry.

Sally C. Carroll, Esq. has served as a director on the Board since 2023. Carroll is a retired member of the New York State Bar. During her career, Carroll has served as a consultant to a variety of REITs and asset management firms. Carroll has also served as the general counsel of an investment manager of asset-backed commercial paper conduits, and practiced corporate and securities law at the New York law firms of Gaston & Snow and Jones Day. Carroll has also served as a director of the Farmington Property Owners Association. Carroll holds a B.A. from the University of Virginia and J.D. from the Duke University School of Law. Carroll was selected to serve on the Board because of her legal experience, including in the REIT sector.

Question: What are stockholders being asked to approve in Proposal 2?

Question: What are stockholders being asked to approve in Proposal 3?

Question: How do I vote?

You may also vote during the Meeting. In order to gain admission to the Meeting, you must go to http://www.virtualshareholdermeeting.com/SELF2024 and enter the control number found on your proxy card, voting instruction form or notice. Otherwise, admittance to the Meeting will not be approved.

Question: How can I attend the Meeting?

3

THE BOARD OF DIRECTORS, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES IN PROPOSAL 1, AND “FOR” PROPOSALS 2 AND 3.

PROPOSAL 1: TO ELECT TO THE BOARD EACH OF THE NOMINEES, WILLIAM C. ZACHARY, THOMAS B. WINMILL, ESQ., GEORGE B. LANGA, MARK C. WINMILL, RUSSELL E. BURKE III, AND SALLY C. CARROLL, ESQ., TO SERVE until the COMPANY’S 2025 Annual Meeting of Stockholders AND UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFY.

Upon the recommendation of the Nominating & Governance Committee for nomination by the Board as a candidate for election as a director, with the unanimous approval of the Independent Directors and the Continuing Directors (as defined in the Company’s governing documents), the Board has nominated each of William C. Zachary, Thomas B. Winmill, Esq., George B. Langa, Mark C. Winmill, Russell E. Burke III, and Sally C. Carroll, Esq., for election as a director to serve until the 2025 Annual Meeting of Stockholders and until their successors are duly elected and qualify. The Nominating & Governance Committee may consider, among other things, diversity of gender, race, national origin, ethnicity, culture, age, religion, military service, socio-economic background, and experience and skills as factors in choosing director candidates. The Nominees currently serve as directors of the Company.

In considering William C. Zachary for election, the Board evaluated Zachary’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Zachary should be elected as a director, the Board considered and evaluated Zachary’s relevant knowledge, experience, expertise, and independence. Zachary has served on the Board since 2016. He was selected as a Nominee because of his prior experience serving on the board of a self storage company and his extensive experience in underwriting and finance.

In considering Thomas B. Winmill, Esq. for election, the Board evaluated T. Winmill’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that T. Winmill should be elected as a director, the Board considered and evaluated T. Winmill’s relevant knowledge, experience and expertise. T. Winmill has served on the Board since 1997. T. Winmill was selected as a Nominee because of his experience and extensive knowledge of finance, accounting, regulatory, investment, and board operational matters. The Board also considered T. Winmill’s service as a director on the board of directors of other companies.

In considering George B. Langa for election, the Board evaluated Langa’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Langa should be elected as a director, the Board considered and evaluated Langa’s relevant knowledge, experience, expertise, and independence. Langa has served on the Board since 2016. He was selected as a Nominee because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

In considering Mark C. Winmill, Esq. for election, the Board evaluated M. Winmill’s background and his oversight and service as Chairman of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that M. Winmill should be elected as a director and the Chairman of the Board, the Board considered and evaluated M. Winmill’s relevant knowledge, experience and expertise. M. Winmill has served as Chief Executive Officer, President and Chairman of the Board since 2012. M. Winmill was selected as a Nominee because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations.

In considering Russell E. Burke III for election, the Board evaluated Burke’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Burke should be elected as a director, the Board considered and evaluated Burke’s relevant knowledge, experience, expertise, and independence. Burke has served on the Board since 2016. He was selected as a Nominee because of his prior experience serving on the board of a self storage company and his experience and extensive knowledge of the self storage industry.

In considering Sally C. Carroll, Esq. for election, the Board evaluated Carroll’s background and her oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Carroll should be elected as a director, the Board considered and evaluated Carroll’s relevant knowledge, experience,

4

expertise, and independence. Carroll has served on the Board since 2023. She was selected as a Nominee because of her legal experience, including in the REIT sector.

The Nominees have consented to being named in this Proxy Statement and have agreed to serve if elected. The persons named in the accompanying form of proxy intend to vote each such proxy “FOR” the election of the Nominees unless a stockholder specifically indicates on a proxy the desire to withhold authority to vote for the Nominees. If you properly execute and return your proxy but do not indicate any voting instructions, your shares will be voted for the election of the Nominees. Should either of the Nominees withdraw or otherwise become unavailable for election due to events not now known or anticipated, it is intended that the proxy holders will vote for the election of such other person or persons as the Board may recommend. Unless indicated below, the address of record for each of the Nominees is 3814 Route 44, Millbrook, New York 12545.

The following is biographical information of the Nominees for director of the Company, based upon information furnished by such Nominee:

William C. Zachary, 59, has served as a director and as the chairman of the Audit Committee since 2016. He is Chief Development Officer at SunLight General Capital, one of the largest owners of distributed generation solar energy systems in the northeast. Prior to that, he was the head of Municipal Finance at Société Générale, specializing in taxable and tax-exempt bond investments, interest rate derivatives, and other traditional banking products. He also worked in the Public Finance Department at Smith Barney. Zachary previously served as a Tuxis Corporation director from 2014 to 2016. He was selected to serve on the Board because of his prior experience serving on the board of another self storage company and his extensive experience in underwriting and finance.

Thomas B. Winmill, Esq., 64, has served as a director of our Company since 1997. He is also President, Chief Executive Officer, Chief Legal Officer, and a director or trustee of Dividend and Income Fund, Foxby Corp., and Midas Series Trust (collectively, the “Funds”). He is President, Chief Executive Officer, Chief Legal Officer, and a director of Bexil Advisers LLC and Midas Management Corporation (registered investment advisers and, collectively, the “Advisers”), Midas Securities Group, Inc. (a registered broker-dealer, the “Broker-Dealer”), and Bexil Corporation (a holding company) (“Bexil”). He is President and Chief Legal Officer of Winmill & Co. Incorporated (a holding company) (“Winco”). He is a director of Bexil American Mortgage Inc. (“Bexil American”). He is a member of the New York State Bar and the SEC Rules Committee and Principal Underwriters Working Group of the Investment Company Institute. He also serves as a member of the Town of Walpole Zoning Board of Adjustment. He was selected to serve on the Board because of his experience and extensive knowledge of finance, accounting, regulatory, investment, and board operational matters. He may be deemed to be an “interested person” of the Company due to his relation to Mark Winmill. Mark and Thomas Winmill are brothers. The Funds, the Advisers, Winco, the Broker-Dealer, Bexil, and Bexil American may be deemed to be affiliates of the Company.

George B. Langa, 61, has served as a director of the Company and as the chairman of the Nominating & Governance Committee since 2016. Langa is a Luxury Collection Specialist, Senior Global Advisor at Berkshire Hathaway Homeservices in New York City and Houlihan Lawrence in Millbrook NY, and a licensed real estate agent in New York State since 2004. Prior to that, he served as Executive Vice President of Millbrook Real Estate, LLC, licensed real estate brokers in New York and Connecticut. He specializes in premium estates, development, land, commercial and agricultural properties. He was selected to serve on the Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

Mark C. Winmill, 66, has served as a director, Chief Executive Officer, President and Chairman of the Board of the Company and its subsidiaries since 2012. He is also Chief Executive Officer, President, and a director of Tuxis (a holding company) and its subsidiaries. He is Vice President of the Funds and Chief Investment Strategist of Midas Management Corporation (a registered investment adviser). He is Executive Vice President and a director of Winco. He is a principal of the Broker-Dealer. He manages all aspects of the Company’s self storage facility businesses including, among other things, the formation of business objectives and strategies, identification of potential acquisition targets, development of project plans, retention of employees, establishment of compensation and compensation incentives, negotiation and closing of property acquisitions, obtaining zoning approvals, overseeing construction, and development of leasing and tenant acquisition strategies. He was selected to serve on the Board because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations. He may be deemed to be an “interested person” of the Company due to his role as an officer and director of the Company. Mark and Thomas Winmill are brothers.

Russell E. Burke III, 77, has served as a director and as the chairman of the Compensation Committee since 2016. He is President of Ninigret Trading Corporation, an art investment and appraisal company. He is also a Board Member of the New

5

Britain Museum of American Art. Previously, he served as an auction house president and partner with responsibility for storage and disposal in connection with large estates. Burke previously served as a director of Tuxis Corporation from 1997 to 2016. Burke was selected to serve on the Board because of his prior experience serving on the board of a self storage company and his experience and extensive knowledge of the self storage industry.

Sally C. Carroll, Esq., 63, has served as a director on the Board since 2023. Carroll is a retired member of the New York State Bar. During her career, Carroll has served as a consultant to a variety of REITs and asset management firms. Carroll has also served as the general counsel of an investment manager of asset-backed commercial paper conduits, and practiced corporate and securities law at the New York law firms of Gaston & Snow and Jones Day. Carroll has also served as a director of the Farmington Property Owners Association. Carroll holds a B.A. from the University of Virginia and J.D. from the Duke University School of Law. Carroll was selected to serve on the Board because of her legal experience, including in the REIT sector.

Vote Required

As set forth in the Company’s bylaws, except as otherwise provided in the Company’s charter and notwithstanding any other provision of Maryland law, unless all nominees for director are approved by a majority of the Continuing Directors (as such term is defined in the Company’s governing documents), the affirmative vote of the holders of at least two-thirds of the outstanding shares of all classes of voting stock, voting together, shall be required to elect a director. However, if all nominees for director are approved by a majority of the Continuing Directors, a plurality of all the votes cast at a meeting at which a quorum is present shall be sufficient to elect a director. Inasmuch as the election of each of the Nominees was approved by a majority of the Continuing Directors, a plurality of all the votes cast at the Meeting at which a quorum is present shall be sufficient to elect each of the Nominees. Because directors will be elected by a plurality of the votes cast in the election of directors, and no additional nominations may properly be presented at the Meeting, “withhold” votes will have no effect on the result of the vote on this proposal. Abstentions and broker non-votes are not votes cast and will have no effect on the result of the vote on this proposal, although they will be considered present for the purpose of determining the presence of a quorum. Proxies solicited by the Board will be voted "FOR" each of the Nominees, unless otherwise instructed.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE NOMINEES.

BOARD OF DIRECTORS AND COMMITTEE MATTERS

The Board is responsible for overseeing our affairs. The Board conducts its business through meetings and actions taken by written consent in lieu of meetings. Each of the Nominees currently serves as a director of the Board.

Board Committees and Board Meetings

Audit Committee. The Board has an Audit Committee, comprised of Zachary (Chair), Burke, Langa, and Carroll. The Board determined that all of the members of the Audit Committee are independent as required by the Nasdaq Listing Rules and SEC rules governing the qualifications of Audit Committee members. The Board has also determined, based upon its qualitative assessment of their relevant levels of knowledge and business experience, that Zachary, Burke and Langa qualify as “audit committee financial experts” for purposes of, and as defined by, the SEC rules and possess the requisite financial sophistication, as required by the Nasdaq Listing Rules. The purpose of the Audit Committee is to meet with the Company’s independent registered public accounting firm (“independent registered public accounting firm”) to review its financial reporting, external audit matters, and fees charged by the Company’s independent registered public accounting firm and to evaluate the independence of the independent registered public accounting firm. The Audit Committee is also responsible for recommending the selection, retention, or termination of the Company’s independent registered public accounting firm, reviews with the independent registered public accounting firm the plans and results of the audit engagement, reviews the adequacy of the Company’s internal accounting controls, and reviews any other relevant matter to seek to provide integrity and accuracy in the Company’s financial reporting. The Audit Committee met four times during the fiscal year ended December 31, 2023. A current copy of the Audit Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Compensation Committee. The Board has a Compensation Committee, comprised of Burke (Chair), Langa, Zachary, and Carroll. The Board determined that all of the members of the Compensation Committee are independent as required by the Nasdaq Listing Rules. The role of the Compensation Committee is to assist the Board by: (i) making decisions on the compensation of the Company’s executive officers; (ii) reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer’s compensation, evaluating his performance relative to those goals and objectives, and setting his

6

compensation annually; and (iii) assisting the Board with other related tasks, as assigned from time to time. The Compensation Committee may delegate its responsibilities to subcommittees as it deems appropriate. The Compensation Committee met two times during fiscal year ended December 31, 2023. A current copy of the Compensation Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Nominating & Governance Committee. The Board has a Nominating & Governance Committee comprised of Langa (Chair), Burke, Zachary, and Carroll. The primary nominating related purposes and responsibilities of the Nominating & Governance Committee are: (i) to identify individuals qualified to become members of the Board in the event that a position is vacated or created, (ii) to consider all candidates proposed to become members of the Board, subject to the procedures and policies set forth in the Nominating & Governance Committee Charter, the Company's charter, the Company's bylaws, and resolutions of the Board, (iii) to select and nominate, or recommend for nomination by the Board, candidates for election as Directors, and (iv) to set any necessary standards or qualifications for service on the Board. The primary governance related purposes and responsibilities of the Nominating & Governance Committee are: (i) to monitor and oversee management’s efforts and activities on environmental, social, and governance matters, (ii) to periodically review Board and committee performance and recommend appropriate changes to the committees of the Board as the Nominating & Governance Committee deems necessary and/or advisable, (iii) to periodically review the Company’s Code of Conduct and Ethics, Conflict of Interest and Corporate Opportunities Policy, and other corporate governance documents applicable to the Company and recommend changes to those governance documents as the Nominating & Governance Committee deems necessary and advisable, (iii) to review the charter and composition of each committee of the Board and recommend appropriate changes as the Committee deems necessary and/or advisable; and (iv) to otherwise take a leadership role in shaping the corporate governance of the Company. The Nominating & Governance Committee met five times during fiscal year ended December 31, 2023. A current copy of the Nominating & Governance Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Executive Committee. The Board has an executive committee (the “Executive Committee”), comprised of Mark Winmill, which may meet from time to time, the function of which is to exercise the powers of the Board between meetings of the Board to the extent permitted by law to be delegated and not delegated by the Board to any other committee. The Executive Committee did not meet during the fiscal year ended December 31, 2023.

Committee of Continuing Directors. The Company has a committee of continuing directors (the “Committee of Continuing Directors”) which may meet from time to time, to take such actions as are required by the governing documents of the Company. The Committee of Continuing Directors is comprised of Burke, Langa, Zachary, Mark Winmill, Thomas Winmill, and Carroll. The Committee of Continuing Directors did not meet during the fiscal year ended December 31, 2023.

For the fiscal year ended December 31, 2023, the Board held two regularly scheduled meetings and two special meetings. For the fiscal year ended December 31, 2023, each of the directors currently in office attended 100% of the total number of meetings of the Board and of all committees of the Board on which such directors served during the period.

Director Compensation

Members of the Board who are not independent receive no compensation for their service as directors. Currently, the Independent Directors are paid an annual retainer of $2,000, payable semi-annually, a fee of $10,500 for each semi-annual regular Board meeting attended, $250 for each special Board meeting attended, $250 for each committee meeting attended, $500 per annum per committee chaired, and $500 for attendance at the Company’s annual meeting of stockholders. Each Independent Director is reimbursed for reasonable travel and out-of-pocket expenses associated with attending Board and committee meetings.

Retainer payments are prorated when a director joins the Board other than at the beginning of a calendar year.

Each Independent Director may elect to receive, at any time, the value of their cash compensation in shares of common stock of the Company reserved under the 2017 Equity Incentive Plan (the "Plan").

7

A summary of the compensation and benefits for the Independent Directors for the fiscal year ended December 31, 2023 is shown in the following table:

2023 Director Compensation

Name |

|

Fees earned in cash (1) ($) |

|

|

Share awards (1) ($) |

|

All other compensation ($) |

|

|

Total ($) |

|

||||||

Russell E. Burke III |

|

$ |

14,503 |

|

$ |

11,747 |

|

$ |

- |

|

|

$ |

26,250 |

|

|||

George B. Langa |

|

$ |

26,250 |

|

$ |

- |

|

$ |

- |

|

|

$ |

26,250 |

|

|||

William C. Zachary |

|

$ |

14,503 |

|

$ |

11,747 |

|

$ |

- |

|

|

$ |

26,250 |

|

|||

Sally C. Carroll, Esq. |

|

$ |

11,539 |

|

$ |

- |

|

$ |

- |

|

|

$ |

11,539 |

|

|||

(1) Each of Messrs. Burke and Zachary elected to receive payment of a portion of the value of his cash compensation in shares of common stock. Accordingly, Burke and Zachary were each awarded 2,294 shares of common stock from the Plan. The shares were unrestricted and vested immediately. The dollar values shown in the table for the share awards represent the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718.

Qualifications of the Board

Each director’s background and his oversight and service as a member of other boards of directors was evaluated in determining whether he/she should serve as a director of the Company. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that each person should serve as a director of the Company, each director’s relevant knowledge, experience, expertise, and independence was considered and evaluated. Burke was selected to serve on the Board because of his prior experience serving on the board of another self storage company and his experience and extensive knowledge of the self storage industry. Langa was selected to serve on the Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management. Zachary was selected to serve on the Board because of his prior experience serving on the board of another self storage company and his experience in underwriting finance. Carroll was selected to serve on the Board because of her legal experience, including in the REIT sector. Thomas Winmill, Esq. was selected to serve on the Board because of his experience with finance, accounting, regulatory, investment, and board operational matters as a result of his service as an officer and director for more than 20 years of the Funds. Mark Winmill was selected to serve on the Board because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations. Each of the directors has experience with finance, accounting, regulatory, and board operational matters as a result of his/her service as a director on the Board and other boards of directors.

EXECUTIVE OFFICERS

The Company’s named executive officers, other than Mark Winmill who also serves as a director, and their relevant biographical information are set forth below, based on the information furnished by such executive officer:

Thomas O’Malley, 65, has served as our Chief Financial Officer, Chief Accounting Officer, Treasurer, and Senior Vice President since 2005. He oversees financial reporting for the Company and assists the Chief Executive Officer in acquiring, developing, managing, and operating the Company's self storage facility businesses. He is also Chief Financial Officer, Chief Accounting Officer, Treasurer, and Vice President of the Funds, the Advisers, the Broker-Dealer, Bexil, Tuxis, and Winco. He is a certified public accountant.

Donald Klimoski II, Esq., 43, has served as our General Counsel, Secretary, Chief Compliance Officer since 2017 and Senior Vice President - Operations since 2022. He oversees the operations of the Company and legal and compliance matters, and assists in acquiring, developing, managing, and operating the Company’s self storage facility businesses. Klimoski also serves as General Counsel, Secretary, and Chief Compliance Officer of Tuxis; Klimoski also serves as Co-General Counsel, Secretary, and Chief Compliance Officer of Winco; and Assistant Secretary, Assistant General Counsel, and Assistant Chief Compliance Officer of the Funds, the Advisers, and Bexil. Prior to joining the Company, Klimoski served as the Associate General Counsel of Commvault Systems, Inc. from 2014 to 2017. Prior to leaving private practice, Klimoski was an associate at Sullivan and Cromwell LLP from 2008 to 2014. Klimoski began his legal career as a law clerk to the Honorable Freda L. Wolfson

8

of the United States District Court of New Jersey. He is admitted as a member of the United States Patent and Trademark Office, and the New York and New Jersey State Bars.

Overview

We are focused on building our company for the long-term to generate sustainable growth. To that end, we have established a cross-functional Environmental, Social, and Governance (“ESG”) committee, comprised of management, responsible for establishing our sustainability priorities and objectives. Management regularly evaluates sustainability risks faced by our portfolio and believes the low obsolescence, geographic diversification, and low emissions of our portfolio help to mitigate those risks. Our ESG committee reports annually to the Board on the status of our ESG program, our progress against the goals we have set, and provide updates on the various initiatives we have undertaken to improve our sustainability.

A key area of focus from a sustainability perspective is minimizing the impact we make on the environment. Self-storage remains a low-environmental impact business as it consumes less energy and water while emitting fewer greenhouse gases than other real estate property types. We continue to look for ways to further reduce our low impact through a variety of initiatives including solar panel installations, HVAC upgrades, high-efficiency LED lighting retrofits, energy management systems, and paper reduction through our online rental platform. We continue to explore the installation of solar panels at our properties which we expect would reduce energy consumption and costs at such locations.

Environmental

We are committed to managing climate-related risks and opportunities in relation to our business. This commitment is a key component of our recognition that we must operate in a responsible and sustainable manner that aligns with our long-term corporate strategy and promotes our best interests along with those of our stakeholders, including our tenants, investors, employees, and the communities in which we operate.

Our ESG committee guides our commitment to sustainability and will have primary responsibility for climate-related activities. Our ESG committee reports annually to the Board, which oversees all of our sustainability initiatives.

We consider potential environmental impacts—both positive and negative—in our decision making across the business. The following features of our properties reflect our commitment to responsible environmental stewardship:

Social

We seek to create a diverse and inclusive work environment that values each employee’s talents and contributions. Our success relies on the general professionalism of our property managers and staff which are contributing factors to our ability to successfully secure rentals, retain tenants and maintain clean and secure self storage properties. We seek to increase employee retention and well-being and our employees enjoy an attractive benefit package that includes medical, dental, vision, life insurance, 401(k) with matching employer contribution, cash bonuses, and long-term equity compensation. We offer competitive health benefits and encourage our employees to participate in employee health and wellness programs. We also offer individualized counseling to our employees to assist them with their journey towards better health.

We also seek to promote diversity among our employees and management team. As of December 31, 2023, approximately 40% of our non-store (including finance, human resources, accounting, tax, legal, and marketing, but excluding store-level

9

operations) employees were women. As of December 31, 2023, we had 35 employees, which includes employees of our property management platform.

In order to attract and retain diverse top talent, we offer training and development opportunities for our employees. In 2023, we offered training and development for our employees, which included anti-harassment training, cyber security training, and site manager training. We value the safety of our employees and provide regular training for our employees to increase safety at our properties. During 2024, we continued to make masks and other personal protective equipment available to our employees.

Governance

We remain committed to strong governance practices and the highest ethical standards. For further details on our corporate governance, see the section of this proxy statement titled “Corporate Governance.”

CORPORATE GOVERNANCE

Code of Conduct and Ethics

We have adopted a Code of Conduct and Ethics in compliance with rules of the SEC that applies to all of our personnel, including the Board, Chief Executive Officer and Chief Financial Officer. The Code of Conduct and Ethics is available free of charge on the “Governance Documents” section of our website at www.GlobalSelfStorage.us. We intend to satisfy any disclosure requirements under Item 5.05 of Form 8-K regarding amendments to, or waivers from, provisions of our Code of Conduct and Ethics by posting such information on our web site at the address specified above.

Director Independence

The Nasdaq Listing Rules generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and governance committees be independent.

Accordingly, the Board has evaluated the independence of its members based upon the rules of Nasdaq and the SEC and the transactions referenced under “Certain Relationships and Related Party Transactions” in this Proxy Statement. Applying these standards, the Board determined that none of the directors who currently serve, other than Mark and Thomas Winmill, have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that Burke, Langa, Zachary, and Carroll are “independent” as that term is defined under Rule 5605(a)(2) of the Nasdaq Listing Rules. Mark and Thomas Winmill are not considered independent because they are officers of the Company and/or its affiliates. The Board also determined that each non-employee director who serves as a member of the Audit, Compensation and Nominating & Governance Committees satisfies the independence standards for such committee established by the SEC and the Nasdaq Listing Rules, as applicable.

Current Board Leadership Structure and Oversight Responsibilities

The Board is responsible for the oversight of the Company’s operations. The Board is currently composed of six members, four of whom are Independent Directors. As described above, the Board has established five standing committees, the Audit Committee, Compensation Committee, Nominating & Governance Committee, Executive Committee and Committee of Continuing Directors, and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. The inclusion of all Independent Directors as members of the Audit, Compensation, Nominating & Governance, and Continuing Directors committees allows all the Independent Directors to participate in the full range of the Board’s oversight duties, including oversight of risk management processes discussed below.

The Board has designated Mark Winmill to serve as the Chairman of the Board (the “Chairman”). M. Winmill has been active in the real estate and self storage industries for over 20 years as chief executive officer and in other capacities. The Chairman presides at each Board meeting, establishes the agenda for Board meetings, and acts as the primary liaison between the Independent Directors and Company management. The Chairman of the Board is an “interested person” of the Company. The Independent Directors have not appointed a lead Independent Director. The Independent Directors believe that the utilization of an interested person as Chairman provides an efficient structure for them to coordinate with Company management in carrying out their responsibilities. The Chairman plays an important role in communicating with them in identifying matters of special interest to be addressed by Company management and the Board. The Chairman may also perform such other functions as may be requested by the directors from time to time. Designation as Chairman does not impose on such director any duties or standards

10

greater than or different from other directors. The directors believe that the Board’s leadership structure, taking into account, among other things, its committee structure, which permits certain areas of responsibility to be allocated to the Independent Directors, is appropriate given the characteristics and circumstances of the Company.

Risk Oversight

The operation of the Company generally involves a variety of risks. As part of its oversight of the Company, the Board oversees risk management through various regular Board and committee activities. The Board, directly or through its committees, reviews reports from, among others, the Company’s management, including the Company’s Chief Compliance Officer, the Company’s independent registered public accounting firm, outside legal counsel, and others, as appropriate, regarding risks faced by the Company and the extent of its risk management programs. Although the Company’s risk management program is designed to be effective, there is no guarantee that it will anticipate or mitigate all risks. Not all risks that may affect the Company can be identified, eliminated, or mitigated and some risks may not be anticipated or may be beyond the control of the Board or the Company.

Information Regarding the Company’s Process for Director Candidate Recommendations and Director Selection Criteria

In identifying potential nominees for the Board, the Nominating & Governance Committee may consider candidates recommended by one or more of the following sources: (i) the Company’s current directors, (ii) the Company’s officers, (iii) the Company’s affiliates, (iv) the Company’s stockholders, and (v) any other source the Nominating & Governance Committee deems to be appropriate. The Nominating & Governance Committee will not consider self-nominated candidates. The Nominating & Governance Committee may, but is not required to, retain a third-party search firm at the Company’s expense to identify potential candidates. The Nominating & Governance Committee may consider, among other things, diversity of gender, race, national origin, ethnicity, culture, age, religion, military service, socio-economic background, and experience and skills as factors in choosing director candidates, but has not adopted any specific policy in this regard.

Pursuant to the Company’s governing documents, to qualify as a nominee for a directorship, an individual, at the time of nomination, (i)(A) shall be a resident United States citizen and have substantial expertise, experience or relationships relevant to the business of the Company, and (B) shall have a master’s degree in economics, finance, business administration or accounting, a graduate professional degree in law from an accredited university or college in the United States or the equivalent degree from an equivalent institution of higher learning in another country, or a certification as a public accountant in the United States, or be deemed an “audit committee financial expert” as such term is defined in Item 401 of Regulation S-K (or any successor provision) of the Exchange Act; or (ii) shall be a current director of the Company. In addition, to qualify as a nominee for a directorship or election as a director, (i) an incumbent nominee shall not have violated any provision of the Conflicts of Interest and Corporate Opportunities Policy (the “Policy”), adopted by the Board on July 8, 2003, as subsequently amended or modified, and (ii) an individual who is not an incumbent director shall not have a relationship, hold any position or office or otherwise engage in, or have engaged in, any activity that would result in a violation of the Policy if the individual were elected as a director. The Nominating & Governance Committee, in its sole discretion, shall determine whether an individual satisfies the foregoing qualifications. Any individual who does not satisfy the qualifications set forth under the foregoing provisions of this section shall not be eligible for nomination or election as a director. In addition, no person shall be qualified to be a director unless the Nominating & Governance Committee, in consultation with counsel to the Company, has determined that such person, if elected as a director, would not cause the Company to be in violation of, or not in compliance with, applicable law, regulation or regulatory interpretation, or the Company’s charter, or any general policy adopted by the Board regarding either retirement age or the percentage of interested persons and non-interested persons to comprise the Company’s Board.

The Nominating & Governance Committee will consider and evaluate nominee candidates properly submitted by stockholders on the basis of the same criteria used to consider and evaluate candidates recommended by other sources. Nominee candidates proposed by stockholders will be properly submitted for consideration by the Nominating & Governance Committee only if the qualifications and procedures set forth in the Nominating & Governance Committee charter, as it may be amended from time to time by the Nominating & Governance Committee or the Board, are met and followed (recommendations not properly submitted will not be considered by the Nominating & Governance Committee).

A candidate recommended for nomination as a director submitted by a stockholder will not be deemed to be properly submitted to the Nominating & Governance Committee for the Nominating & Governance Committee’s consideration unless the following qualifications have been met and procedures followed:

11

1. A stockholder or group of stockholders (referred to in either case as a “Nominating Stockholder”) that, individually or as a group, has beneficially owned at least 5% of the Company’s common stock for at least two years prior to the date the Nominating Stockholder submits a candidate for nomination as a director may submit one candidate to the Nominating & Governance Committee for consideration at an annual meeting of stockholders.

2. The Nominating Stockholder must submit any such recommendation (a “Stockholder Recommendation”) in writing to the Company, to the attention of the Secretary, at the address of the principal executive offices of the Company.

3. The Stockholder Recommendation must be delivered to or mailed and received at the principal executive offices of the Company not less than 120 calendar days before the first anniversary date of the Company’s proxy statement released to stockholders in connection with the previous year’s annual meeting of stockholders.

4. The Stockholder Recommendation must include: (i) a statement in writing setting forth (A) the name, date of birth, business address and residence address of the person recommended by the Nominating Stockholder (the “Candidate”); (B) any position or business relationship of the candidate, currently or within the preceding five years, with the Nominating Stockholder or an Associated Person of the Nominating Stockholder (as defined below); (C) the class or series and number of all shares of stock of the Company owned of record or beneficially by the Candidate, as reported to such Nominating Stockholder by the Candidate; (D) any other information regarding the Candidate that is required to be disclosed about a nominee in a proxy statement or other filing required to be made in connection with the solicitation of proxies for election of directors pursuant to the Exchange Act; (E) whether the Nominating Stockholder believes that the Candidate is or will be an Independent Director and, if believed not to be an “independent director,” information regarding the Candidate that will be sufficient for the Company to make such determination; and (F) information as to the Candidate’s knowledge of the Company’s industry, experience as a director or senior officer of public companies, and educational background; (ii) the written and signed consent of the Candidate to be named as a nominee and to serve as a director if elected; (iii) the written and signed agreement of the Candidate to complete a directors’ and officers’ questionnaire if elected; (iv) the Nominating Stockholder’s consent to be named as such by the Company; (v) the class or series and number of all shares of stock of the Company owned beneficially and of record by the Nominating Stockholder and any Associated Person of the Nominating Stockholder and the dates on which such shares were acquired, specifying the number of shares of stock owned beneficially but not of record by each, and stating the names of each as they appear on the Company’s record books and the names of any nominee holders for each; and (vi) a description of all arrangements or understandings between the Nominating Stockholder, the Candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made by the Nominating Stockholder. “Associated Person of the Nominating Stockholder” as used herein means any person required to be identified pursuant to clause (vi) and any other person controlling, controlled by or under common control with, directly or indirectly, (a) the Nominating Stockholder or (b) any person required to be identified pursuant to clause (vi).

5. The Nominating & Governance Committee may require the Nominating Stockholder to furnish such other information as it may reasonably require or deem necessary to verify any information furnished pursuant to the requirements of the Nominating & Governance Committee charter or to determine the qualifications and eligibility of the Candidate proposed by the Nominating Stockholder to serve on the Board. If the Nominating Stockholder fails to provide such other information in writing within seven days of receipt of written request from the Nominating & Governance Committee, the recommendation of such Candidate as a nominee will be deemed not properly submitted for consideration, and will not be considered, by the Nominating & Governance Committee.

A detailed description of the criteria used by the Nominating & Governance Committee as well as information required to be provided by stockholders submitting candidates for consideration by the Nominating & Governance Committee are included in the Nominating & Governance Committee charter. The Nominating & Governance Committee charter, as amended, was approved by the Board on March 25, 2024.

Audit Committee Financial Expert

The Board has determined that it has three “audit committee financial experts” (as that term is defined under SEC rules implementing Section 407 of the Sarbanes-Oxley Act) serving on the Audit Committee, each of whom are “independent” directors that satisfy the heightened audit committee independence requirements under the Nasdaq Listing Rules and Rule 10A-3 of the Exchange Act. Further, each member of the Audit Committee possesses the requisite financial sophistication, as required by the Nasdaq Listing Rules.

Executive Sessions of Independent Directors

12

The Independent Directors serving on the Board regularly meet in executive session with outside counsel at board meetings.

Director Attendance at Annual Meetings of Stockholders

The Company does not have a formal policy regarding attendance by directors at annual meetings of stockholders but encourages such attendance. The Company held an annual meeting of stockholders for the fiscal year ended December 31, 2023 on June 6, 2023, at which all directors were in attendance.

Whistleblower Procedures

The Audit Committee has established procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (ii) the confidential and anonymous submission by the Company’s employees of concerns regarding questionable accounting or auditing matters. If you wish to contact the Audit Committee to report complaints or concerns relating to the financial reporting of the Company, you may do so by delivering the report via regular mail, which may be mailed anonymously, to the Audit Committee Chair, c/o Global Self Storage Inc., 3814 Route 44, Millbrook, New York 12545.

PROPOSAL 2: TO ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

The Audit Committee is empowered to appoint a firm to serve as the Company’s independent registered public accounting firm. The Audit Committee has previously appointed RSM to serve as the Company’s independent registered public accounting firm for the fiscal period commencing January 1, 2024. RSM served as the Company’s independent registered public accounting firm for the year ended December 31, 2023.

Although the Audit Committee has sole authority to appoint, re-appoint, and dismiss the Company’s independent registered public accounting firm, it is seeking the opinion of the stockholders regarding its appointment of RSM as the Company’s independent registered public accounting firm. For this reason, stockholders are being asked to ratify this appointment. If stockholders ratify the appointment of RSM as the Company’s independent registered public accounting firm, the Audit Committee will take that fact into consideration, but may, nevertheless, dismiss RSM. If stockholders do not ratify the appointment of RSM as the Company’s independent registered public accounting firm, the Audit Committee will take that fact into consideration, but may, nevertheless, continue to retain RSM.

Representatives of RSM are expected to be present at the Annual Meeting and will be provided with an opportunity to make a statement if so desired and to respond to appropriate inquiries.

Audit and Non-Audit Fee Table

The following table presents the aggregate fees for professional audit services rendered for the integrated audits of our annual financial statements for the years ended December 31, 2023 and 2022, for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q for those fiscal years and fees billed for other services rendered during those periods.

|

|

2023 |

|

|

2022 |

|

||

Audit fees (1) |

|

$ |

224,570 |

|

|

$ |

182,310 |

|

Audit - related fees (2) |

|

|

25,750 |

|

|

|

12,360 |

|

Tax fees (3) |

|

|

73,603 |

|

|

|

68,847 |

|

Total(4) |

|

$ |

323,923 |

|

|

$ |

261,517 |

|

(1) Audit fees consist of services rendered for the audit of our annual financial statements and other financial disclosures, review of the consolidated financial statements included in our Form 10-Q filings.

(2) Audit-related fees represent professional fees for accounting consultation and consents issued related to registration statements, and comfort letters.

(3) Tax fees represent professional services rendered for tax compliance, tax advice and tax planning.

(4) There were no amounts under “all other fees” for 2022 and 2023.

13

Audit Committee Pre-Approval of Services by the Independent Registered Public Accounting Firm

In accordance with the Audit Committee charter, which sets forth the Audit Committee’s responsibilities, and applicable rules and regulations adopted by the SEC, the Audit Committee reviews and pre-approves any engagement of the independent registered public accounting firm to provide audit, review or attest services or non-audit services and the fees for any such services. The Audit Committee annually considers and, if appropriate, approves the provision of audit services by the independent registered public accounting firm. In addition, the Audit Committee periodically considers and, if appropriate, approves the provision of any additional audit and non-audit services by our independent registered public accounting firm that are neither pre-approved by the Audit Committee on an annual basis nor prohibited by applicable rules and regulations of the SEC. The Audit Committee has delegated to the chairman of the Audit Committee, Zachary, the authority to pre-approve, on a case-by-case basis, any such additional audit and non-audit services to be performed by our independent registered public accounting firm. Zachary reports any decision to pre-approve such services to the Audit Committee at its next regular meeting. All of the fees described in the table above were pre-approved by the Audit Committee.

Report of the Audit Committee

The Audit Committee has reviewed and discussed the Company’s audited financial statements in the Company’s annual report on Form 10-K for the year ended December 31, 2023 with Company management and RSM. The Audit Committee has also discussed with RSM the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Audit Committee has received the written disclosures and the letter from RSM pursuant to the applicable requirements of the PCAOB regarding RSM’s communications with the Audit Committee concerning independence and the Audit Committee has discussed with RSM its independence with respect to the Company.

Based on the foregoing review and discussions, the Audit Committee recommended to the Board (and the Board approved) that the Company’s audited financial statements be included in the Company’s annual report on Form 10-K for the year ended December 31, 2023 filed with the SEC.

Russell E. Burke III, Member of the Audit Committee

George B. Langa, Member of the Audit Committee

William C. Zachary, Chairman of the Audit Committee

Sally C. Carroll, Esq., Member of the Audit Committee

The foregoing Audit Committee Report shall not be deemed under the Securities Act of 1933, as amended, or the Exchange Act, to be (i) “soliciting material” or “filed” or (ii) incorporated by reference by any general statement into any filing made by us with the SEC, except to the extent that we specifically incorporate such report by reference.

Vote Required

Under Section 6 of Article II of the Company’s bylaws, a majority of the votes cast at a meeting of stockholders duly called and at which a quorum is present is sufficient to approve any matter which may properly come before the Meeting, unless more than a majority of the votes cast is required by statute or the Company’s charter. Inasmuch as Proposal 2 does not require a greater vote by statute or the Company’s charter, a majority of all the votes cast at the Meeting at which a quorum is present is sufficient to ratify the appointment of the independent registered public accounting firm. Abstentions are not votes cast and will have no effect on the result of the vote on this proposal, although they will be considered present for the purpose of determining the presence of a quorum. Proxies solicited by the Board will be voted "FOR" this proposal, unless otherwise instructed.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE PROPOSAL TO RATIFY THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

PROPOSAL 3: to approve, ON A NON-BINDING, ADVISORY BASIS, the Company’s executive compensation.

As required by Section 14A of the Exchange Act, and in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, stockholders are being asked to approve, on a non-binding, advisory basis, the Company’s executive

14

compensation. This “say-on-pay” vote is a non-binding, advisory vote on whether to approve the Company’s executive compensation as disclosed pursuant to the SEC’s compensation disclosure rules (which disclosure includes the following compensation tables and related material disclosed in this Proxy Statement).

In connection with our 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”), we submitted our executive compensation program to our stockholders for approval, on a non-binding, advisory basis (also known as “Say-on-Pay”). Approximately 86% of voting stockholders at the 2023 Annual Meeting approved our executive compensation program. The Compensation Committee reviews our executive compensation program annually to ensure it is aligned with our long-term business strategy and encourages the creation of long-term stockholder value. At the 2023 Annual Meeting, our stockholders also approved, on a non-binding, advisory basis, “every one year” for the frequency of the “say-on-pay” vote. The Compensation Committee considered such strong stockholder support as an endorsement of the Company’s executive compensation program and policies. The Compensation Committee values the opinions of our stockholders and will continue to consider those opinions when making future executive compensation decisions.

Our executive compensation program reflects the philosophy that compensation should reward executives for outstanding individual performance and, at the same time, align the interests of executives closely with those of stockholders. To implement that philosophy, the Company aims to reward above average corporate performance and recognize individual initiative and achievements. Our executive compensation program is designed to attract, retain, motivate, and reward key executives and align their interests with that of our stockholders. As such, we believe that our executive compensation program and the corresponding executive compensation detailed in this Proxy Statement are aligned with the long-term interests of our stockholders.

As an advisory vote, this proposal is not binding upon the Company. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by stockholders in their vote on this proposal, and intends to consider the outcome of the vote when making future compensation decisions for our executive officers.

The Board strongly endorses the Company’s executive compensation program and recommends that stockholders vote in favor of the following resolution:

RESOLVED, that the stockholders approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers as disclosed pursuant to the compensation disclosure rules of the SEC, including the compensation tables and any related material disclosed in Global Self Storage’s Proxy Statement for the 2024 Annual Meeting of Stockholders.

EXECUTIVE COMPENSATION

General

Our named executive officers for our 2023 fiscal year are:

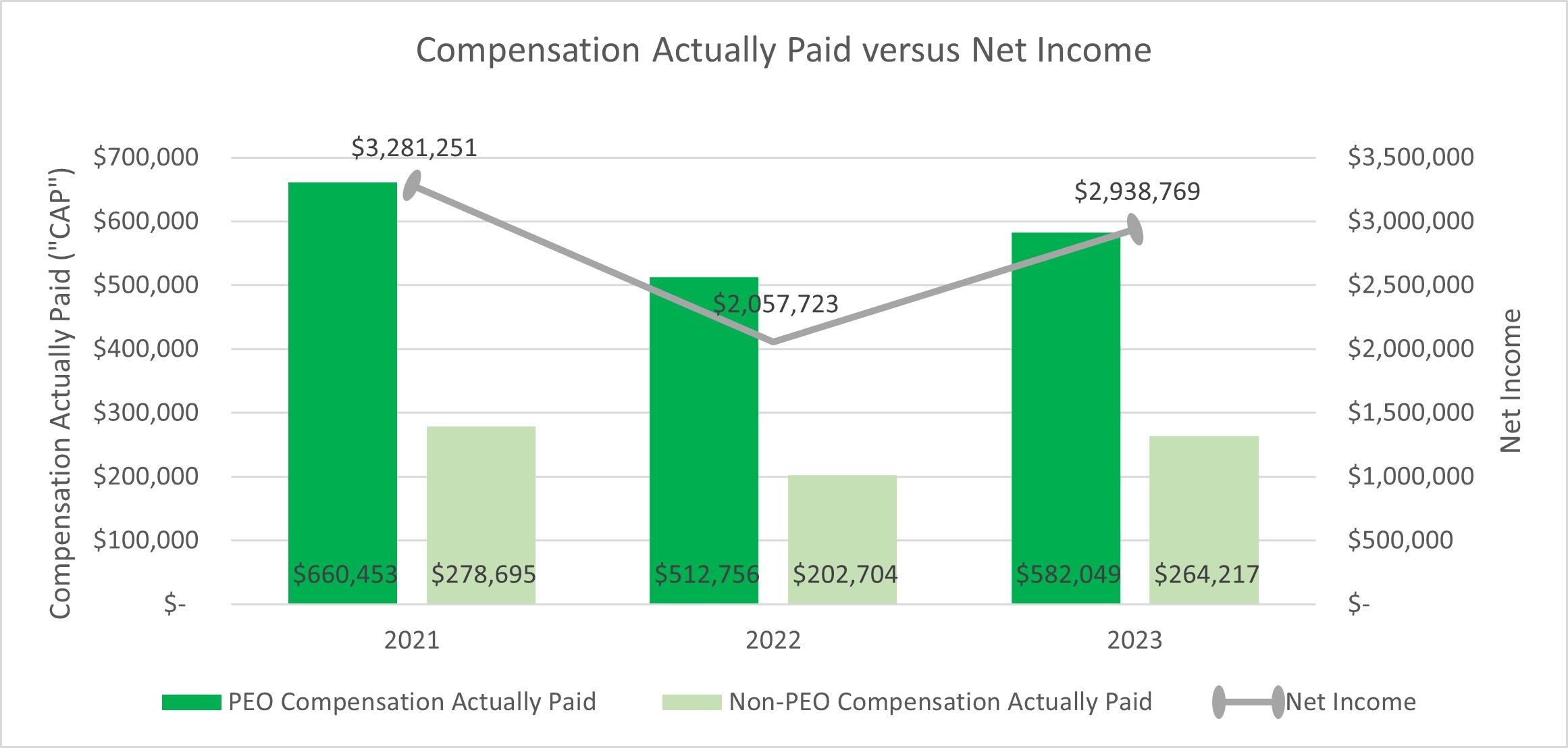

We recognize that the quality, abilities and dedication of our named executive officers are critical factors that drive the long-term value of the Company. One of the primary objectives of the Compensation Committee is to ensure that the Company provides a competitive and comprehensive compensation program that allows us to attract and retain qualified and talented individuals who possess the skills and expertise necessary to lead, manage and grow the Company and who are accountable for the performance of the Company. The Compensation Committee, which is comprised entirely of Independent Directors, has the overall responsibility for monitoring the performance of our named executive officers and evaluating and approving our executive compensation plans, policies and programs.