| Investment Company Act file number: | 811-08025 |

|---|---|

Form N-CSRS is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSRS in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSRS and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSRS unless the Form displays a current valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. sec. 3507.

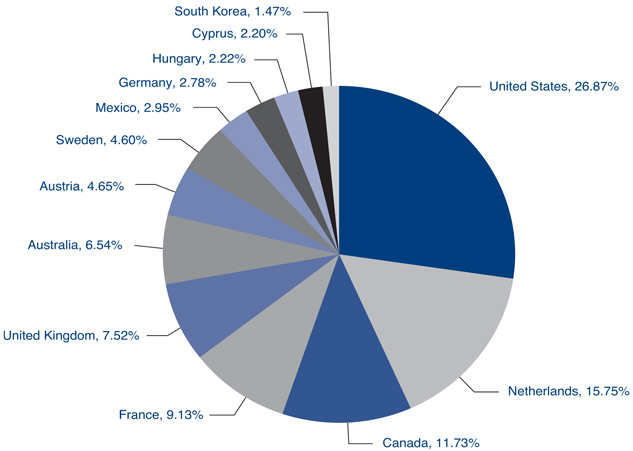

COUNTRY ALLOCATION*

PORTFOLIO ANALYSIS*

Currency Allocation

|

Eurodollar |

43 | % | |

|

U.S. Dollar** |

38 | % | |

|

Australian Dollar |

10 | % | |

|

Canadian Dollar |

4 | % | |

|

British Pound |

3 | % | |

| 98 | % |

Bond Ratings

|

AAA |

23 | % | |

|

AA |

24 | % | |

|

A |

18 | % | |

|

BBB |

6 | % | |

|

<BBB |

1 | % | |

|

NR |

0 | % | |

|

Non-bond investments |

26 | % | |

| 98 | % |

| * | Country allocation and portfolio analysis use approximate percentages of total net assets and may not add up to 100% due to leverage or other assets, rounding, and other factors. Ratings are not a guarantee of credit quality and may change. NR means “not rated.” |

| ** | May include allocation to closed end funds with foreign currency allocations. |

11 Hanover Square, New York, NY 10005

www.globalincomefund.net

July 18, 2008

Fellow Shareholders:

It is a pleasure to submit this 2008 Semi-Annual Report for Global Income Fund and to welcome our new shareholders who find the Fund’s quality approach to global income investing attractive. The primary and fundamental objective of the Fund is to provide a high level of income. The Fund’s secondary, non-fundamental investment objective is capital appreciation. Global Income Fund currently pursues its investment objectives by investing primarily in a global portfolio of investment grade fixed income securities and closed end funds that invest significantly in income producing securities.

Global Income Fund Now Trading Over-the-Counter

With A New Stock Ticker Symbol: GIFD

On April 7, 2008, Global Income Fund announced it had taken steps to delist its common stock from the American Stock Exchange. Immediately upon delisting, the common stock began trading, and is currently quoted, under the symbol GIFD on the OTC Bulletin Board (“OTCBB”) and on the Pink Sheets OTC Markets (“Pink Sheets”). Although the Fund can provide no assurance that OTCBB and Pink Sheets quotations for its stock will continue, the Fund does expect that delisting will allow management to focus its resources on pursuing the Fund’s investment objectives and position the Fund to enhance long term stockholder value. The Fund will continue to maintain its investment company registration and update its stockholders with financial information.

Market Report

The first half of 2008 has seen the United States and a number of other developed countries under increasing monetary and fiscal pressure. Weakening industrial growth, falling housing markets, and tight credit conditions are besetting the prospects for businesses and consumers alike. Inflation remains a leading problem. Consumer price inflation in the developed world has risen to a seven year high, largely from higher oil and food prices, according to the Organization for Economic Cooperation and Development. To address these conditions in the United States, on April 30, the Federal Reserve Open Market Committee (FOMC) cut the key federal funds rate by a quarter percentage point to 2%, its lowest level since 2004. This cut was the seventh consecutive rate cut by the FOMC since September 2007, when the rate had stood at 5.25%. By easing credit conditions, the FOMC appeared to be reacting to the potential for recession and a growing crisis in the financial sector of the economy. With easier credit conditions, however, we expect inflation in the United States to continue to grow. We note that the U.S. Department of Labor Bureau of Labor Statistics reported that from May 2007 to May 2008, the Producer Price Index of finished goods rose 7.2%, intermediate goods rose 12.6%, and crude goods jumped 41.5%. A recent Conference Board survey suggested that 12 month inflation expectations rose to 7.7%, the most since at least 1987. Sadly, U.S. consumer confidence recently hit a 16 year low.

Based on a survey of the National Association of Credit Management, credit conditions in both the services and manufacturing sectors have been deteriorating, with the latter indicating contraction for only the second time since 2002. Reflecting the malaise in U.S. manufacturing, the U.S. auto industry reported disappointing sales in June, with General Motors sales down 18%, Ford Motor down 28%, and Chrysler down 36%. Some cause for optimism exists, however, inasmuch as the general U.S. manufacturing sector expanded in June for the first time in five months, according to the Institute for Supply Management’s index of business activity.

In Europe, concerns over a widespread recession are increasing. Denmark recently became the first European Union country to actually fall into a recession – defined as two consecutive quarters of contraction from

the previous quarter – and other European countries may be expected to follow. One economic research group has suggested that the Purchasing Managers Index for the euro zone’s manufacturing sector contracted in June, which would be the first time in three years. Yet, amidst this declining industrial activity, inflation worries are mounting in Europe causing the European Central Bank to consider raising its key interest rate, which may weigh heavily on sinking European housing prices, particularly in Denmark, Spain, the U.K., and Ireland.

Among developed countries, Japan seems to be weathering current conditions reasonably well. Its export economy, underpinning domestic growth, is expanding due to demand from Asia and other emerging regions, notwithstanding reduced deliveries to the United States and Europe. Also, Japan currently has the lowest inflation rate, approximately 1.3%. But gloom seems to be the mood of the moment, as according to the Bank of Japan’s quarterly survey of corporate sentiment, Japanese corporate sentiment declined for the third consecutive quarter, the worst trend in about five years.

Global Allocation

Given this challenging economic environment, the Fund’s strategy in the first six months of 2008 included holding its assets in primarily investment grade fixed income securities denominated in major world currencies and issued by organizations across many countries and in closed end funds. At June 30, 2008, the Fund held securities of sovereign nations, corporations, and other organizations based in the United States, Netherlands, Canada, France, United Kingdom, Australia, Austria, Mexico, Germany, Hungary, Cyprus, and South Korea. Excluding closed end funds, of these securities approximately 43% were in Eurodollars, 14% in U.S. dollars, 10% in Australian dollars, 3% in British pounds, and 5% in Canadian dollars. About 99% of the Fund’s bond investments are considered investment grade by actual or deemed rating. Closed end fund holdings comprised approximately 24% of the Fund’s investments.

In the six months ending June 30, 2008, the Fund had a net asset value total return of 3.98%, gratifying results for our flexible global allocation process. The Fund’s market total return in the year, however, was 2.82%, reflecting an increased market price discount to net asset value. Recently, the Fund’s net asset value per share was $4.57 and closing market price was $3.76. While investment return and value will vary and shares of the Fund may subsequently be worth more or less than their original cost, this represents an opportunity for investors to purchase the Fund’s shares at a discount from their underlying value.

Distribution Policy

Under the current managed distribution policy, distributions of approximately 5% of the Fund’s net asset value per share on an annual basis are paid primarily from net investment income and any net realized capital gains, with the balance representing return of capital. In the first half of 2008, distributions paid totaling $0.12 per share were approximately all from net investment income and none from either net realized capital gains or return of capital. The estimated components of each quarterly distribution that include a potential return of capital are provided to shareholders of record in a notice accompanying the distributions. The managed quarterly distribution policy is subject to review by the Board of Directors and the amount of the distribution may vary depending on the Fund’s net asset value per share at the time of declaration.

Our current view of the markets suggests that the Fund may benefit during the second half of 2008 from a quality portfolio selection strategy, investing globally in investments in multiple currencies and in closed end funds. We believe this approach provides a sound fixed income strategy for investors over the long term, as well. We look forward to serving your investment needs over the years ahead.

| Sincerely, |

|

|

Thomas B. Winmill President |

| GLOBAL INCOME FUND, INC. | 2 |

SCHEDULE OF PORTFOLIO INVESTMENTS – JUNE 30, 2008 (UNAUDITED)

|

Principal |

Value | |||||

| DEBT SECURITIES (72.20%) | ||||||

| Australia (6.54%) | ||||||

| $ | 1,000,000 | National Australia Bank, 8.60% Subordinated Notes, due 5/19/10 (d) | $ | 1,070,603 | ||

| $ | 300,000 | Principal Financial Group, 144A, 8.20% Senior Notes, due 8/15/09 (b) | 310,061 | |||

| A$ | 500,000 | Telstra Corp. Ltd., 6.25% Senior Notes, due 4/15/15 | 411,574 | |||

| A$ | 500,000 | Telstra Corp. Ltd., 7.25% Senior Notes, due 11/15/12 | 450,405 | |||

| 2,242,643 | ||||||

| Austria (4.65%) | ||||||

| € | 1,000,000 | Republic of Austria, 5.25% Euro Medium Term Notes, due 1/04/11 | 1,593,567 | |||

| Canada (11.29%) | ||||||

| A$ | 1,300,000 | Government of Quebec, 6.00% Senior Unsubordinated Notes, due 2/18/09 | 1,231,911 | |||

| C$ | 1,000,000 | HSBC Financial Corp. Ltd., 4.00% Medium Term Notes, due 5/03/10 | 970,826 | |||

| C$ | 500,000 | Molson Coors Capital Finance, 5.00% Guaranteed Notes, due 9/22/15 | 473,719 | |||

| A$ | 1,350,000 | Province of Ontario, 5.50% Euro Medium Term Notes, due 7/13/12 (d) | 1,197,063 | |||

| 3,873,519 | ||||||

| Cyprus (2.20%) | ||||||

| € | 500,000 | Republic of Cyprus, 4.375% Euro Medium Term Notes, due 7/15/14 | 755,173 | |||

| France (9.13%) | ||||||

| € | 1,000,000 | Elf Aquitaine, 4.50% Senior Unsubordinated Notes, due 3/23/09 | 1,570,444 | |||

| € | 1,000,000 | Societe Nationale des Chemins de Fer Francais, 4.625% | ||||

| Euro Medium Term Notes, due 10/25/09 | 1,562,496 | |||||

| 3,132,940 | ||||||

| Germany (2.78%) | ||||||

| £ | 500,000 | RWE Finance B.V., 4.625% Notes, due 8/17/10 | 956,056 | |||

| Hungary (2.22%) | ||||||

| € | 500,000 | Republic of Hungary, 4.00% Bonds, due 9/27/10 | 761,092 | |||

| Mexico (2.95%) | ||||||

| $ | 1,000,000 | United Mexican States, 5.625% Notes, due 1/15/17 (d) | 1,013,000 | |||

| Netherlands (15.75%) | ||||||

| € | 500,000 | Heineken N.V., 4.375% Bonds, due 2/04/10 | 769,692 | |||

| € | 1,000,000 | ING Bank N.V., 5.50% Euro Medium Term Notes, due 1/04/12 | 1,555,618 | |||

| € | 1,000,000 | Nederlandse Waterschapsbank, 4.00% Notes, due 2/11/09 | 1,564,760 | |||

| € | 1,000,000 | Rabobank Nederland, 3.125% Senior Notes, due 7/19/10 | 1,512,809 | |||

| 5,402,879 | ||||||

| South Korea (1.47%) | ||||||

| $ | 500,000 | Korea Development Bank, 5.75% Notes, due 9/10/13 | 502,597 | |||

| Sweden (4.60%) | ||||||

| € | 1,000,000 | Kingdom of Sweden, 5.00% Eurobonds, due 1/28/09 | 1,577,358 | |||

| United Kingdom (7.52%) | ||||||

| $ | 1,000,000 | National Westminster Bank, 7.375% Subordinated Notes, due 10/01/09 (d) | 1,028,747 | |||

| € | 1,000,000 | Tesco PLC, 4.75% Euro Medium Term Notes, due 4/13/10 (d) | 1,551,848 | |||

| 2,580,595 | ||||||

| See notes to financial statements. | 3 | GLOBAL INCOME FUND, INC. |

SCHEDULE OF PORTFOLIO INVESTMENTS – JUNE 30, 2008 (UNAUDITED)

|

Principal |

Value | |||||

| United States (1.10%) | ||||||

| $ | 458,059 | CIT RV Trust 1998-A B 6.29% Subordinated Bonds, due 1/15/17 | $ | 376,585 | ||

|

Total debt securities (cost: $21,786,933) |

24,768,004 | |||||

|

Shares |

||||||

| CLOSED END FUNDS (23.70%) | ||||||

| United States (23.70%) | ||||||

| 20,000 | 40 | 86 Strategic Income Fund | 169,800 | ||||

| 104,900 | BlackRock Income Trust, Inc. (c) | 619,959 | ||||

| 33,000 | BlackRock Strategic Bond Trust | 377,520 | ||||

| 72,283 | Dreman/Claymore Dividend & Income Fund | 917,994 | ||||

| 46,300 | DWS Dreman Value Income Edge Fund, Inc. | 619,957 | ||||

| 20,000 | DWS Multi-Market Income Trust | 165,600 | ||||

| 32,648 | Evergreen Multi-Sector Income Fund | 505,391 | ||||

| 54,000 | Gabelli Dividend & Income Trust | 953,100 | ||||

| 150,000 | Hyperion Brookfield Total Return Fund, Inc. | 979,500 | ||||

| 96,900 | Hyperion Brookfield Strategic Mortgage Income Fund, Inc. (c) | 821,712 | ||||

| 101,550 | John Hancock Patriot Premium Dividend Fund II | 918,012 | ||||

| 27,100 | Tortoise North American Energy Corporation (c) | 668,015 | ||||

| 24,002 | Western Asset Emerging Markets Debt Fund Inc. | 414,995 | ||||

|

Total closed end funds (cost: $8,732,028) |

8,131,555 | |||||

| PREFERRED STOCKS (1.73%) | ||||||

| United States (1.73%) | ||||||

| 4,000 | BAC Capital Trust II, 7.00% | 88,880 | ||||

| 25,000 | Corporate-Backed Trust Certificates, 8.20% (Motorola) | 504,000 | ||||

|

Total preferred stocks (cost: $725,000) |

592,880 | |||||

| UNIT INVESTMENT TRUST (.44%) | ||||||

| Canada (0.44%) | ||||||

| 43,100 | PRT Forest Regeneration Income Fund (cost: $350,474) | 151,096 | ||||

| INVESTMENT IN SECURITY LENDING COLLATERAL (0.34%) | ||||||

| 115,325 | State Street Navigator Securities Lending Prime Portfolio (cost: $115,325) | 115,325 | ||||

|

Total investments (cost: $31,709,760) (98.41%) |

33,758,860 | |||||

|

Other assets in excess of liabilities (1.59%) |

545,738 | |||||

|

Net assets (100.00%) |

$ | 34,304,598 | ||||

| GLOBAL INCOME FUND, INC. | 4 | See notes to financial statements. |

SCHEDULE OF PORTFOLIO INVESTMENTS – JUNE 30, 2008 (UNAUDITED)

| (a) | The principal amount is stated in U.S. dollars unless otherwise indicated. |

|

Currency Symbols

|

||

| A$ | Australian Dollar | |

| £ | British Pound | |

| C$ | Canadian Dollar | |

| € | Eurodollar | |

| (b) | These securities are exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended or otherwise restricted. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2008, these securities are considered liquid. Restricted securities held by the Fund are as follows: |

|

Security |

Acquisition Date |

Acquisition Cost |

Principal Amount |

Value | Percent of Net Assets |

|||||||||

|

Principal Financial Group, 144A, 8.20% |

9/16/03 | $ | 358,530 | $ | 300,000 | $ | 310,061 | 1.0 | % | |||||

| (c) | All or portion of this security was on loan. The total value of the securities on loan, as of June 30, 2008, was $111,669. |

| (d) | Fully or partially pledged as collateral on bank credit facility. |

| See notes to financial statements. | 5 | GLOBAL INCOME FUND, INC. |

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2008 (Unaudited)

|

ASSETS |

||||

|

Investments, at value-including $111,669 of securities loaned (cost: $31,709,760) |

$ | 33,758,860 | ||

|

Interest receivable |

731,218 | |||

|

Dividends receivable |

10,541 | |||

|

Other assets |

8,828 | |||

|

Total assets |

34,509,447 | |||

|

LIABILITIES |

||||

|

Collateral on securities loaned, at value |

115,325 | |||

|

Accrued expenses |

60,771 | |||

|

Investment management |

19,718 | |||

|

Administrative services |

9,035 | |||

|

Total liabilities |

204,849 | |||

|

NET ASSETS |

$ | 34,304,598 | ||

|

NET ASSET VALUE PER SHARE |

||||

|

(applicable to shares 7,400,804 outstanding: 20,000,000 shares of $.01 par value authorized) |

$ | 4.64 | ||

|

NET ASSETS CONSIST OF: |

||||

|

Paid-in capital |

$ | 34,597,116 | ||

|

Accumulated net realized loss on investments and foreign currencies |

(2,376,229 | ) | ||

|

Net unrealized appreciation on investments and foreign currencies |

2,083,711 | |||

| $ | 34,304,598 | |||

STATEMENT OF OPERATIONS

Six Months Ended June 30, 2008 (Unaudited)

|

INVESTMENT INCOME |

||||

|

Interest (net of $5,723 of foreign tax expense) |

$ | 585,971 | ||

|

Dividends |

276,634 | |||

|

Dividends from affiliate |

4,299 | |||

|

Securities lending income |

9 | |||

|

Total investment income |

866,913 | |||

|

EXPENSES |

||||

|

Investment management |

121,518 | |||

|

Administrative services |

59,227 | |||

|

Printing and postage |

24,114 | |||

|

Bookkeeping and pricing |

19,397 | |||

|

Legal |

17,097 | |||

|

Auditing |

9,966 | |||

|

Directors |

8,190 | |||

|

Custodian |

8,000 | |||

|

Transfer agent |

7,095 | |||

|

Insurance |

4,004 | |||

|

Other |

4,229 | |||

|

Total expenses |

282,837 | |||

|

Expense reductions |

(122 | ) | ||

|

Net expenses |

282,715 | |||

|

Net investment income |

584,198 | |||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

||||

|

Net realized gain: |

||||

|

Foreign currencies |

928,443 | |||

|

Investments |

2,216 | |||

|

Net unrealized appreciation (depreciation): |

||||

|

Investments |

(1,067,274 | ) | ||

|

Translation of assets and liabilities in foreign currencies |

679,338 | |||

|

Net realized and unrealized gain on investments |

542,723 | |||

|

Net change in net assets resulting from operations |

$ | 1,126,921 | ||

| GLOBAL INCOME FUND, INC. | 6 | See notes to financial statements. |

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months Ended June 30, 2008 (Unaudited) |

Year Ended December 31, 2007 |

|||||||

|

OPERATIONS |

||||||||

|

Net investment income |

$ | 584,198 | $ | 964,509 | ||||

|

Net realized gain on investments and foreign currency transactions |

930,659 | 312,482 | ||||||

|

Unrealized appreciation (depreciation) of investments and foreign currency translations |

(387,936 | ) | 2,024,944 | |||||

|

Net increase in net assets resulting from operations |

1,126,921 | 3,301,935 | ||||||

|

DISTRIBUTIONS TO SHAREHOLDERS |

||||||||

|

Distributions from ordinary income ($0.12 and $0.17 per share, respectively) |

(887,905 | ) | (1,276,991 | ) | ||||

|

Tax return of capital ($- and $0.05 per share, respectively) |

— | (350,108 | ) | |||||

|

Decrease in net assets from distributions to shareholders |

(887,905 | ) | (1,627,099 | ) | ||||

|

CAPITAL SHARE TRANSACTIONS |

||||||||

|

Reinvestment of distributions to shareholders (2,091 and 5,141 shares, respectively) |

8,208 | 20,365 | ||||||

|

Increase in net assets from capital share transactions |

8,208 | 20,365 | ||||||

|

Net increase in net assets |

247,224 | 1,695,201 | ||||||

|

NET ASSETS |

||||||||

|

Beginning of period |

34,057,374 | 32,362,173 | ||||||

|

End of period |

$ | 34,304,598 | $ | 34,057,374 | ||||

| See notes to financial statements. | 7 | GLOBAL INCOME FUND, INC. |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED)

| 1. | Organization and Significant Accounting Policies |

Global Income Fund, Inc., a Maryland corporation registered under the Investment Company Act of 1940, as amended (the “Act”), is a non-diversified, closed end management investment company, whose shares are currently quoted under the symbol GIFD on the OTC Bulletin Board and on the Pink Sheets. The Fund’s investment objectives are primarily to provide a high level of income and, secondarily, capital appreciation. The Fund retains CEF Advisers, Inc. as its Investment Manager.

The following is a summary of the Fund’s significant accounting policies.

Security Valuation – Securities traded on a U.S. national securities exchange (“USNSE”) are valued at the last reported sale price on the day the valuations are made. Securities traded primarily on the Nasdaq Stock Market (“Nasdaq”) are normally valued by the Fund at the Nasdaq Official Closing Price (“NOCP”) provided by Nasdaq each business day. The NOCP is the most recently reported price as of 4:00:02 p.m., Eastern Time, unless that price is outside the range of the “inside” bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, Nasdaq will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. Securities that are not traded on a particular day and securities traded in foreign and over-the-counter markets that are not also traded on a USNSE or on Nasdaq are valued at the mean between the last bid and asked prices. Certain of the securities in which the Fund invests are priced through pricing services that may utilize a matrix pricing system which takes into consideration factors such as yields, prices, maturities, call features, and ratings on comparable securities. Bonds may be valued according to prices quoted by a dealer in bonds that offers pricing services. Open end investment companies are valued at their net asset value. Securities for which quotations are not readily available or reliable and other assets may be valued as determined in good faith under the direction of and pursuant to procedures established by the Fund’s Board of Directors. Due to the inherent uncertainty of valuation, these values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. A security’s valuation may differ depending on the method used for determining value. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ from the net asset value that would be calculated using market prices.

The Fund adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”) on January 1, 2008. FAS 157 defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. FAS 157 establishes a framework for measuring fair value and a three level hierarchy for fair value measurements based on the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the inputs which are significant to the overall valuation. The hierarchy of inputs is summarized below.

The inputs or methodology used for valuing investments are not an indication of the risk associated with investing in those securities.

|

Level 1 - |

quoted prices in active markets for identical investments. | |

|

Level 2 - |

other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). | |

|

Level 3 - |

significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments). | |

| GLOBAL INCOME FUND, INC. | 8 |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED) (CONTINUED)

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund’s investments:

|

Valuation Input |

Investment in Securities |

||

|

Level 1 |

$ | 33,758,860 | |

|

Level 2 |

— | ||

|

Level 3 |

— | ||

|

Total |

$ | 33,758,860 | |

Foreign Currency Translation – Securities denominated in foreign currencies are translated into U.S. dollars at prevailing exchange rates. Realized gain or loss on a sale of investments denominated in foreign currencies is reported separately from gain or loss attributable to a change in foreign exchange rates for those investments.

Foreign Currency Contracts – Forward contracts are marked to market and the change in market value is recorded by the Fund as an unrealized gain or loss. When a contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably.

Investment in Affiliated Money Market Fund – The Board of Directors has authorized the Fund to invest daily available cash balances in Midas Dollar Reserves, Inc. (“MDR”). MDR is an open end investment company registered under the Act. MDR operates as a money market fund and seeks maximum current income consistent with preservation of capital and maintenance of liquidity by investing exclusively in obligations of the U.S. Government, its agencies and instrumentalities. Midas Management Corporation (“MMC”) and Investor Service Center, Inc. (“ISC”), affiliates of the Investment Manager, act as the investment adviser and distributor, respectively, of MDR. The Investment Manager, MMC, and ISC are wholly owned subsidiaries of Winmill & Co. Incorporated. As a shareholder, the Fund is subject to its proportional share of MDR’s expenses, including its management and distribution fees. MMC and ISC have contractually agreed to waive their fees from April 29, 2008 to April 29, 2009. MMC and ISC may voluntarily waive their fees after April 29, 2009 but are not contractually obligated to do so. Should ISC no longer voluntarily waive its distribution fee, the Investment Manager will waive a sufficient amount of its management fee to offset the cost of ISC’s distribution fee.

Investments in Other Investment Companies – The Fund may invest, from time to time, in shares of other investment companies (or entities that would be considered investment companies but are excluded from the definition pursuant to certain exceptions under the Act) (the “Acquired Funds”) in accordance with the Act and related rules. As a shareholder in the Fund, you would bear the pro rata portion of the fees and expenses of the Acquired Funds in addition to the Fund’s expenses. Expenses incurred by the Fund that are disclosed in the Statement of Operations, do not include fees and expenses incurred by the Acquired Funds in which the Fund invests. The fees and expenses of the Acquired Funds are included in the Fund’s total returns.

Security Transactions – Security transactions are accounted for on the trade date (the date the order to buy or sell is executed). Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income – Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Expenses – Estimated expenses are accrued daily. Expenses directly attributable to the Fund are charged to the Fund. Expenses borne by the complex of related investment companies, which includes open end

| 9 | GLOBAL INCOME FUND, INC. |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED) (Continued)

and closed end investment companies for which the Investment Manager or its affiliates serves as investment manager, that are not directly attributed to the Fund are allocated among the Fund and the other investment companies in the complex on the basis of relative net assets, except where a more appropriate allocation of expenses to each investment company in the complex otherwise can be made fairly.

Expense Reduction Arrangement – Through arrangements with the Fund’s custodian and cash management bank, credits realized as a result of uninvested cash balances were used to reduce custody expense by $122.

Distributions – Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Income Taxes – No provision has been made for U.S. income taxes because the Fund’s current intention is to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute to its shareholders substantially all of its taxable income and net realized gains. Foreign securities held by the Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests.

The Fund has reviewed its tax positions taken on federal, state, and local income tax returns for all open tax years (tax years ended December 31, 2004-2007) and has concluded that no provision for income taxes is required in the Fund’s financial statements.

Use of Estimates – In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications – The Fund indemnifies its officers and directors for certain liabilities that might arise from their performance of their duties for the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as it involves future claims that may be made against the Fund under circumstances that have not occurred.

| 2. | Fees and Transactions with Related Parties |

The Fund retains the Investment Manager pursuant to an Investment Management Agreement (“IMA”). Under the terms of the IMA, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at an annual rate of 7/10 of 1% of the first $50 million, 5/8 of 1% over $50 million to $150 million, and 1/2 of 1% over $150 million. Certain officers and directors of the Fund are officers and directors of the Investment Manager. Pursuant to the IMA, the Fund reimburses the Investment Manager for providing at cost certain administrative services comprised of compliance and accounting services. For the six months ended June 30, 2008, the Fund incurred total administrative costs of $59,227, comprised of $41,192 and $18,035 for compliance and accounting services, respectively.

| 3. | Distributions to Shareholders and Distributable Earnings |

The Fund paid distributions totaling $887,905 for the six months ended June 30, 2008. The majority, and possibly all, of the 2008 distribution may be comprised of net investment income. This is only an estimate based

| GLOBAL INCOME FUND, INC. | 10 |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED) (Continued)

on information available at this time and is subject to change. Actual amounts may be recharacterized between net investment income and return of capital for tax purposes after year end 2008, although the exact amount is not estimable at June 30, 2008.

The tax character of distributions paid to shareholders for the year ended December 31, 2007 was as follows:

|

Ordinary income |

$ | 1,276,991 | |

|

Return of capital |

350,108 | ||

| $ | 1,627,099 | ||

As of December 31, 2007, the components of distributable earnings on a tax basis were as follows:

|

Unrealized appreciation on investments and foreign currencies |

$ | 2,471,647 | ||

|

Capital loss carryovers |

(3,003,181 | ) | ||

|

Post-October foreign currency losses |

— | |||

| $ | (531,534 | ) | ||

Accounting principles generally accepted in the United States of America require certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2007, permanent differences between book and tax accounting have been reclassified as follows:

|

Decrease in |

Decrease in Accumulated Net Realized Loss on Investments and Foreign Currencies |

Decrease in Paid-in Capital |

|||||

| $ 662,591 | $ | 1,396,051 | $ | (2,058,642 | ) | ||

As of December 31, 2007, the Fund had net capital loss carryovers of $3,003,181, of which $1,381,580, $1,369,211 and $252,390 expires in 2008, 2010, and 2014, respectively, that may be used to offset future realized capital gains for federal income tax purposes.

| 4. | Securities Transactions |

Purchases and sales of securities, other than short term investments, aggregated $6,078,209 and $5,980,729, respectively, for the six months ended June 30, 2008. At June 30, 2008, for federal income tax purposes the aggregate cost of securities was $31,709,760 and net unrealized appreciation was $2,049,100, comprised of gross unrealized appreciation of $3,115,441 and gross unrealized depreciation of $1,066,341.

| 5. | Affiliated Issuer |

As defined under the Act, the Fund’s affiliates include, among others, companies in which the Fund has (a) direct or indirect ownership, control, or voting power over 5% or more of the outstanding voting shares of such company, or (b) controls, is controlled by, or is under common control with such other company or person. Transactions with affiliates for the six months ended June 30, 2008 were as follows:

| Number of Shares Held | Value June 30, 2008 |

Dividend Income |

Realized Gains/ (Losses) |

||||||||||||||

|

Name of Issuer |

December 31, 2007 |

Gross Additions |

Gross Reductions |

June 30, 2008 |

|||||||||||||

|

Midas Dollar Reserves, Inc. |

71,367 | 6,687,851 | 6,759,218 | — | $ | — | $ | 4,299 | $ | — | |||||||

| 6. | Bank Credit Facility |

The Fund, Foxby Corp., Midas Fund, Inc., and Midas Special Fund, Inc. (the “Borrowers”) have entered into a committed secured line of credit facility with State Street Bank & Trust Company (“SSB”), the Fund’s custodian. Foxby Corp. is a closed end investment company managed by the Investment Manager, and Midas Fund, Inc. and Midas Special Fund, Inc. are open end investment companies managed by MMC. The aggregate amount of the credit facility is $25,000,000. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. SSB will make revolving loans to a Borrower not to exceed in the

| GLOBAL INCOME FUND, INC. | 11 |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED) (CONTINUED)

aggregate outstanding at any time with respect to any one Borrower, the least of $25,000,000, the maximum amount permitted pursuant to each Borrower’s investment policies, or as permitted under the Act. The commitment fee on this facility is 0.10% per annum on the unused portion of the commitment, based on a 360-day year. All loans under this facility will be available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days), each as in effect from time to time, plus 0.75% per annum, calculated on the basis of actual days elapsed for a 360-day year. At June 30, 2008, the Fund had no outstanding borrowings under the facility. For the six months ended June 30, 2008, the Fund’s weighted average interest rate under the facility was 3.27% based on its balances outstanding during the period and the Fund’s average daily amount outstanding during the period was $18,166. The Fund incurred interest and fees of $677 for the six months ended June 30, 2008.

| 7. | Securities Lending |

Effective June 23, 2008, the Fund may lend its securities through an agreement with SSB. In accordance with the Fund’s security lending procedures, the loans are collateralized at all times with cash or securities or both with a value at least equal to the securities on loan. The value of the loaned securities is determined at the close of business of the Fund, in accordance with the Fund’s valuation policies or, if applicable, by the valuation procedures established by the Fund’s Board of Directors, and any additional required collateral is delivered to the Fund on the next business day. As with other extensions of credit, the Fund bears the risk of delay on recovery or loss of rights in the collateral should the borrower of the securities fail financially.

The Fund invests the cash collateral received in connection with securities lending transactions in the State Street Navigator Securities Lending Prime Portfolio (the “Navigator Portfolio”). The Navigator Portfolio is a private, registered money market fund and is managed by State Street Global Advisors. The Navigator Portfolio has been established primarily for the investment of cash collateral on behalf of funds participating in SSB’s securities lending program and complies with the requirements of Rule 2a-7 of the Act. The Fund bears the risk of incurring a loss from the investment of cash collateral due to either credit or market factors. Both the Fund and SSB receive compensation relating to the lending of the Fund’s securities. The amount earned by the Fund for the period ended June 30, 2008, is reported in the Statement of Operations.

The value of the loaned securities and related collateral outstanding at June 30, 2008, was $111,669 and $115,325, respectively. The Fund received cash collateral which was subsequently invested in the Navigator Portfolio.

| 8. | Foreign Securities Risk |

Investing in securities of foreign issuers involves special risks which include changes in foreign exchange rates and the possibility of future adverse political and economic developments which could adversely affect the value of such securities. Moreover, securities of many foreign issuers and in foreign markets may be less liquid and their prices more volatile than those of U.S. issuers and markets.

| 9. | Capital Stock |

At June 30, 2008, there were 7,400,804 shares of $.01 par value common stock outstanding (20,000,000 shares authorized). The shares issued and resulting increase in paid-in capital in connection with reinvestment of distributions for the six months ended June 30, 2008 and for the year ended December 31, 2007 were as follows:

| June 30, 2008 |

December 31, 2007 |

|||||

|

Shares issued |

2,091 | 5,141 | ||||

|

Increase in paid-in capital |

$ | 8,208 | $ | 20,365 | ||

| GLOBAL INCOME FUND, INC. | 12 |

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2008 (UNAUDITED) (Concluded)

| 10. | Share Repurchase Program |

In accordance with Section 23(c) of the Act, the Fund may from time to time repurchase shares of the Fund in the open market at the option of the Board of Directors and upon such terms as the Directors shall determine. The Fund did not repurchase any of its own shares for the six months and year ended June 30, 2008 and December 31, 2007, respectively.

| 11. | Recently Issued Accounting Standards |

In March 2008, the FASB issued Statement on Financial Accounting Standards No. 161 (“FAS 161”),”Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No.133,” which requires enhanced disclosures about an entity’s derivative and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Fund does not expect FAS 161 to have a material impact on its financial statements.

| 13 | GLOBAL INCOME FUND, INC. |

FINANCIAL HIGHLIGHTS

| Six Months Ended June 30, 2008 (Unaudited) |

Years Ended December 31, | |||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||||||

|

Per Share Operating Performance |

||||||||||||||||||||||||

|

(for a share outstanding throughout each period) |

||||||||||||||||||||||||

|

Net asset value, beginning of period |

$ | 4.60 | $ | 4.38 | $ | 4.33 | $ | 4.97 | $ | 5.16 | $ | 5.04 | ||||||||||||

|

Income from investment operations: |

||||||||||||||||||||||||

|

Net investment income |

.08 | .13 | .13 | .11 | .11 | .18 | ||||||||||||||||||

|

Net realized and unrealized gain (loss) on investments |

.08 | .31 | .20 | (.47 | ) | .25 | .30 | |||||||||||||||||

|

Total income from investment operations |

.16 | .44 | .33 | (.36 | ) | .36 | .48 | |||||||||||||||||

|

Dilution from rights offering |

— | — | — | — | (.21 | ) | — | |||||||||||||||||

|

Less distributions to shareholders: |

||||||||||||||||||||||||

|

Net investment income |

(.12 | ) | (.17 | ) | (.13 | ) | (.20 | ) | (.25 | ) | (.22 | ) | ||||||||||||

|

Return of capital |

— | (.05 | ) | (.15 | ) | (.08 | ) | (.09 | ) | (.14 | ) | |||||||||||||

|

Total distributions |

(.12 | ) | (.22 | ) | (.28 | ) | (.28 | ) | (.34 | ) | (.36 | ) | ||||||||||||

|

Net asset value, end of period |

$ | 4.64 | $ | 4.60 | $ | 4.38 | $ | 4.33 | $ | 4.97 | $ | 5.16 | ||||||||||||

|

Market value, end of period |

$ | 3.89 | $ | 3.90 | $ | 4.18 | $ | 3.95 | $ | 4.82 | $ | 5.01 | ||||||||||||

|

Total Return (a) |

||||||||||||||||||||||||

|

Based on net asset value |

3.98 | % | 11.00 | % | 8.43 | % | (6.95 | )% | 3.57 | % | 10.22 | % | ||||||||||||

|

Based on market price |

2.82 | % | (1.39 | )% | 13.43 | % | (12.47 | )% | 3.45 | % | 17.25 | % | ||||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||||||

|

Net assets, end of period (000’s omitted) |

$ | 34,305 | $ | 34,057 | $ | 32,362 | $ | 31,975 | $ | 36,671 | $ | 28,712 | ||||||||||||

|

Ratio of total expenses to average net assets |

1.62 | %(b)(c) | 1.77 | % | 1.89 | % | 1.59 | % | 1.66 | % | 1.61 | % | ||||||||||||

|

Ratio of net expenses to average net assets |

1.62 | %(b)(c) | 1.77 | % | 1.89 | % | 1.59 | % | 1.67 | % | 1.61 | % | ||||||||||||

|

Ratio of net expenses excluding loan interest and fees to average net assets |

1.62 | %(b)(c) | 1.75 | % | 1.87 | % | 1.58 | % | 1.66 | % | 1.61 | % | ||||||||||||

|

Ratio of net investment income to average net assets |

3.35 | %(b)(c) | 2.91 | % | 2.71 | % | 2.44 | % | 2.49 | % | 3.54 | % | ||||||||||||

|

Portfolio turnover rate |

18 | % | 10 | % | 17 | % | 32 | % | 97 | % | 146 | % | ||||||||||||

| (a) | Total return on a market value basis is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Generally, total return on a net asset value basis will be higher than total return on a market value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return on a net asset value basis will be lower than total return on a market value basis in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total return calculated for a period of less than one year is not annualized. The calculation does not reflect brokerage commissions, if any. |

| (b) | Annualized. |

| (c) | Does not include expenses incurred by the Acquired Funds in which the Fund invests. |

| GLOBAL INCOME FUND, INC. | 14 |

The additional information below and on the following pages is supplemental and not part of the financial statements of the Fund.

BOARD OF DIRECTORS’ ANNUAL APPROVAL OF THE INVESTMENT MANAGEMENT AGREEMENT

The investment management agreement (the “Agreement”) between Global Income Fund, Inc. and the investment manager, CEF Advisers, Inc., generally provides that the Agreement shall continue automatically for successive periods of twelve months each, provided that such continuance is specifically approved at least annually (i) by a vote of a majority of the Directors of the Fund who are not parties to the Agreement, or interested persons of any such party and (ii) by the Board of Directors of the Fund or by the vote of the holders of a majority of the outstanding voting securities of the Fund.

In considering the annual approval of the Agreement, the Board of Directors considered information that had been provided throughout the year at regular Board meetings, as well as information furnished to the Board for the meeting held in March 2008 to specifically consider the continuance of the Agreement. Such information included, among other things, the following: information comparing the management fee of the Fund with those of comparable funds; information regarding Fund investment performance in comparison to a relevant peer group of funds; the economic outlook and the general investment outlook in relevant investment markets; the investment manager’s cost of services, results and financial condition, and the overall organization of the investment manager; the allocation of brokerage and the benefits received by the investment manager as a result of brokerage allocation; the investment manager’s management of relationships with the custodian, transfer agents, and fund accountants; the resources devoted to the investment manager’s compliance efforts undertaken on behalf of the funds it manages and the record of compliance with the investment policies and restrictions and with policies on personal securities transactions; the quality, nature, cost, and character of the administrative and other non-investment management services provided by the investment manager and its affiliates; and the terms of the Agreement and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein.

The Board of Directors also considered the nature, extent and quality of the management services provided by the investment manager. In so doing, the Board considered the investment manager’s management capabilities with respect to the types of investments held by the Fund, including information relating to the education, experience, and number of investment professionals and other personnel who provide services under the Agreement. The Board also took into account the time and attention to be devoted by the investment manager to the Fund. The Board evaluated the level of skill required to manage the Fund and concluded that the human resources available at the investment manager were appropriate to fulfill effectively its duties on behalf of the Fund. The Directors also noted that the investment manager has managed the Fund since 1997 and the Directors believe that a long term relationship with a capable, conscientious investment manager is in the interests of the Fund.

The Board received information concerning the investment philosophy and investment process applied by the investment manager in managing the Fund. In this regard, the Board considered the investment manager’s in-house research capabilities as well as other resources available to the investment manager personnel, including research services that may be available to the investment manager as a result of securities transactions effected for the Fund. The Board concluded that the investment manager’s investment process, research capabilities, and philosophy were well suited to the Fund, given the Fund’s investment objective and policies.

In its review of comparative information with respect to Fund investment performance, the Board received comparative information, comparing the Fund’s performance to that of a similar peer group. After reviewing this information, the Board concluded that the Fund has performed within a range that the Board deemed competitive. With respect to its review of the investment management fee, the Board considered information comparing the Fund’s management fee and expense ratio to those of comparable funds. The Board noted that economies of scale may develop for the Fund as its assets increase and fund level expenses decline as

| Additional Information (Unaudited) | 15 | GLOBAL INCOME FUND, INC. |

a percentage of assets, but that fund level economies of scale may not necessarily result in investment manager level economies of scale. This information assisted the Board in concluding that the fee paid by the Fund is within the range of those paid by comparable funds within the closed end fund industry.

In reviewing the information regarding the expense ratio of the Fund, the Board concluded that although the Fund’s expense ratio is within a higher range, excluding extraordinary expenses, it is competitive with comparable funds in light of the quality of services received and assets managed.

In addition to the factors mentioned above, the Board reviewed the level of the investment manager’s profits in providing investment management and related services for the Fund. The Board considered the fiduciary duty assumed by the investment manager in connection with the services rendered to the Fund and the business reputation of the investment manager and its financial resources. The Board also considered information regarding the character and amount of other incidental benefits received by the investment manager and its affiliates from their association with the Fund. The Board concluded that potential “fall-out” benefits that the investment manager and its affiliates may receive, such as greater name recognition, affiliated brokerage commissions, or increased ability to obtain research services, appear to be reasonable, and may, in some cases, benefit the Fund. The Board concluded that in light of the services rendered, the profits realized by the investment manager are not unreasonable.

The Board did not consider any single factor as controlling in determining whether or not to continue the Agreement. In assessing the information provided by the investment manager and its affiliates, the Board also took into consideration the benefits to shareholders of investing in a fund that is part of an investment company complex.

Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by counsel, the Board concluded that the approval of the Agreement, including the fee structure, is in the interests of the Fund.

| GLOBAL INCOME FUND, INC. | 16 | Additional Information (Unaudited) |

INVESTMENT OBJECTIVES AND POLICIES

The Fund’s primary investment objective of providing a high level of income is fundamental and may not be changed without shareholder approval. The Fund is also subject to certain investment restrictions, set forth in its most recently effective Statement of Additional Information, that are fundamental and cannot be changed without shareholder approval. The Fund’s secondary investment objective of capital appreciation and the other investment policies described herein, unless otherwise stated, are not fundamental and may be changed by the Board of Directors without shareholder approval. Notice to shareholders of any change in the Fund’s secondary investment objective will be provided as required by law.

PRIVACY POLICY

The Fund recognizes the importance of protecting the personal and financial information of its shareholders. We consider each shareholder’s personal information to be private and confidential. This describes the practices followed by us to protect our shareholders’ privacy. We may obtain information about you from the following sources: (1) information we receive from you on forms and other information you provide to us whether in writing, by telephone, electronically or by any other means; and (2) information regarding your transactions with us, our corporate affiliates, or others. We do not sell shareholder personal information to third parties. We will collect and use shareholder personal information only to service shareholder accounts. This information may be used by us in connection with providing services or financial products requested by shareholders. We will not disclose shareholder personal information to any non-affiliated third party except as permitted by law. We take steps to safeguard shareholder information. We restrict access to non-public personal information about you to those employees and service providers who need to know such information to provide products or services to you. Together with our service providers, we maintain physical, electronic, and procedural safeguards to guard your non-public personal information. Even if you are no longer a shareholder, our Privacy Policy will continue to apply to you. We reserve the right to modify, remove, or add portions of this Privacy Policy at any time.

PROXY VOTING

The Fund’s Proxy Voting Guidelines (the “Guidelines”) and its voting record for the most recent 12 months ended June 30, are available without charge by calling the Fund collect at 1-212-344-6310 and on the SEC’s website at www.sec.gov. The Guidelines are also posted at www.globalincomefund.net.

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund makes the Forms N-Q available on its website at www.globalincomefund.net.

WWW.GLOBALINCOMEFUND.NET

Visit us on the web at www.globalincomefund.net. The site provides information about the Fund, including market performance, net asset value (“NAV”), dividends, press releases, and shareholder reports. For further information, please email us at info@globalincomefund.net. The Fund is a member of the Closed-End Fund Association (“CEFA”). Its website address is www.cefa.com. CEFA is solely responsible for the content of its website.

| Additional Information (Unaudited) | 17 | GLOBAL INCOME FUND, INC. |

MANAGED DISTRIBUTIONS

The Board’s current policy is to provide investors with a stable quarterly distribution out of current income, supplemented by realized capital gains, and to the extent necessary, paid-in capital. The Fund is subject to U.S. corporate, tax, and securities laws. Under U.S. tax accounting rules, the amount of distributable net income is determined on an annual basis and is dependent during the fiscal year on the aggregate gains and losses realized by the Fund and, to a lesser extent, the actual exchange rate between the U.S. dollar and the currencies in which Fund assets are denominated. Therefore, the exact amount of distributable income can only be determined as of the end of the Fund’s fiscal year. Under the Investment Company Act of 1940, as amended, however, the Fund is required to indicate the source of each distribution to shareholders. The Fund estimates that distributions for the fiscal period commencing January 1, 2008, including the distributions paid quarterly, will be comprised approximately all from net investment income and none from paid-in capital. This estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future realized gains and losses on securities and fluctuations in the value of currencies in which Fund assets are denominated. In January after each fiscal year, a Form 1099-DIV will be sent to shareholders stating the amount and composition of distributions and providing information about their appropriate tax treatment.

DIVIDEND REINVESTMENT PLAN

Terms and Conditions of the

2008 Amended Dividend Reinvestment Plan

1. Each shareholder (the “Shareholder”) holding shares of common stock (the “Shares”) of Global Income Fund, Inc. (the “Fund”) will automatically be a participant in the Dividend Reinvestment Plan (the “Plan”), unless the Shareholder specifically elects to receive all dividends and capital gains in cash paid by check mailed directly to the Shareholder by Illinois Stock Transfer Company, 209 West Jackson Blvd., Suite 903, Chicago, Illinois 60606, 1-800-757-5755, as agent under the Plan (the “Agent”). The Agent will open an account for each Shareholder under the Plan in the same name in which such Shareholder’s shares of Common Stock are registered.

2. Whenever the Fund declares a capital gain distribution or an income dividend payable in Shares or cash, participating Shareholders will take the distribution or dividend entirely in Shares and the Agent will automatically receive the Shares, including fractions, for the Shareholder’s account in accordance with the following:

Whenever the Market Price (as defined in Section 3 below) per Share is equal to or exceeds the net asset value per Share at the time Shares are valued for the purpose of determining the number of Shares equivalent to the cash dividend or capital gain distribution (the “Valuation Date”), participants will be issued additional Shares equal to the amount of such dividend divided by the greater of the Fund’s net asset value per Share or 95% of the Fund’s Market Price per Share. Whenever the Market Price per Share is less than such net asset value on the Valuation Date, participants will be issued additional Shares equal to the amount of such dividend divided by the Market Price. The Valuation Date is the day before the dividend or distribution payment date or, if that day is not an OTC Bulletin Board (“OTCBB”) trading day, the next trading day. If the Fund should declare a dividend or capital gain distribution payable only in cash, the Agent will, as purchasing agent for the participating Shareholders, buy Shares in the open market, on the OTCBB or elsewhere, for such Shareholders’ accounts after the payment date, except that the Agent will endeavor to terminate purchases in the open market and cause the Fund to issue the remaining Shares if, following the commencement of the purchases, the market value of the Shares exceeds the net asset value. These remaining Shares will be issued by the Fund at a price equal to the Market Price.

In a case where the Agent has terminated open market purchases and caused the issuance of remaining Shares by the Fund, the number of Shares received by the participant in respect of the cash dividend or distribution will be based on the weighted average of prices paid for Shares

| GLOBAL INCOME FUND, INC. | 18 | Additional Information (Unaudited) |

purchased in the open market and the price at which the Fund issues remaining Shares. To the extent that the Agent is unable to terminate purchases in the open market before the Agent has completed its purchases, or remaining Shares cannot be issued by the Fund because the Fund declared a dividend or distribution payable only in cash, and the market price exceeds the net asset value of the Shares, the average Share purchase price paid by the Agent may exceed the net asset value of the Shares, resulting in the acquisition of fewer Shares than if the dividend or capital gain distribution had been paid in Shares issued by the Fund.

The Agent will apply all cash received as a dividend or capital gain distribution to purchase shares of common stock on the open market as soon as practicable after the payment date of the dividend or capital gain distribution, but in no event later than 45 days after that date, except when necessary to comply with applicable provisions of the federal securities laws.

3. For all purposes of the Plan: (a) the Market Price of the Shares on a particular date shall be the average of the volume weighted average sale prices or, if no sale occurred then the mean between the closing bid and asked quotations, for the Shares on the OTCBB on each of the five trading days the Shares traded ex-dividend on the OTCBB immediately prior to such date, and (b) net asset value per share on a particular date shall be as determined by or on behalf of the Fund.

4. The open-market purchases provided for herein may be made on any securities exchange on which the Shares are traded, in the over-the-counter market, or in negotiated transactions, and may be on such terms as to price, delivery and otherwise as the Agent shall determine. Funds held by the Agent uninvested will not bear interest, and it is understood that, in any event, the Agent shall have no liability in connection with any inability to purchase Shares within 45 days after the initial date of such purchase as herein provided, or with the timing of any purchases effected. The Agent shall have no responsibility as to the value of the Shares acquired for the Shareholder’s account.

5. The Agent will hold Shares acquired pursuant to the Plan in noncertificated form in the Agent’s name or that of its nominee. At no additional cost, a Shareholder participating in the Plan may send to the Agent for deposit into its Plan account those certificate shares of the Fund in its possession. These Shares will be combined with those unissued full and fractional Shares acquired under the Plan and held by the Agent. Shortly thereafter, such Shareholder will receive a statement showing its combined holdings. The Agent will forward to the Shareholder any proxy solicitation material and will vote any Shares so held for the Shareholder only in accordance with the proxy returned by the Shareholder to the Fund. Upon the Shareholder’s written request, the Agent will deliver to him or her, without charge, a certificate or certificates for the full Shares.

6. The Agent will confirm to the Shareholder each acquisition for the Shareholder’s account as soon as practicable but not later than 60 days after the date thereof. Although the Shareholder may from time to time have an individual fractional interest (computed to three decimal places) in a Share, no certificates for fractional Shares will be issued. However, dividends and distributions on fractional Shares will be credited to Shareholders’ accounts. In the event of a termination of a Shareholder’s account under the Plan, the Agent will adjust for any such undivided fractional interest in cash at the opening market value of the Shares at the time of termination.

7. Any stock dividends or split Shares distributed by the Fund on Shares held by the Agent for the Shareholder will be credited to the Shareholder’s account. In the event that the Fund makes available to the Shareholder the right to purchase additional Shares or other securities, the Shares held for a Shareholder under the Plan will be added to other Shares held by the Shareholder in calculating the number of rights to be issued to such Shareholder. Transaction processing may either be curtailed or suspended until the completion of any stock dividend, stock split, or corporate action.

8. The Agent’s service fee for handling capital gain distributions or income dividends will be paid by the Fund. The Shareholder will be charged a pro rata share of brokerage commissions on all open market purchases.

9. The Shareholder may terminate the account under the Plan by notifying the Agent. A termination will be effective immediately if notice is received by the Agent two days prior to any dividend or distribution payment

| Additional Information (Unaudited) | 19 | GLOBAL INCOME FUND, INC. |

date. If the request is received less than two days prior to the payment date, then that dividend will be invested, and all subsequent dividends will be paid in cash. Upon any termination the Agent will cause a certificate or certificates for the full Shares held for the Shareholder under the Plan and cash adjustment for any fraction to be delivered to the Shareholder.

10. These terms and conditions may be amended or supplemented by the Fund at any time or times but, except when necessary or appropriate to comply with applicable law or the rules or policies of the Securities and Exchange Commission or any other regulatory authority, only by mailing to the Shareholder appropriate written notice at least 30 days prior to the effective date thereof. The amendment or supplement shall be deemed to be accepted by the Shareholder unless, prior to the effective date thereof, the Agent receives written notice of the termination of such Shareholder’s account under the Plan. Any such amendment may include an appointment by the Fund of a successor agent in its place and stead under these terms and conditions, with full power and authority to perform all or any of the acts to be performed by the Agent. Upon any such appointment of an Agent for the purpose of receiving dividends and distributions, the Fund will be authorized to pay to such successor Agent all dividends and distributions payable on Shares held in the Shareholder’s name or under the Plan for retention or application by such successor Agent as provided in these terms and conditions.

11. In the case of Shareholders, such as banks, brokers or nominees, which hold Shares for others who are the beneficial owners, the Agent will administer the Plan on the basis of the number of Shares certified from time to time by the Shareholders as representing the total amount registered in the Shareholder’s name and held for the account of beneficial owners who are to participate in the Plan.

12. The Agent shall at all times act in good faith and agree to use its best efforts within reasonable limits to insure the accuracy of all services performed under this agreement and to comply with applicable law, but assumes no responsibility and shall not be liable for loss or damage due to errors unless the errors are caused by its negligence, bad faith or willful misconduct or that of its employees.

13. Neither the Fund or the Agent will be liable for any act performed in good faith or for any good faith omission to act, including without limitation, any claim of liability arising out of (i) failure to terminate a Shareholder’s account, sell shares or purchase shares, (ii) the prices which shares are purchased or sold for the Shareholder’s account, and (iii) the time such purchases or sales are made, including price fluctuation in market value after such purchases or sales.

HISTORICAL DISTRIBUTION SUMMARY

|

Period |

Investment Income |

Return of Capital |

Total | ||||||

|

6 Months Ended 6/30/08 * |

$ | 0.120 | $ | — | $ | 0.120 | |||

|

2007 |

$ | 0.170 | $ | 0.050 | $ | 0.220 | |||

|

2006 |

$ | 0.130 | $ | 0.150 | $ | 0.280 | |||

|

2005 |

$ | 0.200 | $ | 0.080 | $ | 0.280 | |||

|

2004 |

$ | 0.245 | $ | 0.090 | $ | 0.335 | |||

|

2003 |

$ | 0.220 | $ | 0.140 | $ | 0.360 | |||

|

2002 |

$ | 0.280 | $ | 0.220 | $ | 0.500 | |||

|

2001 |

$ | 0.360 | $ | 0.200 | $ | 0.560 | |||

|

2000 |

$ | 0.420 | $ | 0.160 | $ | 0.580 | |||

|

6 Months Ended 12/31/99 |

$ | 0.230 | $ | 0.070 | $ | 0.300 | |||

|

12 Months Ended 6/30/99 |

$ | 0.550 | $ | 0.130 | $ | 0.680 | |||

|

12 Months Ended 6/30/98 |

$ | 0.520 | $ | 0.320 | $ | 0.840 | |||

| * | The majority, and possibly all, of the 2008 distribution may be comprised of net investment income. This is only an estimate based on information available at this time and is subject to change. Actual amounts may be recharacterized between net investment income and return of capital for tax purposes after year end 2008, although the exact amount is not estimable at June 30, 2008. |

| GLOBAL INCOME FUND, INC. | 20 | Additional Information (Unaudited) |

STOCK DATA

|

Price (6/30/08) |

$ | 3.89 | ||

|

Net Asset Value (6/30/08) |

$ | 4.64 | ||

|

Discount |

16.2 | % |

Symbol: GIFD

2008 DISTRIBUTION PAYMENT DATES

|

Declaration |

Record |

Payment |

||

| March 3 | March 17 | March 31 | ||

| June 2 | June 16 | June 30 | ||

| September 4 | September 18 | September 30 | ||

| December 1 | December 15 | December 31 |

FUND INFORMATION

|

Investment Manager CEF Advisers, Inc. 11 Hanover Square New York, NY 10005 www.cefadvisers.com 1-212-344-6310 |

Stock Transfer Agent and Registrar Illinois Stock Transfer Company 209 West Jackson Blvd., Suite 903 Chicago, IL 60606 www.illinoisstocktransfer.com 1-800-757-5755 |

This report, including the financial statements herein, is transmitted to the shareholders of the Fund for their information. The financial information included herein is taken from the records of the Fund. This is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report. Pursuant to Section 23 of the Investment Company Act of 1940, notice is hereby given that the Fund may in the future purchase shares of its own common stock in the open market. These purchases may be made from time to time, at such times and in such amounts as may be deemed advantageous to the Fund, although nothing herein shall be considered a commitment to purchase such shares.

| Additional Information (Unaudited) | 21 | GLOBAL INCOME FUND, INC. |

Not applicable.

Not applicable.

Not applicable.

Not applicable.

Item 6. Schedule of Investments.

Included as part of the report to stockholders filed under Item 1 of this Form.

Not applicable.

Not applicable.

Not applicable.

Not applicable.

Item 11. Controls and Procedures.

| (a) | The registrant's principal executive officer and principal financial officer have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a- 3(c) under the Investment Company Act of 1940, as amended (the "1940 Act")) are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the 1940 Act and 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the registrant's second fiscal quarter of the period covered by the report that have materially affected, or are likely to materially affect the registrant's internal control over financial reporting. |

| (a) | Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940(17 CFR 270.360a-2) attached hereto as Exhibits EX-31 and certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto as Exhibit EX-32. |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

September 8, 2008 |

Global Income Fund, Inc. By: /s/ Thomas B. Winmill —————————————— Thomas B. Winmill President |

September 8, 2008 |

Global Income Fund, Inc. By: /s/ Thomas O'Malley —————————————— Thomas O'Malley Chief Financial Officer |