UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number:

|

811-08025

|

Global Income Fund, Inc.

(Exact name of registrant as specified in charter)

| 11 Hanover Square, New York, NY |

10005 |

| (Address of principal executive offices) |

(Zipcode) |

John F. Ramírez, Esq.

11 Hanover Square

New York, NY 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-344-6310

Date of fiscal year end: 12/31

Date of reporting period: 1/1/10 - 12/31/10

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a current valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. sec. 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

December 31, 2010

Ticker:

GIFD

11 Hanover Square

New York, NY 10005

www.globalincomefund.net

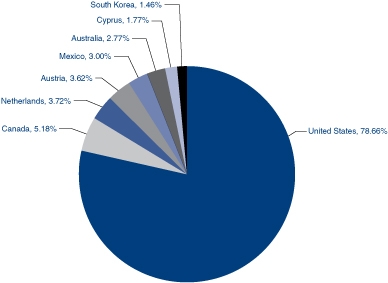

COUNTRY ALLOCATION*

PORTFOLIO ANALYSIS*

| Currency Allocation |

|

|

Bond Ratings |

| |

|

|

|

|

| |

|

|

|

AAA |

3% |

| U.S. Dollars** |

83% |

|

|

AA |

4% |

| Euros |

9% |

|

|

A |

10% |

| Australian Dollars |

7% |

|

|

BBB |

4% |

| Canadian Dollars |

1% |

|

|

<BBB |

1% |

| |

100% |

|

|

Non-bond investments |

78% |

| |

|

|

|

|

100% |

|

*

|

Country allocation and portfolio analysis use approximate percentages of net assets and may not add up to 100% due to leverage or other assets, rounding, and other factors. Ratings are not a guarantee of credit quality and may change. U.S. allocation may include closed end funds that may invest in foreign securities.

|

|

**

|

May include allocation to closed end funds that may invest in securities denominated in foreign currencies.

|

| |

| GLOBAL INCOME |

|

|

| FUND |

Ticker

Symbol:

|

GIFD

|

| |

| 11 Hanover Square, New York, NY 10005 |

|

|

| www.globalincomefund.net |

|

|

January 25, 2011

Dear Shareholders:

It is a pleasure to submit this 2010 Annual Report for Global Income Fund and to welcome our new shareholders who find the Fund's quality approach attractive. The Fund’s primary and fundamental objective is to provide a high level of income, with a secondary, non-fundamental investment objective of capital appreciation. The Fund currently pursues its investment objectives by investing primarily in closed end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities.

In the 2010 year, the Fund enjoyed a strong total return based on net asset value of 19.60%, and an even greater total return based on market value of 21.07%, reflecting a reduced market price discount to net asset value. Recently, the Fund's net asset value per share was $5.04 and its share closing market price was $4.12. While investment return and value will vary and shares of the Fund may subsequently be worth more or less than their original cost, this represents an opportunity for investors to purchase the Fund's shares at a discount to their underlying net asset value.

Distribution Policy

Under the current managed distribution policy, distributions of approximately 5% of the Fund's net asset value per share on an annual basis are paid primarily from net investment income and any net realized capital gains, with the balance representing return of capital. The estimated components of each quarterly distribution that includes a potential return of capital are provided to shareholders of record in a notice accompanying the distributions. In 2010, the Fund paid distributions from net investment income totaling $.22 per share, 100% from net investment income. The managed distribution policy is subject to review and may be canceled at any time by the Board of Directors and the amount of the distribution may vary depending on the Fund's net asset value per share at the time of declaration.

For those shareholders currently receiving the Fund's quarterly dividends in cash but are interested in adding to their account through the Fund's Dividend Reinvestment Plan, we encourage you to review the Plan set forth later in this document and contact the Fund’s Transfer Agent, who will be pleased to assist you, with no obligation on your part.

Global Report and Outlook

U.S. economic activity has been increasing at a moderate rate, according to a recent report of the U.S. Federal Reserve Open Market Committee (FOMC). Specifically, the pace of consumer spending picked up in the fourth quarter, exports rose, and the recovery in some business spending appeared to be continuing. In contrast, the FOMC sees residential and nonresidential construction activity as still “depressed.” Encouragingly, manufacturing production has shown recent gains, nonfarm businesses continued to add workers, while inflation expectations and trends are viewed by the FOMC as relatively benign. Unemployment levels, however, remain high.

In 2010 China, with the world’s second largest economy, after the United States, is estimated to have had GDP growth of around 10% and appears set to enjoy another year of strong growth in 2011. Yet, China also has problems with rising inflation and is suspected to be suffering from widespread non-performing debt at local levels. Meanwhile, Japan also showed healthy, if not as dramatic, economic recovery, with 2010 GDP growth estimated at approximately 3%.

Europe appears to be recovering slowly, although painfully. According to Eurostat, the European Union's statistics agency, the 16 country euro area is estimated to have had relatively weak, although improving, 1.7% GDP growth in 2010. But, annual inflation rose to 2.2% in December 2010, while the unemployment rate stood at 10.1% in the preceding month. Giving cause for some optimism, however, in November 2010 compared with October 2010, industrial new orders were up by 2.1% in the euro area.

Allocation Strategy

Given this comparatively benign economic environment, the Fund's strategy in 2010 included investing an increased percentage of its assets in closed end funds that invest significantly in income producing securities, while reducing its allocation to a global portfolio of investment grade fixed income securities denominated in major world currencies and issued by organizations across many countries. At year end, holdings of closed end funds and closed end fund business development companies comprised approximately 76% of the Fund's investments. In its global portfolio of fixed income securities, the Fund held securities of sovereign nations, corporations, and other organizations based in the Netherlands, Austria, Mexico, Australia, Cyprus, South Korea, Canada, and the United States. Approximately 98% of the Fund's bond investments are considered investment grade by actual or deemed rating. Of the Fund's net assets, approximately 83% were denominated in U.S. dollars, 9% in euros, 7% in Australian dollars, and 1% in Canadian dollars, although it should be noted that some of the closed end funds owned by Global Income Fund may invest in securities denominated in foreign currencies.

The outlook, according to the International Monetary Fund (IMF), is for global output to expand by about 4.5% in 2011. Interestingly, the IMF believes that the advanced economies' growth will slow to 2.5% from 3.0% last year, while emerging markets may see 6.5% growth, down from 7.1% in 2010. In view of these possible trends, we expect that a quality, globally approach with allocations to emerging markets may provide satisfactory results.

Quality and Flexibility

Our review of the markets indicates that the Fund has benefitted from its quality and flexible portfolio strategy by holding closed end funds that invest significantly in income producing securities, as well as income producing investments in multiple currencies. We note, however, that a sound investment strategy for investors seeking income should consider other types of asset classes when appropriate in view of, and proportional to, the perceived and acceptable risks.

As always, we are grateful to the Fund's long standing shareholders for their continuing support.

Sincerely,

Thomas B. Winmill

President

SCHEDULE OF PORTFOLIO INVESTMENTS – DECEMBER 31, 2010

|

Shares

|

|

|

|

Cost

|

|

|

Value

|

|

| |

|

CLOSED END FUNDS (62.21%)

|

|

|

|

|

|

|

| |

|

United States

|

|

|

|

|

|

|

| |

135,000 |

|

AllianceBernstein Income Fund, Inc

|

|

$ |

1,061,384 |

|

|

$ |

1,070,550 |

|

| |

110,488 |

|

Alpine Global Premier Properties Fund

|

|

|

676,590 |

|

|

|

783,360 |

|

| |

100,000 |

|

BlackRock Credit Allocation Income Trust I, Inc

|

|

|

908,295 |

|

|

|

915,000 |

|

| |

90,000 |

|

BlackRock Credit Allocation Income Trust III, Inc

|

|

|

1,019,233 |

|

|

|

946,800 |

|

| |

104,900 |

|

BlackRock Income Trust, Inc

|

|

|

609,177 |

|

|

|

717,516 |

|

| |

117,012 |

|

Calamos Strategic Total Return Fund

|

|

|

1,033,149 |

|

|

|

1,083,531 |

|

| |

97,141 |

|

Cohen & Steers Dividend Majors Fund, Inc

|

|

|

1,076,946 |

|

|

|

1,258,947 |

|

| |

72,871 |

|

Cohen & Steers Infrastructure Fund, Inc

|

|

|

984,177 |

|

|

|

1,196,542 |

|

| |

40,934 |

|

Cohen & Steers Quality Income Realty Fund, Inc

|

|

|

250,489 |

|

|

|

354,079 |

|

| |

601,720 |

|

DCA Total Return Fund

|

|

|

1,579,340 |

|

|

|

2,075,934 |

|

| |

209,827 |

|

First Trust Strategic High Income Fund III

|

|

|

907,087 |

|

|

|

912,747 |

|

| |

54,000 |

|

Gabelli Dividend & Income Trust (a)

|

|

|

898,496 |

|

|

|

829,440 |

|

| |

144,783 |

|

Helios Advantage Income Fund, Inc

|

|

|

887,852 |

|

|

|

1,107,590 |

|

| |

42,000 |

|

John Hancock Bank and Thrift Opportunity Fund

|

|

|

631,158 |

|

|

|

723,240 |

|

| |

64,592 |

|

Lazard World Dividend & Income Fund, Inc

|

|

|

732,620 |

|

|

|

828,069 |

|

| |

28,297 |

|

LMP Capital & Income Fund Inc.

|

|

|

282,900 |

|

|

|

352,298 |

|

| |

89,982 |

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund

|

|

|

1,057,200 |

|

|

|

1,302,939 |

|

| |

63,369 |

|

Macquarie Global Infrastructure Total Return Fund Inc

|

|

|

1,023,476 |

|

|

|

1,095,016 |

|

| |

73,330 |

|

NFJ Dividend, Interest & Premium Strategy Fund

|

|

|

1,018,338 |

|

|

|

1,284,008 |

|

| |

62,000 |

|

Nuveen Diversified Dividend and Income Fund

|

|

|

618,254 |

|

|

|

675,180 |

|

| |

59,477 |

|

RMR Real Estate Fund

|

|

|

808,673 |

|

|

|

1,772,415 |

|

| |

74,453 |

|

RiverSource LaSalle International Real Estate Fund Inc

|

|

|

642,099 |

|

|

|

699,858 |

|

| |

60,000 |

|

Western Asset Global Corporate Defined Opportunity Fund Inc

|

|

|

1,071,197 |

|

|

|

1,075,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total closed end funds

|

|

|

19,778,130 |

|

|

|

23,060,859 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount (b)

|

|

|

|

|

|

|

|

|

| |

|

DEBT SECURITIES (21.96%)

|

|

|

|

|

|

|

| |

|

Australia (2.77%)

|

|

|

|

|

|

|

| A$500,000 |

|

Telstra Corp. Ltd., 6.25% Senior Notes, due 4/15/15

|

|

|

365,869 |

|

|

|

502,348 |

|

| A$500,000 |

|

Telstra Corp. Ltd., 7.25% Senior Notes, due 11/15/12 (a)

|

|

|

392,327 |

|

|

|

522,637 |

|

| |

|

|

|

|

758,196 |

|

|

|

1,024,985 |

|

| |

|

Austria (3.62%)

|

|

|

|

|

|

|

|

|

| € 1,000,000 |

|

Republic of Austria, 5.25% Euro Medium Term Notes, due 1/04/11 (a)

|

|

|

1,282,616 |

|

|

|

1,341,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Canada (5.18%)

|

|

|

|

|

|

|

|

|

| C$500,000 |

|

Molson Coors Capital Finance, 5.00% Guaranteed Notes,

|

|

|

|

|

|

|

|

|

| |

|

due 9/22/15 (a)

|

|

|

447,225 |

|

|

|

532,879 |

|

| A$1,350,000 |

|

Province of Ontario, 5.50% Euro Medium Term Notes, due 7/13/12 (a)

|

|

|

1,037,522 |

|

|

|

1,386,937 |

|

| |

|

|

|

|

1,484,747 |

|

|

|

1,919,816 |

|

| |

|

Cyprus (1.77%)

|

|

|

|

|

|

|

|

|

| € 500,000 |

|

Republic of Cyprus, 4.375% Euro Medium Term Notes, due 7/15/14

|

|

|

619,210 |

|

|

|

657,405 |

|

See notes to financial statements.

SCHEDULE OF PORTFOLIO INVESTMENTS – DECEMBER 31, 2010

|

Principal

Amount (b)

|

|

|

|

Cost

|

|

|

Value

|

|

| |

|

DEBT SECURITIES (continued)

|

|

|

|

|

|

|

| |

|

Mexico (3.00%)

|

|

|

|

|

|

|

| |

1,000,000 |

|

United Mexican States, 5.625% Notes, due 1/15/17 (a)

|

|

$ |

985,130 |

|

|

$ |

1,111,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Netherlands (3.72%)

|

|

|

|

|

|

|

|

|

| |

€1,000,000 |

|

ING Bank N.V., 5.50% Euro Medium Term Notes, due 1/04/12

|

|

|

1,307,769 |

|

|

|

1,379,892 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

South Korea (1.46%)

|

|

|

|

|

|

|

|

|

| |

500,000 |

|

Korea Development Bank, 5.75% Notes, due 9/10/13 (a)

|

|

|

505,005 |

|

|

|

542,564 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

United States (0.44%)

|

|

|

|

|

|

|

|

|

| |

203,312 |

|

CIT RV Trust 1998-A B 6.29% Subordinated Bonds, due 1/15/17 (a)

|

|

|

206,599 |

|

|

|

162,614 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total debt securities

|

|

|

7,149,272 |

|

|

|

8,139,820 |

|

| |

|

CLOSED END FUND BUSINESS DEVELOPMENT

|

|

|

|

|

|

|

|

Shares

|

|

COMPANIES (14.03%)

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

United States

|

|

|

|

|

|

|

| |

131,389 |

|

Kohlberg Capital Corp

|

|

|

659,505 |

|

|

|

915,781 |

|

| |

110,000 |

|

MCG Capital Corp

|

|

|

662,176 |

|

|

|

766,700 |

|

| |

101,500 |

|

MVC Capital, Inc

|

|

|

980,236 |

|

|

|

1,481,900 |

|

| |

129,294 |

|

NGP Capital Resources Co

|

|

|

919,594 |

|

|

|

1,189,505 |

|

| |

48,591 |

|

Saratoga Investment Corp

|

|

|

1,057,161 |

|

|

|

848,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total closed end fund business development companies

|

|

|

4,278,672 |

|

|

|

5,202,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PREFERRED STOCKS (1.98%)

|

|

|

|

|

|

|

|

|

| |

|

|

United States

|

|

|

|

|

|

|

|

|

| |

4,000 |

|

BAC Capital Trust II, 7.00%

|

|

|

100,000 |

|

|

|

97,600 |

|

| |

25,000 |

|

Corporate-Backed Trust Certificates, 8.20% (Motorola)

|

|

|

625,000 |

|

|

|

636,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total preferred stocks

|

|

|

725,000 |

|

|

|

734,100 |

|

See notes to financial statements.

SCHEDULE OF PORTFOLIO INVESTMENTS – DECEMBER 31, 2010

|

Shares

|

|

|

|

Cost

|

|

|

Value

|

|

| |

|

|

|

|

|

|

|

|

| |

|

MONEY MARKET FUND (less than 0.01%)

|

|

|

|

|

|

|

| |

|

United States

|

|

|

|

|

|

|

| |

10 |

|

SSgA Money Market Fund, 7 day annualized yield 0.01%

|

|

$ |

10 |

|

|

$ |

10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total investments (100.18%)

|

|

$ |

31,931,084 |

|

|

|

37,137,074 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Liabilities in excess of other assets (-0.18%)

|

|

|

|

|

|

|

(65,955 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Net assets (100.00%)

|

|

|

|

|

|

$ |

37,071,119 |

|

|

(a)

|

Fully or partially pledged as collateral on bank credit facility.

|

|

(b)

|

The principal amount is stated in U.S. dollars unless otherwise indicated.

|

|

|

|

| A$ |

|

Australian Dollar

|

|

| C$ |

|

Canadian Dollar

|

|

| € |

|

Euro

|

|

See notes to financial statements.

|

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2010

|

|

|

|

STATEMENT OF OPERATIONS

Year Ended December 31, 2010

|

|

|

|

| |

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

INVESTMENT INCOME

|

|

|

|

|

Investments, at value (cost: $31,931,084)

|

|

$ |

37,137,074 |

|

Dividends

|

|

$ |

1,688,333 |

|

|

Cash

|

|

|

218,372 |

|

Interest

|

|

|

463,803 |

|

|

Receivables

|

|

|

|

|

|

|

|

|

|

|

Interest

|

|

|

246,585 |

|

Total investment income

|

|

|

2,152,136 |

|

|

Dividends

|

|

|

216,623 |

|

|

|

|

|

|

|

Securities sold

|

|

|

198,699 |

|

EXPENSES

|

|

|

|

|

|

Other assets

|

|

|

12,471 |

|

Investment management

|

|

|

237,977 |

|

| |

|

|

|

|

Legal

|

|

|

204,528 |

|

|

Total assets

|

|

|

38,029,824 |

|

Administrative services

|

|

|

89,509 |

|

| |

|

|

|

|

Bookkeeping and pricing

|

|

|

44,477 |

|

|

LIABILITIES

|

|

|

|

|

Directors

|

|

|

24,769 |

|

|

Bank line of credit

|

|

|

854,520 |

|

Auditing

|

|

|

20,935 |

|

|

Payables

|

|

|

|

|

Interest and fees on bank credit facility

|

|

|

13,373 |

|

|

Accrued expenses

|

|

|

72,199 |

|

Shareholder communications

|

|

|

13,097 |

|

|

Investment management

|

|

|

21,580 |

|

Insurance

|

|

|

10,320 |

|

|

Administrative services

|

|

|

10,406 |

|

Custodian

|

|

|

9,869 |

|

| |

|

|

|

|

Other

|

|

|

6,386 |

|

|

Total liabilities

|

|

|

958,705 |

|

Transfer agent

|

|

|

5,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

$ |

37,071,119 |

|

Total expenses

|

|

|

681,140 |

|

| |

|

|

|

|

|

|

|

|

|

|

NET ASSET VALUE PER SHARE

|

|

|

|

|

Net investment income

|

|

|

1,470,996 |

|

|

(applicable to 7,412,095 shares

|

|

|

|

|

|

|

|

|

|

|

outstanding: 20,000,000 shares of $.01

|

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

|

|

|

|

|

|

par value authorized)

|

|

$ |

5.00 |

|

Net realized gain (loss)

|

|

|

|

|

| |

|

|

|

|

Investments

|

|

|

2,456,073 |

|

|

NET ASSETS CONSIST OF

|

|

|

|

|

Foreign currencies

|

|

|

7,677 |

|

|

Paid in capital

|

|

$ |

33,271,398 |

|

Short sales

|

|

|

(4,296 |

) |

|

Accumulated undistributed net investments

|

|

|

|

|

Net unrealized appreciation (depreciation)

|

|

|

|

|

|

Income

|

|

|

129,680 |

|

Investments

|

|

|

3,045,584 |

|

|

Accumulated net realized loss on

|

|

|

|

|

Translation of assets and liabilities

|

|

|

|

|

|

investments and foreign currencies

|

|

|

(1,547,640 |

) |

in foreign currencies

|

|

|

(1,100,331 |

) |

|

Net unrealized appreciation on

|

|

|

|

|

|

|

|

|

|

|

investments and foreign currencies

|

|

|

5,217,681 |

|

Net realized and unrealized gain

|

|

|

4,404,707 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

$ |

37,071,119 |

|

Net change in net assets

|

|

|

|

|

| |

|

|

|

|

resulting from operations

|

|

$ |

5,875,703 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

See notes to financial statements.

STATEMENTS OF CHANGES IN NET ASSETS

For the Years Ended December 31, 2010 and 2009

| |

|

2010

|

|

|

2009

|

|

| |

|

|

|

|

|

|

|

OPERATIONS

|

|

|

|

|

|

|

|

Net investment income

|

|

$ |

1,470,996 |

|

|

$ |

1,519,973 |

|

|

Net realized gain (loss)

|

|

|

2,459,454 |

|

|

|

(1,542,455 |

) |

|

Unrealized appreciation

|

|

|

1,945,253 |

|

|

|

7,581,905 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase in net assets resulting from operations

|

|

|

5,875,703 |

|

|

|

7,559,423 |

|

| |

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS

|

|

|

|

|

|

|

|

|

|

Distributions from ordinary income ($0.22 and $0.235 per share, respectively)

|

|

|

(1,630,219 |

) |

|

|

(1,740,436 |

) |

| |

|

|

|

|

|

|

|

|

|

CAPITAL SHARE TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

Reinvestment of distributions to shareholders (3,212 and 5,006 shares, respectively)

|

|

|

12,144 |

|

|

|

15,554 |

|

| |

|

|

|

|

|

|

|

|

|

Total change in net assets

|

|

|

4,257,628 |

|

|

|

5,834,541 |

|

| |

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

32,813,491 |

|

|

|

26,978,950 |

|

| |

|

|

|

|

|

|

|

|

|

End of year

|

|

$ |

37,071,119 |

|

|

$ |

32,813,491 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Undistributed net investment income included in net assets

|

|

$ |

129,680 |

|

|

$ |

345,096 |

|

See notes to financial statements.

STATEMENT OF CASH FLOWS

Year Ended December 31, 2010

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

Net increase in net assets resulting from operations

|

|

$ |

5,875,703 |

|

|

Adjustments to reconcile change in net assets resulting from operations to net cash provided by (used in) operating activities:

|

|

|

|

|

|

Proceeds from sales of long term investments

|

|

|

19,063,734 |

|

|

Purchase of long term investments

|

|

|

(18,565,717 |

) |

|

Net purchases of short term investment securities

|

|

|

4,372 |

|

|

Unrealized appreciation of investments and foreign currencies

|

|

|

(1,930,142 |

) |

|

Net realized gain on sales of investments, short sales, and foreign currencies

|

|

|

(2,459,454 |

) |

|

Buy to cover investments held short

|

|

|

(485,000 |

) |

|

Proceeds from securities sold short

|

|

|

480,704 |

|

|

Amortization of premium net of accretion of discount of investments

|

|

|

66,869 |

|

|

Increase in receivable for investments sold

|

|

|

(198,699 |

) |

|

Decrease in interest receivable

|

|

|

138,977 |

|

|

Increase in dividends receivable

|

|

|

(122,188 |

) |

|

Increase in other assets

|

|

|

(1,722 |

) |

|

Increase in accrued expenses

|

|

|

9,377 |

|

|

Decrease in investment management fee payable

|

|

|

2,365 |

|

|

Increase in administrative services payable

|

|

|

1,056 |

|

| |

|

|

|

|

|

Net cash provided by operating activities

|

|

|

1,880,235 |

|

| |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

Cash distributions paid

|

|

|

(1,618,075 |

) |

|

Repayment of bank line of credit

|

|

|

(43,788 |

) |

| |

|

|

|

|

|

Net cash used in financing activities

|

|

|

(1,661,863 |

) |

| |

|

|

|

|

|

Net change in cash

|

|

|

218,372 |

|

| |

|

|

|

|

|

CASH

|

|

|

|

|

|

Beginning of year

|

|

|

-- |

|

|

End of year

|

|

$ |

218,372 |

|

| |

|

|

|

|

| |

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

|

|

|

|

|

Cash paid for interest and fees on bank credit facility

|

|

$ |

11,925 |

|

|

Non-cash financing activities not included herein consisted of reinvestment of distributions

|

|

$ |

12,144 |

|

| |

|

|

|

|

See notes to financial statements.

NOTES TO FINANCIAL STATEMENTS - DECEMBER 31, 2010

1. Organization and Significant Accounting Policies

Global Income Fund, Inc., a Maryland corporation registered under the Investment Company Act of 1940, as amended (the “Act”), is a non-diversified, closed end management investment company, whose shares are quoted over the counter under the ticker symbol GIFD. The Fund’s investment objectives are primarily to provide a high level of income and, secondarily, capital appreciation. The Fund retains CEF Advisers, Inc. as its Investment Manager.

The following is a summary of the Fund’s significant accounting policies.

Security Valuation – Portfolio securities are valued by various methods depending on the primary market or exchange on which they trade. Most equity securities for which the primary market is the United States are valued at the official closing price, last sale price or, if no sale has occurred, at the closing bid price. Most equity securities for which the primary market is outside the United States are valued using the official closing price or the last sale price in the principal market in which they are traded. If the last sale price on the local exchange is unavailable, the last evaluated quote or closing bid price normally is used. Certain of the securities in which the Fund invests are priced through pricing services that may utilize a matrix pricing system which takes into consideration factors such as yields, prices, maturities, call features, and ratings on comparable securities. Bonds may be valued according to prices quoted by a bond dealer that offers pricing services. Open end investment companies are valued at their net asset value. Securities for which quotations are not readily available or reliable and other assets may be valued as determined in good faith by the Investment Manager under the direction of or pursuant to procedures established by the Fund’s Board of Directors. Due to the inherent uncertainty of valuation, these values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. A security’s valuation may differ depending on the method used for determining value. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ from the net asset value that would be calculated using market prices.

Foreign Currency Translation – Securities denominated in foreign currencies are translated into U.S. dollars at prevailing exchange rates. Realized gain or loss on sales of such investments in local currency terms is reported separately from gain or loss attributable to a change in foreign exchange rates for those investments.

Foreign Currency Contracts – Forward foreign currency contracts are marked to market and the change in market value is recorded by the Fund as an unrealized gain or loss. When a contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably.

Investments in Other Investment Companies – The Fund may invest in shares of other investment companies (or entities that would be considered investment companies but are excluded from the definition pursuant to certain exceptions under the Act) (the “Acquired Funds”) in accordance with the Act and related rules. Shareholders in the Fund bear the pro rata portion of the fees and expenses of the Acquired Funds in addition to the Fund’s expenses. Expenses incurred by the Fund that are disclosed in the Statement of Operations do not include fees and expenses incurred by the Acquired Funds. The fees and expenses of the Acquired Funds are included in the Fund’s total returns.

Short Sales – The Fund may sell a security it does not own in anticipation of a decline in the value of the security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker/dealer through which it made the short sale. The Fund is liable for any dividends or interest paid on securities sold short. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale. Securities sold short result in off balance sheet risk as the Fund’s ultimate obligation to satisfy the terms of the sale of securities sold short may exceed the amount recognized in the Statement of Assets and Liabilities.

Investment Transactions – Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Realized gains or losses are determined by specifically identifying the cost basis of the investment sold.

Investment Income – Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date. Taxes withheld on income from foreign securities have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

NOTES TO FINANCIAL STATEMENTS (Continued)

Expenses – Estimated expenses are accrued daily. Expenses directly attributable to the Fund are charged to the Fund. Expenses borne by the complex of related investment companies, which includes open end and closed end investment companies for which the Investment Manager and its affiliates serve as investment manager, that are not directly attributed to the Fund are allocated among the Fund and the other investment companies in the complex on the basis of relative net assets, except where a more appropriate allocation of expenses can be made fairly.

Expense Reduction Arrangement – Through arrangements with the Fund’s custodian and cash management bank, credits realized as a result of uninvested cash balances are used to reduce custodian expenses. No credits were realized by the Fund during the period.

Distributions to Shareholders – Distributions to shareholders are determined in accordance with income tax regulations and recorded on the ex-dividend date.

Income Taxes – No provision has been made for U.S. income taxes because the Fund’s current intention is to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute to its shareholders substantially all of its taxable income and net realized gains. Foreign securities held by the Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has reviewed its tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on federal, state, and local income tax returns for open tax years (2007 – 2009), or expected to be taken in the Fund’s 2010 tax returns.

Use of Estimates – In preparing financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”), management makes estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications – The Fund indemnifies its officers and directors from certain liabilities that might arise from their performance of their duties for the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as it involves future claims that may be made against the Fund under circumstances that have not occurred.

Recently Issued Accounting Standards Updates – In January 2010, the Financial Accounting Standard Board released Accounting Standards Update (“ASU”) No. 2010-06, Improving Disclosures about Fair Value Measurements. Among the new disclosures and clarifications of existing disclosures the ASU requires the Fund to disclose separately the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and to describe the reasons for the transfers. Significance shall be judged with respect to total earnings and total assets or total liabilities. The ASU requires the Level 3 roll forward reconciliation of beginning and ending balances to be prepared on a gross basis, in particular separately presenting information about purchases, sales, issuances, and settlements. The ASU also requires disclosure of the reasons for significant transfers in and out of Level 3. The Fund adopted the ASU on January 1, 2010, except for the Level 3 gross basis roll forward reconciliation which is effective for fiscal years beginning after December 15, 2010 and for interim periods within those fiscal years.

NOTES TO FINANCIAL STATEMENTS (Continued)

2. Fees and Transactions with Related Parties

The Fund retains the Investment Manager pursuant to an Investment Management Agreement (“IMA”). Under the terms of the IMA, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at an annual rate of 7/10 of 1% of the first $50 million, 5/8 of 1% over $50 million to $150 million, and 1/2 of 1% over $150 million. Certain officers and directors of the Fund are officers and directors of the Investment Manager. Pursuant to the IMA, the Fund reimburses the Investment Manager for providing at cost certain administrative services comprised of compliance and accounting services. For the year ended December 31, 2010, the Fund incurred total administrative costs of $89,509, comprised of $56,755 and $32,754 for compliance and accounting services, respectively.

3. Distributions to Shareholders and Distributable Earnings

The tax character of distributions paid to shareholders for the year ended December 31, 2010 in the amount of $1,630,219 was comprised of ordinary income.

As of December 31, 2010, the components of distributable earnings on a tax basis were as follows:

|

Undistributed net investment income

|

|

$ |

34,368 |

|

|

Unrealized appreciation on investments and foreign currencies

|

|

|

5,311,261 |

|

|

Capital loss carryovers

|

|

|

(1,545,908 |

) |

| |

|

$ |

3,799,721 |

|

Federal income tax regulations permit post-October net capital losses, if any, to be deferred and recognized on the tax return of the next succeeding taxable year.

GAAP requires certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2010, permanent differences between book and tax accounting have been reclassified as follows:

|

Increase in

Undistributed

Net Investment Income

|

|

|

Increase in

Net Realized Loss on

Investments and Foreign Currencies

|

|

Increase in

Paid in Capital

|

| $7,677 |

|

$(7,677) |

|

$0 |

As of December 31, 2010, the Fund had a net capital loss carryover that may be used to offset future realized capital gains for federal income tax purposes of $1,545,908 which expires in 2017.

4. Fair Value Measurements

The Fund uses a three level hierarchy for fair value measurements based on the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the inputs which are significant to the overall valuation.

NOTES TO FINANCIAL STATEMENTS (Continued)

The inputs or methodology used for valuing investments are not an indication of the risk associated with investing in those securities. The hierarchy of inputs is summarized below.

|

Level

|

1

|

- unadjusted quoted prices in active markets for identical assets or liabilities including securities actively traded on a securities exchange.

|

|

Level

|

2

|

- observable inputs other than quoted prices included in level 1 that are observable for the asset or liability which may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

|

|

Level

|

3

|

- unobservable inputs for the asset or liability including the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability.

|

The following is a summary of the inputs used as of December 31, 2010 in valuing the Fund’s assets carried at fair value. Refer to the Schedule of Portfolio Investments for detailed information on specific investments.

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closed end funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

$ |

23,060,859 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

23,060,859 |

|

|

Debt securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia

|

|

|

— |

|

|

|

1,024,985 |

|

|

|

— |

|

|

|

1,024,985 |

|

|

Austria

|

|

|

— |

|

|

|

1,341,544 |

|

|

|

— |

|

|

|

1,341,544 |

|

|

Canada

|

|

|

— |

|

|

|

1,919,816 |

|

|

|

— |

|

|

|

1,919,816 |

|

|

Cyprus

|

|

|

— |

|

|

|

657,405 |

|

|

|

— |

|

|

|

657,405 |

|

|

Mexico

|

|

|

— |

|

|

|

1,111,000 |

|

|

|

— |

|

|

|

1,111,000 |

|

|

Netherlands

|

|

|

— |

|

|

|

1,379,892 |

|

|

|

— |

|

|

|

1,379,892 |

|

|

South Korea

|

|

|

— |

|

|

|

542,564 |

|

|

|

— |

|

|

|

542,564 |

|

|

United States

|

|

|

— |

|

|

|

162,614 |

|

|

|

— |

|

|

|

162,614 |

|

|

Closed end fund business development companies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

5,202,285 |

|

|

|

— |

|

|

|

— |

|

|

|

5,202,285 |

|

|

Preferred stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

734,100 |

|

|

|

— |

|

|

|

— |

|

|

|

734,100 |

|

|

Money market fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

$ |

28,997,254 |

|

|

$ |

8,139,820 |

|

|

$ |

— |

|

|

$ |

37,137,074 |

|

There were no transfers between Level 1 and Level 2 during the year ended December 31, 2010.

5. Securities Transactions

Purchases and sales/repayments/maturities of securities, excluding short sale transactions and short term investments, aggregated $18,565,717 and $19,063,734, respectively, for the year ended December 31, 2010. At December 31, 2010, for federal income tax purposes, the aggregate cost of securities was $31,931,084 and net unrealized appreciation was $5,205,990, comprised of gross unrealized appreciation of $5,602,626 and gross unrealized depreciation of $396,636.

6. Bank Credit Facility

The Fund, Foxby Corp., Midas Fund, Inc., and Midas Special Fund, Inc. (the “Borrowers”) have entered into a committed secured line of credit facility, which is subject to annual renewal, with State Street Bank and Trust Company (“SSB”), the Fund’s custodian. Foxby Corp. is a closed end investment company managed by the

NOTES TO FINANCIAL STATEMENTS (Continued)

Investment Manager, and Midas Fund, Inc. and Midas Special Fund, Inc. are open end investment companies managed by an affiliate of the Investment Manager. The aggregate amount of the credit facility is $10,000,000. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. SSB will make revolving loans to a Borrower not to exceed in the aggregate outstanding at any time with respect to any one Borrower the least of $10,000,000, the maximum amount permitted pursuant to each Borrower’s investment policies, or as permitted under the Act. The commitment fee on this facility is 0.15% per annum on the unused portion of the commitment, based on a 360 day year. All loans under this facility will be available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days), each as in effect from time to time, plus 1.50% per annum, calculated on the basis of actual days elapsed for a 360 day year. At December 31, 2010, there were investment securities pledged as collateral with a value of $6,429,614 and outstanding borrowings under the credit facility of $854,520. For the year ended December 31, 2010, the Fund’s weighted average interest rate under the credit facility was 1.92% based on its balances outstanding during the period and the Fund’s average daily amount outstanding during the period was $289,941.

7. Foreign Securities Risk

Investing in securities of foreign issuers involves special risks, including changes in foreign exchange rates and the possibility of future adverse political and economic developments, which could adversely affect the value of such securities. Moreover, securities in foreign issuers and markets may be less liquid and their prices more volatile than those of U.S. issuers and markets.

8. Capital Stock

At December 31, 2010, there were 7,412,095 shares of $.01 par value common stock outstanding (20,000,000 shares authorized). The shares issued and resulting increase in paid in capital in connection with reinvestment of distributions for the years ended December 31, 2010 and 2009 were as follows:

| |

|

2010

|

|

|

2009

|

|

|

Shares issued

|

|

|

3,212 |

|

|

|

5,006 |

|

|

Increase in paid in capital

|

|

$ |

12,144 |

|

|

$ |

15,554 |

|

9. Share Repurchase Program

In accordance with Section 23(c) of the Act, the Fund may from time to time repurchase its shares in the open market at the discretion of the Board of Directors and upon such terms as the Directors shall determine. During the years ended December 31, 2010 and 2009, the Fund did not repurchase any of its shares.

10. Other Information

The Fund may at times raise cash for investment by issuing shares through one or more offerings, including rights offerings. Proceeds from any such offerings will be invested in accordance with the investment objectives and policies of the Fund.

11. Subsequent Events

The Fund has evaluated subsequent events through the date the financial statements were issued and determined that no subsequent events have occurred that require additional disclosure in the financial statements.

FINANCIAL HIGHLIGHTS

| |

|

Year Ended December 31, |

|

| |

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Operating Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(for a share outstanding throughout

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

each period)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period

|

|

$ |

4.43 |

|

|

$ |

3.64 |

|

|

$ |

4.60 |

|

|

$ |

4.38 |

|

|

$ |

4.33 |

|

|

Income from investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (1)

|

|

|

.20 |

|

|

|

.21 |

|

|

|

.19 |

|

|

|

.13 |

|

|

|

.13 |

|

|

Net realized and unrealized gain (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on investments

|

|

|

.59 |

|

|

|

.82 |

|

|

|

(.91 |

) |

|

|

.31 |

|

|

|

.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total income from investment operations

|

|

|

.79 |

|

|

|

1.03 |

|

|

|

(.72 |

) |

|

|

.44 |

|

|

|

.33 |

|

|

Less distributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

(.22 |

) |

|

|

(.24 |

) |

|

|

(.24 |

) |

|

|

(.17 |

) |

|

|

(.13 |

) |

|

Return of capital

|

|

|

– |

|

|

|

– |

|

|

|

- |

|

|

|

(.05 |

) |

|

|

(.15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributions

|

|

|

(.22 |

) |

|

|

(.24 |

) |

|

|

(.24 |

) |

|

|

(.22 |

) |

|

|

(.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of period

|

|

$ |

5.00 |

|

|

$ |

4.43 |

|

|

$ |

3.64 |

|

|

$ |

4.60 |

|

|

$ |

4.38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market value, end of period

|

|

$ |

4.17 |

|

|

$ |

3.65 |

|

|

$ |

2.70 |

|

|

$ |

3.90 |

|

|

$ |

4.18 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on net asset value

|

|

|

19.60 |

% |

|

|

31.03 |

% |

|

|

(14.94 |

)% |

|

|

11.00 |

% |

|

|

8.43 |

% |

|

Based on market price

|

|

|

21.07 |

% |

|

|

45.55 |

% |

|

|

(25.58 |

)% |

|

|

(1.39 |

)% |

|

|

13.43 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental Data (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (000’s omitted)

|

|

$ |

37,071 |

|

|

$ |

32,813 |

|

|

$ |

26,979 |

|

|

$ |

34,057 |

|

|

$ |

32,362 |

|

|

Ratio of total expenses to average net assets

|

|

|

2.00 |

% |

|

|

1.62 |

% |

|

|

1.68 |

% |

|

|

1.77 |

% |

|

|

1.89 |

% |

|

Ratio of net expenses to average net assets

|

|

|

2.00 |

% |

|

|

1.62 |

% |

|

|

1.68 |

% |

|

|

1.77 |

% |

|

|

1.89 |

% |

|

Ratio of net expenses excluding loan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest and fees to average net assets

|

|

|

1.96 |

% |

|

|

1.56 |

% |

|

|

1.66 |

% |

|

|

1.75 |

% |

|

|

1.87 |

% |

|

Ratio of net investment income to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

average net assets

|

|

|

4.33 |

% |

|

|

5.23 |

% |

|

|

4.31 |

% |

|

|

2.91 |

% |

|

|

2.71 |

% |

|

Portfolio turnover rate

|

|

|

55 |

% |

|

|

48 |

% |

|

|

21 |

% |

|

|

10 |

% |

|

|

17 |

% |

|

(1)

|

The per share amounts were calculated using the average number of common shares outstanding during the period.

|

|

(2)

|

Total return on a market value basis is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Generally, total return on a net asset value basis will be higher than total return on a market value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return on a net asset value basis will be lower than total return on a market value basis in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total return calculated for a period of less than one year is not annualized. The calculation does not reflect brokerage commissions, if any.

|

|

(3)

|

Expense and income ratios for 2008, 2009, and 2010, do not include expenses incurred by the Acquired Funds in which the Fund invests.

|

See notes to financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Global Income Fund, Inc.

We have audited the accompanying statement of assets and liabilities of Global Income Fund, Inc., including the schedule of portfolio investments as of December 31, 2010 and the related statement of operations and of cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years indicated thereon. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Global Income Fund, Inc. as of December 31, 2010, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years indicated thereon, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

February 25, 2011

INVESTMENT OBJECTIVES AND POLICIES

The Fund’s primary investment objective of providing a high level of income is fundamental and may not be changed without shareholder approval. The Fund is also subject to certain investment restrictions, set forth in its most recently effective Statement of Additional Information, that are fundamental and cannot be changed without shareholder approval. The Fund’s secondary investment objective of capital appreciation and the other investment policies described herein, unless otherwise stated, are not fundamental and may be changed by the Board of Directors without shareholder approval. Notice to shareholders of any change in the Fund’s secondary investment objective will be provided as required by law.

PROXY VOTING

The Fund’s Proxy Voting Guidelines, as well as its voting record for the most recent 12 months ended June 30, are available without charge by calling the Fund collect at 1-212-344-6310, on the SEC’s website at www.sec.gov, and on the Fund’s website at www.globalincomefund.net.

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund makes the Forms N-Q available on its website at www.globalincomefund.net.

GLOBALINCOMEFUND.NET

Visit us on the web at www.globalincomefund.net. The site provides information about the Fund, including market performance, net asset value, dividends, press releases, and shareholder reports. For further information, please email us at info@globalincomefund.net.

MANAGED DISTRIBUTIONS

The Board’s current policy is to provide investors with a stable quarterly distribution out of current income, supplemented by realized capital gains, and to the extent necessary, paid in capital. The Fund is subject to U.S. corporate, tax, and securities laws. Under U.S. tax accounting rules, the amount of distributable net income is determined on an annual basis and is dependent during the fiscal year on the aggregate gains and losses realized by the Fund and, to a lesser extent, the actual exchange rate between the U.S. dollar and the currencies in which Fund assets are denominated. Therefore, the exact amount of distributable income can only be determined as of the end of the Fund’s fiscal year. Under the Investment Company Act of 1940, as amended, however, the Fund is required to indicate the source of each distribution to shareholders. The Fund estimates that distributions for the fiscal period commencing January 1, 2011, including the distributions paid quarterly, will be comprised primarily from net investment income and the balance from paid in capital. This estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future realized gains and losses on securities and fluctuations in the value of currencies in which Fund assets are denominated. After each fiscal year, a Form 1099-DIV will be sent to shareholders stating the amount and composition of distributions and providing information about their appropriate tax treatment.

Additional Information (Unaudited)

DIVIDEND REINVESTMENT PLAN

Terms and Conditions of the

2008 Amended Dividend Reinvestment Plan

1. Each shareholder (the “Shareholder”) holding shares of common stock (the “Shares”) of Global Income Fund, Inc. (the “Fund”) will automatically be a participant in the Dividend Reinvestment Plan (the “Plan”), unless the Shareholder specifically elects to receive all dividends and capital gains in cash paid by check mailed directly to the Shareholder by Illinois Stock Transfer Company, 209 West Jackson Blvd., Suite 903, Chicago, Illinois 60606, 1-800-757-5755, as agent under the Plan (the “Agent”). The Agent will open an account for each Shareholder under the Plan in the same name in which such Shareholder's shares of Common Stock are registered.

2. Whenever the Fund declares a capital gain distribution or an income dividend payable in Shares or cash, participating Shareholders will take the distribution or dividend entirely in Shares and the Agent will automatically receive the Shares, including fractions, for the Shareholder’s account in accordance with the following:

Whenever the Market Price (as defined in Section 3 below) per Share is equal to or exceeds the net asset value per Share at the time Shares are valued for the purpose of determining the number of Shares equivalent to the cash dividend or capital gain distribution (the “Valuation Date”), participants will be issued additional Shares equal to the amount of such dividend divided by the greater of the Fund’s net asset value per Share or 95% of the Fund’s Market Price per Share. Whenever the Market Price per Share is less than such net asset value on the Valuation Date, participants will be issued additional Shares equal to the amount of such dividend divided by the Market Price. The Valuation Date is the day before the dividend or distribution payment date or, if that day is not a business day, the next business day. If the Fund should declare a dividend or capital gain distribution payable only in cash, the Agent will, as purchasing agent for the participating Shareholders, buy Shares in the open market, or elsewhere, for such Shareholders' accounts after the payment date, except that the Agent will endeavor to terminate purchases in the open market and cause the Fund to issue the remaining Shares if, following the commencement of the purchases, the market value of the Shares exceeds the net asset value. These remaining Shares will be issued by the Fund at a price equal to the Market Price.

In a case where the Agent has terminated open market purchases and caused the issuance of remaining Shares by the Fund, the number of Shares received by the participant in respect of the cash dividend or distribution will be based on the weighted average of prices paid for Shares purchased in the open market and the price at which the Fund issues remaining Shares. To the extent that the Agent is unable to terminate purchases in the open market before the Agent has completed its purchases, or remaining Shares cannot be issued by the Fund because the Fund declared a dividend or distribution payable only in cash, and the market price exceeds the net asset value of the Shares, the average Share purchase price paid by the Agent may exceed the net asset value of the Shares, resulting in the acquisition of fewer Shares than if the dividend or capital gain distribution had been paid in Shares issued by the Fund.

The Agent will apply all cash received as a dividend or capital gain distribution to purchase shares of common stock on the open market as soon as practicable after the payment date of the dividend or capital gain distribution, but in no event later than 45 days after that date, except when necessary to comply with applicable provisions of the federal securities laws.

3. For all purposes of the Plan: (a) the Market Price of the Shares on a particular date shall be the average of the volume weighted average sale prices or, if no sale occurred then the mean between the closing bid and asked quotations, for the Shares on each of the five trading days the Shares traded ex-dividend immediately prior to such date, and (b) net asset value per share on a particular date shall be as determined by or on behalf of the Fund.

Additional Information (Unaudited)