40-8F-2: Initial application for de-registration pursuant to Investment Company Act Rule 0-2

Published on March 28, 2014

Securities and Exchange Commission

Washington, D.C. 20549

--------------------------------------------------------------------------------

In the Matter of

SELF STORAGE GROUP, INC.

11 Hanover Square

12th Floor

New York, NY 10005

File No. 811-08025

--------------------------------------------------------------------------------

Application Pursuant to Section 8(f) of

The Investment Company Act of 1940 for an Order Declaring

That Applicant has Ceased to be an Investment Company

--------------------------------------------------------------------------------

Communications regarding this Application

should be addressed to:

R. Darrell Mounts, Esq.

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006-1600

(202) 778-9298

|

I.

|

NATURE OF RELIEF SOUGHT BY APPLICANT

|

Self Storage Group, Inc. (“Applicant”) seeks an order pursuant to Section 8(f) of the Investment Company Act of 1940, as amended (the “Act”), declaring that Applicant has ceased to be an investment company under the Act.

|

II.

|

BACKGROUND

|

Applicant is currently a registered, non-diversified, closed-end management investment company. Applicant was incorporated on December 12, 1996 under the laws of the state of Maryland, and from that date through the date of this Application, Applicant has been a corporation duly qualified and in good standing in that state. On January 23, 1997, Applicant (formerly known as Global Income Fund, Inc.) filed a Form N-8A Notification of Registration pursuant to Section 8(a) of the Act, registering Applicant as an investment company thereunder, and a Registration Statement on Form N-2 for closed-end investment companies. Applicant commenced operations as a closed-end management investment company on February 7, 1997.1 Applicant’s fiscal/taxable year ends December 31.

Applicant is currently authorized to issue twenty million (20,000,000) shares of common stock, with a par value of ($.01) per share. As of December 31, 2013, 7,416,766 shares of common stock of Applicant were outstanding. These shares are quoted over the counter with Pink OTC Markets Inc. under the ticker symbol “SELF” and are held by 34 stockholders of record, as of December 31, 2013. In connection with the adoption of a stockholder rights plan, Applicant’s Board of Directors (the “Board”) declared a special dividend distribution of one non-transferrable right for each outstanding share of Applicant’s common stock, par value $.01 per share, to stockholders of record at the close of business on December 6, 2013. Each right entitles the registered holder to purchase from Applicant one share of its common stock, par value $.01 per share, subject to adjustment. The rights will expire on April 4, 2014 unless earlier redeemed or exchanged by Applicant. Applicant does not have any other securities outstanding.

Prior to 2012, Applicant operated as a non-diversified management investment company with a primary investment objective to provide stockholders with a high level of income, with capital appreciation as a secondary objective. At a special meeting of stockholders held on December 15, 2011 and adjourned to February 29, 2012 (the “Special Meeting”), Applicant’s stockholders approved a proposal to change Applicant’s business from an investment company investing primarily in closed-end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities to an operating company that would own, operate, manage, acquire, develop and redevelop professionally managed self storage facilities and would seek to qualify as a real estate investment trust (“REIT”) for federal tax purposes (the “Business Proposal”). Following stockholder approval of the Business Proposal, Applicant’s management has implemented the Business Proposal by terminating its investment management agreement, purchasing real property self storage facilities through wholly owned subsidiaries, and engaging in a strategy to convert from an investment company to an operating company. As a result of these efforts, Applicant believes that it no longer qualifies as an “investment company” within the meaning of the Act.

1 From September 1, 1983 to February 7, 1997, Applicant was a diversified series of shares of Bull & Bear Incorporated, an open-end management investment company.

1

|

III.

|

ACTION REGARDING DEREGISTRATION

|

The Securities and Exchange Commission (the “Commission”) has historically reviewed Section 8(f) applications on a case-by-case basis and has made determinations founded on the following general criteria: (i) the company’s historical development; (ii) its public representations of policy; (iii) the activity of its directors, officers, and employees; (iv) the nature of its assets; and (v) the sources of its income.2 This Application will address each of these criteria as they apply to Applicant.

|

A.

|

Historical Development

|

As discussed above, Applicant was incorporated in Maryland in 1996 and is registered under the Act as a closed-end, non-diversified management investment company. Applicant’s investment objective is to provide stockholders with a high level of income, with capital appreciation as a secondary objective. Applicant pursued its investment objectives by investing primarily in closed-end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities. In December 2009, a special committee (“Special Committee”) of the Board began to consider the Business Proposal. Between December 2009 and September 2011, the Special Committee reviewed, among other things, materials prepared by the current and proposed new management of Applicant and engaged two independent experts to assist with the evaluation of the Business Proposal. Subsequently, on September 29, 2011, the Special Committee reported to the Board its findings and the Board unanimously approved the Business Proposal and determined to submit it to stockholders for approval.

On or about November 9, 2011, Applicant mailed to existing stockholders its Proxy Statement for a Special Meeting of Shareholders (the “Proxy Statement”) to be held on December 15, 2011 (the “Special Meeting”) soliciting stockholder approval of the Business Proposal.3 The Proxy Statement stated that if the Business Proposal was approved, Applicant would, among other things, (i) change its fundamental investment restrictions to permit it to pursue its new business; (ii) sell all assets in its portfolio that are not “Real Estate Assets” (defined as real property, interests in REITs, interests in mortgages on real property, and other investments in the real estate investment, service and related industries) and acquire Real Estate Assets in seeking to qualify for treatment as a REIT for federal tax purposes; (iii) terminate Applicant’s investment management agreement (the “Investment Management Agreement”) with its investment manager, CEF Advisers, Inc. (the “Investment Manager”), and become internally managed by its newly appointed executive officers and other new employees or agents; (iv) seek to list its common stock on NASDAQ Capital Market (“NASDAQ”) and change its name to “Self Storage Group, Inc.”; and (v) deregister as an investment company when less than 40% of the value of its total assets (exclusive of Government securities and cash) constitutes “investment securities” (as defined in Section 3(a) of the Act) (“Investment Securities”). A copy of the Proxy Statement for the Special Meeting is attached hereto as Exhibit A and is incorporated herein by reference.

2 Tonopah Mining Company Co. of Nevada, 26 SEC 426, 1947 WL 26116 (July 21, 1947).

3 The Proxy Statement also included a proposal to amend Applicant’s Articles of Incorporation to impose certain limits and restrictions on ownership and transferability relating to Applicant’s capital stock in order to comply with certain federal tax requirements applicable to REITs (the “Charter Proposal”). Insufficient stockholder votes were cast to approve the Charter Proposal.

2

The Proxy Statement set forth certain consequences to existing stockholders associated with the approval of the Business Proposal, including the fact that, after deregistering as a registered investment company, Applicant’s stockholders would not be afforded certain regulatory protections under the Act, including those that require: restrictions on borrowing and issuing senior securities; prohibition of certain transactions with affiliates; filing of a registration statement containing fundamental investment policies and seeking stockholder approval of changes to such policies; conforming its dividend distributions and share repurchases to certain rules; every share of common stock Applicant issues to be voting stock with voting rights equal to those of every other outstanding voting stock; banks or broker dealers to maintain custody of assets; and fidelity bonding. However, the Proxy Statement noted that, as an operating company, Applicant would be subject to the reporting obligations of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), including the requirements to file an annual report on Form 10-K and quarterly reports on Form 10-Q, each of which requires the filing of full financial statements, and current reports on Form 8-K. Further, the Proxy Statement stated that if Applicant’s common stock is listed on NASDAQ, stockholders would also have the benefit of the regulatory protections provided by the NASDAQ corporate governance requirements, including those that require that a majority of the directors be “independent directors” (as defined under the NASDAQ rules), director nominations and the compensation of all of Applicant’s executive officers, including its chief executive officer, be subject to independent director approval, and that Applicant hold an annual meeting of stockholders no later than one year after its first fiscal year-end following listing.

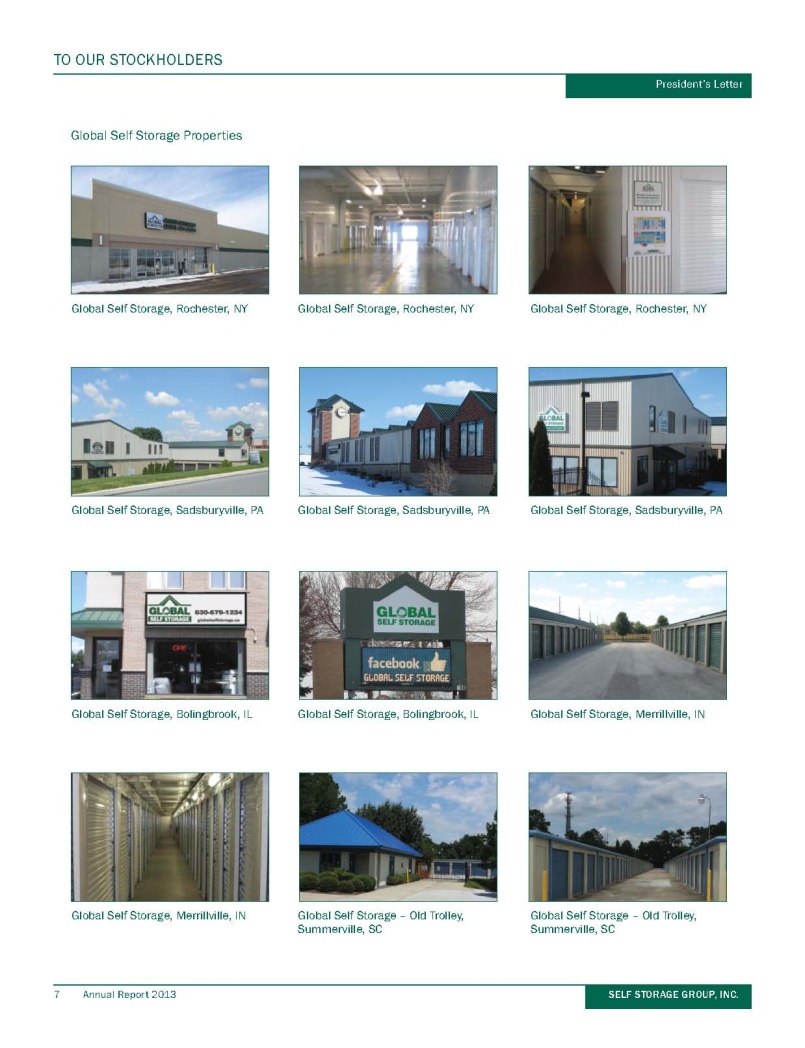

At the Special Meeting, Applicant’s stockholders approved the Business Proposal. Accordingly, Applicant’s management commenced seeking acquisition opportunities in real property self storage facilities consistent with its implementation of the Business Proposal. Those efforts have resulted in Applicant’s assets being concentrated in the following wholly owned subsidiaries as of December 31, 2013, all of which own and operate real property self storage facilities: SSG Sadsbury LLC (formerly Self Storage Group I LLC) (“SSG Sadsbury”), SSG Rochester LLC (formerly Self Storage Group II LLC) (“SSG Rochester”), SSG Bolingbrook LLC (“SSG Bolingbrook”), SSG Dolton LLC (“SSG Dolton”), SSG Merrillville LLC (“SSG Merrillville”), SSG Summerville I LLC (“SSG Summerville I”), and SSG Summerville II LLC (“SSG Summerville II”). Attached hereto as Exhibit B and incorporated herein by reference is Applicant’s annual report for the year ended December 31, 2013 reflecting that these wholly owned subsidiaries comprised approximately 78% and 81% of Applicant’s total and net assets, respectively, on a combined basis as of December 31, 2013. As of December 31, 2013, the value and cost of Applicant’s holdings in its wholly owned subsidiaries engaged in self storage operations were $27,434,500 and $26,975,000, respectively. On August 30, 2013, Applicant announced that it will publish its net asset value as of the end of each calendar quarter. Additionally, Applicant qualified for treatment as a REIT for federal tax purposes in fiscal year 2013.

Each of the foregoing actions is consistent with Applicant’s pronounced intention of converting from an investment company to an operating company. Thus, although Applicant may historically have operated as an investment company, Applicant has obtained consent of its stockholders to, and has subsequently accomplished, a change in the nature of its business such that it should no longer be registered as an investment company under the Act.

3

|

B.

|

Public Representations of Policy

|

Since stockholders approved the Business Proposal, Applicant has consistently represented that it is involved in the business of owning, operating, managing, acquiring, developing, and redeveloping professionally managed self storage facilities. While Applicant is required under the Act to state in its financial statements that it is a registered investment company, Applicant’s periodic reports to stockholders and press releases have indicated that Applicant is implementing the Business Proposal pursuant to representations in the Proxy Statement by seeking acquisition opportunities in real property self storage facilities. Similarly, Applicant’s website, www.selfstoragegroupinc.com, represents that stockholders approved the Business Proposal and includes information about Applicant’s top ten holdings, all of which are either indirect acquisitions of real property self storage facilities through Applicant’s wholly owned subsidiaries or interests in publicly traded REITs. Further, in connection with approving the Business Proposal, stockholders approved Applicant’s change of corporate name to “Self Storage Group, Inc.” to reflect its new strategy and, in the event of deregistration, to avoid any potential that it would be perceived to be an investment company by virtue of the words “Global Income Fund” being included in its name. Applicant changed its name to Self Storage Group, Inc., effective November 15, 2013. Upon deregistration, Applicant will issue a press release to stockholders indicating that it is an operating company and cease indicating in its financial statements that it is a registered investment company.

|

C.

|

Activities of Directors, Officers and Employees

|

The primary activities of Applicant’s officers, like Applicant’s historical development and public representations, indicate that Applicant has ceased to be an investment company. On June 15, 2012, in accordance with the implementation of the Business Proposal, the Board approved the termination of Applicant’s Investment Management Agreement and Applicant became internally managed by its executive officers. Specifically, since the termination of Applicant’s Investment Management Agreement with its Investment Manager, Applicant’s strategy and operations have been internally managed by Mark C. Winmill, Applicant’s President, with the assistance of Applicant’s executive officers. In his capacity as Applicant’s President, Mr. Winmill manages all aspects of Applicant’s self storage facility businesses and has devoted significant time to Applicant’s self storage facility businesses in connection with the formation of business objectives and strategies, identification of potential acquisition targets, development of project plans, retention of employees, establishment of compensation and compensation incentives, negotiation and closing of property acquisitions, obtaining zoning approvals, overseeing construction, and development of leasing and tenant acquisition strategies. Mr. Winmill also is engaged primarily in fulfilling management responsibilities for Applicant and its wholly owned subsidiaries. The activities of Mr. Winmill and Applicant’s other executive officers, together with Applicant’s decision to terminate the Investment Management Agreement with its Investment Manager and thereafter operate on an internally managed basis, indicate that Applicant no longer operates as an investment company, but rather, is engaged in the business of owning, operating, managing, acquiring, developing, and redeveloping professionally managed self storage facilities through its wholly owned subsidiaries.

4

|

D.

|

Applicant’s Present Assets

|

As of December 31, 2013, Applicant’s assets were comprised of its wholly owned subsidiaries, cash items,4 and publicly traded REITs. SSG Sadsbury’s assets were approximately 91% in a 480-unit self storage facility in Sadsburyville, Pennsylvania, 4% cash, less than 1% accounts receivable-trade, and 5% intercompany receivables, pre-paid items, and other assets. SSG Rochester’s assets were approximately 96% in a 649-unit self storage facility in Rochester, New York, 2% cash, and approximately 2% accounts receivable-trade, pre-paid items, and other assets. SSG Bolingbrook’s assets were approximately 94% in a 597-unit self storage facility in Bolingbrook, Illinois, 5% cash, and approximately 1% accounts receivable-trade, pre-paid items, and other assets. SSG Merrillville’s assets were approximately 94% in a 506-unit self storage facility in Merrillville, Indiana, 5% cash, and approximately 1% accounts receivable-trade, pre-paid items, and other assets. SSG Dolton’s assets were approximately 94% in a 651-unit self storage facility in Dolton, Illinois, 5% cash, and approximately1% accounts receivable-trade, pre-paid items, and other assets. SSG Summerville I’s assets were approximately 93% in a 559-unit self storage facility in Summerville, South Carolina, 6% cash, and approximately 1% accounts receivable-trade, pre-paid items, and other assets. SSG Summerville II’s assets were approximately 93% in a 236-unit self storage facility in Summerville, South Carolina, 5% cash, and approximately 1% accounts receivable-trade, pre-paid items, and other assets.

As of December 31, 2013, SSG Sadsbury, SSG Rochester, SSG Bolingbrook, SSG Merrillville, SSG Dolton, SSG Summerville I, and SSG Summerville II represented approximately 12%, 11%, 16%, 14%, 15%, 7%, and 4%, respectively, of Applicant’s total assets measured at fair value on an unconsolidated basis (exclusive of Government securities and cash items). Also as of December 31, 2013, wholly owned subsidiaries through which Applicant holds real estate assets represented approximately 78%, interests in publicly traded REITs represented approximately 21%, and cash items represented approximately 2% of Applicant’s total assets on an unconsolidated basis. As of December 31, 2013, Applicant’s time deposit, which is included as a cash item, represented approximately 2% of Applicant’s total assets on an unconsolidated basis.

Applicant’s Annual Report for the year ended December 31, 2013, as filed with the Commission on March 11, 2014, is attached hereto as Exhibit B and is incorporated herein by reference. All of Applicant’s assets have been valued in accordance with Section 2(a)(41) of the Act. The nature of Applicant's assets suggests it should no longer be registered as an investment company under the Act.

|

E.

|

Applicant’s Present Income

|

During fiscal 2013, Applicant’s wholly owned subsidiaries commenced operations, except for SSG Sadsbury and SSG Rochester, each of which commenced operations in December 2012. During this initial startup period, no distributions were paid by the subsidiaries. During fiscal 2013, Applicant derived virtually all of its gross income (excluding gross income earned by each subsidiary and treated for federal income tax purposes as if earned by Applicant) from dividends paid by, and realized gains from dispositions of shares of, publicly traded REITs, and less than 1% from its cash items. For the year ended December 31, 2013, Applicant received interest and dividends of $452,898 from its holdings of Investment Securities and a time deposit. Applicant expects its income from its self storage facility operations to increase and its income from Investment Securities and the time deposit to decrease as its current self storage facility operations continue to develop and as it makes additional self storage facility acquisitions. For example, SSG Sadsbury, SSG Rochester, SSG Bolingbrook, SSG Merrillville, SSG Dolton, SSG Summerville I, and SSG Summerville II are currently generating approximately $42,000, $61,000, $52,000, $44,000, $47,000, $26,000, and $16,000 per month in rental income, respectively. Applicant anticipates currently that, for fiscal 2014, on a consolidated basis, it will derive approximately 89% of its gross income from its self storage facility operations and 11% from its holdings of Investment Securities and a time deposit. SSG Sadsbury, SSG Rochester, SSG Bolingbrook, SSG Merrillville, SSG Dolton, SSG Summerville I, and SSG Summerville II do not derive any of their gross income from Investment Securities. Further, Applicant’s management is actively reviewing a number of other self storage facility development and acquisition opportunities. Accordingly, Applicant is currently managing its assets and income in a manner that suggests it should no longer be registered as an investment company under the Act.

4 Cash items include accounts receivable, pre-paid items, a checking account balance, and a time deposit. Pre-paid items consist of an insurance deposit and premium.

5

|

IV.

|

FEDERAL TAX CONSIDERATIONS

|

It is anticipated that deregistration will have no unfavorable tax consequences to Applicant or its stockholders. As a registered investment company, Applicant filed its federal income tax returns for its taxable years 1997-2012 on the basis that it qualified to be taxed as a “regulated investment company” (“RIC”), as that term is defined in the applicable provision of the Internal Revenue Code of 1986, as amended (the “Code”).

In order to qualify for REIT tax treatment, Applicant, among other things, had to satisfy certain REIT asset and income requirements under by the Code. For its taxable year ended December 31, 2013, Applicant satisfied all those requirements and qualified to be taxed as a REIT (i.e., a “real estate investment trust” as that term is defined in the applicable provision of the Code).

Qualification for REIT tax treatment in 2013 (and RIC tax treatment through 2012) provided Applicant and its stockholders with certain favorable tax consequences. In particular, Applicant was not taxed at the corporate level, either as a RIC or a REIT, on its net income and net realized gains that it distributed to its stockholders.

Applicant qualified as a REIT, but did not qualify as a RIC, in 2013 due to the nature of its assets and income, and it intends to continue to qualify for “pass-through” tax treatment. Accordingly, there is no longer a federal income tax reason for Applicant to be registered with the Commission as an investment company. Thus, not only will deregistration have no unfavorable federal income tax consequences to Applicant or its stockholders, deregistration will also be consistent with Applicant’s ongoing business plan and the tax treatment that is incident thereto.

|

V.

|

APPLICABLE STATUTORY PROVISIONS

|

Since Applicant no longer is, proposes, or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities within the meaning of Section 3(a)(1)(A) of the Act, and no longer owns or proposes to acquire Investment Securities having a value exceeding forty percent (40%) of the value of its total assets (exclusive of Government securities and cash items) on a consolidated basis as contemplated by Section 3(a)(1)(C) of the Act, Applicant has ceased to be an investment company within the meaning of Section 3 of the 1940 Act.5 Accordingly, Applicant hereby requests that the Commission issue an order pursuant to Section 8(f) of the Act declaring that Applicant has ceased to be an investment company.

6

|

A.

|

Applicant is Not a Section 3(a)(1)(A) Investment Company

|

Applicant is no longer an investment company as defined in Section 3(a)(1)(A) of the Act, which provides that an “ ‘investment company’ means any issuer which . . . is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting, or trading in securities.” As discussed in Section III above, the Commission and courts have generally referred to the following factors in determining whether an issuer is an investment company under Section 3(a)(1)(A): (i) the company’s historical development; (ii) its public representations of policy; (iii) the activity of its directors, officers, and employees; (iv) the nature of its present assets; and (v) the sources of its present income. While these factors were developed primarily in analyses under Section 3(b)(2) of the Act, they are equally applicable to analyses under Section 3(a)(1)(A). 6

Each of the five factors as they relate to Applicant and its wholly owned subsidiaries is discussed above in Section III of this Application. With respect to factors (i) and (ii), Applicant has clearly and consistently indicated to the public and its stockholders its intention to become an operating company and cease being a registered investment company and continues to do so with each public financial report and press release. With respect to factor (iii), Mr. Winmill spends substantially all the time that he devotes to Applicant’s business on (a) overseeing and guiding the management of its wholly owned subsidiaries’ self storage facilities and (b) conducting strategic review of Applicant’s lines of business in order to determine if these units are appropriately structured to implement Applicant’s objectives. Mr. Winmill spends no time engaged in investing and reinvesting Applicant’s assets in Investment Securities other than to reduce Applicant’s holdings in Investment Securities.

With respect to factors (iv) and (v), less than 40% of the value of Applicant’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis are invested in Investment Securities and less than 15% of Applicant’s income is expected from Investment Securities. As noted previously, Applicant’s income in 2014 is expected primarily from its self storage facility operations. Further, Applicant’s management is actively reviewing a number of other self storage facility development and acquisition opportunities and anticipates additional transactions in the future.

5 Applicant notes that it also may be eligible to rely on the Section 3(c)(6) exemption under the Act, which exempts from the definition of an investment company any company primarily engaged, directly or through majority-owned subsidiaries, in, inter alia, (i) purchasing or otherwise acquiring mortgages and other liens on and interests in real estate pursuant to the Section 3(c)(5)(C) exemption under the Act and (ii) one or more of such businesses (from which not less than 25 percent of such company’s gross income during its last fiscal year was derived) together with additional business or businesses other than investing, reinvesting, owning, holding, or trading in securities. However, Applicant does not believe that it is necessary to rely on this exemption because it is no longer an investment company as defined under Sections 3(a)(1)(A) and 3(a)(1)(C) of the Act.

6 Tonopah Mining Company Co., supra note 2; Certain Prima Facie Inv. Companies, Inv. Co. Act Release No. 10937, [1979-1980] Fed. Sec. L. Rep. (CCH) ¶ 82,465, n.24 (Nov. 13, 1979).

7

Applicant acknowledges that Section 3(a)(1)(A) speaks in terms of “securities” rather than “investment securities,” and that if Applicant’s principal business were, for example, operating a Government securities fund, Applicant would be an investment company regardless of the amount of its self storage facility operations. In this case, however, Applicant’s primary business is in the real estate industry, and its business risks relate primarily to Applicant’s self storage facility operations. Applicant’s remaining assets held in Investment Securities and the time deposit are awaiting deployment in its self storage facility business strategy. Applicant’s business strategy requires significant management time and effort to research, plan, acquire, and prepare the development of self storage facilities. To implement this long-term strategy, Applicant requires current liquidity for salaries, general and administrative expenses, etc. and consequently holds for these purposes a time deposit, rather than cash. Lastly, we note that the Commission previously has granted orders pursuant to Section 8(f) and/or Section 3(b)(2) to companies with more than nominal holdings of Government securities (which are often awaiting deployment in the applicant’s principal business).7

Since Applicant does not presently hold itself out as being engaged in primarily, nor does it propose in the future to engage primarily, in the business of investing, reinvesting, or trading in securities, Applicant submits that it is no longer an investment company under Section 3(a)(1)(A) of the Act. We also note that the Commission previously has granted an order pursuant to Sections 3(b)(2) and 8(f) to a company that changed the nature of its business so that it was primarily engaged in a business other than investing, reinvesting, owning, holding, or trading securities.8

|

B.

|

Applicant is Not a Section 3(a)(1)(C) Investment Company

|

Applicant no longer is an investment company as defined in Section 3(a)(1)(C) of the Act. Section 3(a)(1)(C) of the Act defines an investment company as an issuer which “is engaged or proposes to engage in the business of investing, reinvesting, owning, holding, or trading in securities, and owns or proposes to acquire investment securities having a value exceeding 40 per centum of the value of such issuer’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis.” Section 3(a)(2) provides, in pertinent part, that “[a]s used in this section, ‘investment securities’ includes all securities except (A) Government securities, . . . and (C) securities issued by majority-owned subsidiaries of the owner which (i) are not investment companies, and (ii) are not relying on the exception from the definition of investment company in paragraph (1) or (7) of subsection (c).”

7 See In re Se. Capital Corp., Inv. Co. Act Rel. Nos. 13896, 1984 WL 471618 (Apr. 23, 1984) (notice) and 13956, 1984 WL 470655 (May 21, 1984) (63% of applicant's total assets in “cash, cash equivalents and government securities”); In re Baldwin Sec. Corp., Inv. Co. Act Rel. Nos. 15700, 1987 WL 756120 (Apr. 24, 1987) (notice) and 15747, 1987 WL 757491 (May 20, 1987) (order) (application states that income derived almost 100% from investments in Government securities; approximately 90% of total assets held in cash or cash equivalents; liquidity needed to fund the purchase in the near future of positions in operating companies pursuant to applicant's business plan of converting from an investment to an operating company); In re Madison Fund, Inc., Inv. Co. Act Rel. Nos. 13565, 1983 WL 401415 (Oct. 5, 1983) (notice) and 13611, 1983 WL 401599 (Nov. 1, 1983) (order) (notice states that 53% of assets in cash and cash items, primarily U.S. Treasury securities and that majority of income is from interest on U.S. Treasury securities; application states that only 39.6% of assets in natural resources business (including cash and Government securities) and that the remainder is in cash and Government securities awaiting investment; applicant has rigorous evaluation procedures and conducts analysis on possible deals); and Alpha-Delta (staff states that investments in U.S. Treasury bills will not automatically trigger investment company status, even if more than 50% of a company's assets are invested in U.S. Treasury bills, if the primary engagement of the company is in other activities).

8 Redwood Microcap Fund, Inc., Inv. Co. Act Rel. Nos. 27050 (notice) and 27119 (Oct. 21, 2005) (order).

8

Given the percentage of Applicant’s total assets invested through its wholly owned subsidiaries in self storage facility operations, Applicant no longer owns, holds, or trades in securities, or owns or proposes to acquire Investment Securities having a value exceeding forty percent (40%) of the value of Applicant’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis. Accordingly, based on the foregoing authority, we urge the Commission to conclude that Applicant is no longer an investment company under Section 3(a)(1)(C) of the Act.

|

VI.

|

HARDSHIP FOR CONTINUED COMPLIANCE

|

Continued compliance with the Act would present an undue hardship to Applicant. By design, the Act is not intended to regulate operating companies and, as such, contains many proscriptions and limitations with respect to activities normally within the scope of an operating company’s business, operations, and financial viability. Examples include a general prohibition on the granting of warrants, and requirements to obtain stockholder approval prior to issuing securities at less than the net asset value per share. In addition, the limitations imposed by Section 18 of the Act on Applicant’s capital structure constrain Applicant’s ability to borrow and otherwise manage its capital structure in ways that the Board believes are prudent and reasonable for an operating company but are prohibited for a registered investment company. Such restrictions present significant obstacles to capital raising activities in which Applicant would otherwise participate if it were not for its status as a registered investment company. Further, the prohibitions of Section 17 of the Act on transactions with affiliates, together with Section 23(a) of the Act, also present an obstacle to Applicant by effectively prohibiting many types of incentive based compensation the Board considers to be reasonable and necessary to attract and retain the best qualified persons to manage Applicant’s business.

|

VII.

|

CONCLUSION

|

Applicant is no longer an investment company by virtue of the fact that Section 3(a)(1)(A) is not applicable to Applicant, and Applicant’s Investment Securities equal approximately 22% of its total assets, well below the 40% threshold set forth in Section 3(a)(1)(C) of the Act. Further, Applicant is primarily engaged in the business of owning, operating, managing, acquiring, developing, and redeveloping professionally managed self storage facilities through its wholly owned subsidiaries. Applicant fully intends to continue to manage its assets and income in a manner that causes Applicant to continue to be excluded from the definition of an investment company under the Act. In addition, after entry of the order requested by this Application, Applicant will seek to list its common stock on NASDAQ and be subject to the reporting and other requirements of the Exchange Act. Accordingly, for the reasons set forth above, Applicant asserts that it satisfies the standards for an exemptive order under Section 8(f) of the Act.

9

AUTHORITY TO FILE THIS APPLICATION

Pursuant to Rule 0-2(c) under the Act, Applicant states that the Board, by resolution duly adopted and attached hereto as Exhibit C, has authorized certain officers of Applicant to prepare, or cause to be prepared, and to execute and file with the Commission, this Application.

The verification required by Rule 0-2(d) under the Act is attached hereto as Exhibit D. All other requirements for the execution and filing of this Application in the name of, and on behalf of, Applicant by the undersigned officer of Applicant have been complied with and such officer is fully authorized to do so.

Pursuant to Rule 0-2(f) under the Act, Applicant states that its address is 11 Hanover Square, New York, NY 10005-3452, and Applicant further states that all communications or questions concerning this Application or any amendment thereto should be directed to R. Darrell Mounts, Esq., K&L Gates LLP, 1601 K Street, NW, Washington, DC 20006-1600, (202) 778-9298.

It is desired that the Commission issue an Order pursuant to Rule 0-5 under the Act without a hearing being held.

The proposed notice of the filing of this Application required by Rule 0-2(g) under the Act is attached hereto as Exhibit E and is incorporated herein by reference.

Applicant has caused this Application to be duly signed on its behalf on the date and year set forth below.

|

SELF STORAGE GROUP, INC.

|

|

| By: /s/ Mark C. Winmill | |

| Mark C. Winmill | |

| President |

Dated: March 28, 2014

10

INDEX TO EXHIBITS

|

Exhibit A

|

Definitive Proxy Statement on Schedule 14A, as filed with the Commission on November 10, 2011

|

|

Exhibit B

|

Annual Report for the year ended December 31, 2013, as filed with the Commission on March 11, 2014

|

Exhibit C Authorization - Board of Directors Resolution as Required by Rule 0-2(c)

Exhibit D Verification, as Required by Rule 0-2(d)

Exhibit E Proposed Form of Notice of Application, as Required by Rule 0-2(g)

|

Exhibit A

|

Definitive Proxy Statement on Schedule 14A, as filed with the Commission on November 10, 2011

|

GLOBAL INCOME FUND, INC.

11 Hanover Square

New York, NY 10005

November 9, 2011

Dear Shareholder,

In December 2009, a special committee of the Board of Directors (“Board”) of Global Income Fund, Inc. (“Company”) began to consider a strategic alternative for the Company, one which could potentially deliver better total return to shareholders over the long term. Those deliberations have culminated in our presenting to you the proposed changes in the Company’s business and status. Enclosed with this letter are proxy materials dated November 9, 2011, relating to a Special Meeting of Shareholders of the Company (“Meeting”) where the proposals will be considered.

We are seeking shareholder approval to change the Company’s business from an investment company investing primarily in closed-end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities to an operating company that will own, operate, manage, acquire, develop and redevelop professionally managed self storage facilities and will seek to qualify as a real estate investment trust (“REIT”) for federal tax purposes (“Business Proposal”). A self storage facility refers to a property that offers storage space rental, generally on a month-to-month basis, for personal or business use. As part of the Business Proposal, we are seeking shareholder approval to amend the Company’s fundamental investment restrictions regarding industry concentration and investing in real estate to permit the Company to pursue its new business. If the Business Proposal is approved, sometime before the Company ceases to be a registered investment company, the Company will seek to list the Company’s common stock on the NASDAQ Capital Market. In connection with qualifying to be treated as a REIT, we are also seeking shareholder approval to amend the Company’s Articles of Incorporation to enable the Company to comply with certain federal tax requirements applicable to REITs (“Charter Proposal”).

The Board of Directors supports the change and unanimously recommends that you vote “FOR” each proposal. Although there can be no assurances, the Board believes that the Company may be able to deliver potentially better total return over the long term if it operates as a self storage REIT rather than as an investment company.

In the pages that follow we have described the risks and benefits of voting FOR each proposal. We have also provided a question and answer section intended to answer many of the questions you may have. If you have further questions, please call 1-800-821-8780.

Your vote is important. Whether or not you are able to attend the Meeting in person, it is important that your shares be represented at the Meeting. We ask that you please sign, date and return the enclosed proxy card at your earliest convenience. As an alternative to using the proxy card to vote, you may submit your proxy by telephone. Please follow the instructions on the enclosed proxy card.

On behalf of the Board and management of the Company, I extend our appreciation for your continued support.

Sincerely yours,

Bassett S. Winmill

Chairman of the Board

GLOBAL INCOME FUND, INC.

____________________________

Notice of Special Meeting of Shareholders

____________________________

To the Shareholders:

Notice is hereby given that a Special Meeting of Shareholders of Global Income Fund, Inc. (“Company”) will be held at the offices of the Company at 11 Hanover Square, New York, New York, on December 15, 2011 at 8:30 a.m., local time, to consider and vote on the following proposals, which are more fully described in the accompanying Proxy Statement:

|

|

1.

|

To change the Company’s business from an investment company to an operating company that will own, operate, manage, acquire, develop and redevelop professionally managed self storage facilities and, in connection therewith, to amend the Company’s fundamental investment restrictions to permit the Company to pursue its new business; and

|

|

|

2.

|

To amend the Company’s Articles of Incorporation to impose certain limits and restrictions on ownership and transferability relating to the Company’s capital stock in order to comply with certain federal tax requirements applicable to real estate investment trusts.

|

The Board unanimously recommends that shareholders vote in favor of each proposal.

Shareholders of record at the close of business on November 1, 2011 (“Record Date”), are entitled to receive notice of and to vote at the meeting and any postponements or adjournments thereof (“Meeting”).

The appointed proxies will vote in their discretion on any other business that may properly come before the Meeting. Any proposal submitted to a vote at the Meeting by anyone other than the officers or directors of the Company may be voted on only in person or by written proxy.

The Company will admit to the Meeting (1) all shareholders of record of the Company as of the Record Date, (2) persons holding proof of beneficial ownership thereof at the Record Date, such as a letter or account statement from a broker, (3) persons who have been granted proxies and (4) such other persons that the Company, in its sole discretion, may elect to admit. All persons wishing to be admitted to the Meeting must present photo identification. If you plan to attend the Meeting, please call 1-800-821-8780.

Important Notice Regarding the Availability of Proxy Materials for the Meeting: This Notice and the accompanying Proxy Statement are available on the Internet at www.globalincomefund.net.

If you have any questions about the proposals or the voting instructions, please call 1-800-821-8780, toll free to speak with The Altman Group, which is assisting in the solicitation of proxies.

By Order of the Board

John F. Ramírez

Secretary

New York, New York

November 9, 2011

EVEN IF YOU PLAN TO ATTEND THE MEETING, SHAREHOLDERS ARE URGED TO SIGN THE ENCLOSED PROXY CARD (UNLESS AUTHORIZING THEIR PROXY VIA TOUCH-TONE TELEPHONE) AND MAIL IT IN THE ENCLOSED ENVELOPE TO ENSURE A QUORUM AT THE MEETING. THIS IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid the time and expense to the Company involved in validating your vote if you fail to sign your proxy card properly.

|

1.

|

Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

|

|

2.

|

Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration.

|

|

3.

|

All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

|

|

REGISTRATION

|

VALID SIGNATURE

|

|

Corporate Accounts

|

|

|

(1) ABC Corp.

|

ABC Corp., by [title of authorized officer]

|

|

(2) ABC Corp.

|

John Doe, Treasurer

|

|

(3) ABC Corp.,

|

|

|

c/o John Doe, Treasurer

|

John Doe

|

|

(4) ABC Corp. Profit Sharing Plan

|

John Doe, Trustee

|

|

Trust Accounts

|

|

|

(1) ABC Trust

|

Jane B. Doe, Trustee

|

|

(2) Jane B. Doe, Trustee,

|

|

|

u/t/d xx/xx/xxxx

|

Jane B. Doe

|

|

Custodian or Estate Accounts

|

|

|

(1) John B. Smith, Cust.,

f/b/o John B. Smith, Jr., UGMA

|

John B. Smith

|

|

(2) John B. Smith

|

John B. Smith, Jr., Executor

|

Unless proxy cards submitted by corporations and partnerships are signed by the appropriate persons as indicated in the voting instructions on the proxy cards, they will not be voted. If no instructions are specified on a proxy card, shares will be voted “FOR” each proposal and “FOR,” “ABSTAIN,” or “AGAINST” any other matters acted upon at the Meeting in the discretion of the persons named as proxies.

GLOBAL INCOME FUND, INC.

________________________

PROXY STATEMENT

________________________

Special Meeting of Shareholders

to be held December 15, 2011

This proxy statement, dated November 9, 2011, for Global Income Fund, Inc., a Maryland corporation (“Company”) (“Proxy Statement”), is furnished in connection with the solicitation of proxies by the Company’s Board of Directors (“Board,” and each member thereof, a “Director”) for use at a Special Meeting of Shareholders of the Company to be held at the Company’s principal executive offices at 11 Hanover Square, New York, New York 10005, on December 15, 2011, at 8:30 a.m., local time, and at any postponements or adjournments thereof (“Meeting”) for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders.

Only shareholders of record at the close of business on November 1, 2011 (“Record Date”), are entitled to be present and to vote at the Meeting. As of the Record Date, the Company had 7,414,987 shares of common stock issued and outstanding. Shareholders of the Company vote as a single class.

The expense of preparing, assembling, printing and mailing this Proxy Statement, proxy card and any other material used for the solicitation of proxies by the Board will be paid by the Company. In addition to the solicitation of proxies by use of the mails, Directors and officers of the Company may solicit proxies by telephone, electronic communications or personal contact, for which they will not receive any additional compensation. The Company has retained The Altman Group, 60 East 42nd Street, New York, NY 10165, to assist in the solicitation of proxies for a fee of $5,000, plus reimbursement for out-of-pocket expenses. Such solicitation will primarily be by mail and telephone. The Company will also reimburse brokers, nominees and fiduciaries that are registered owners of shares of the Company for the out-of-pocket and clerical expenses of transmitting copies of the proxy materials to the beneficial owners of such shares. The approximate mailing date of this Proxy Statement and the proxy card will be November 10, 2011.

Copies of the Company’s most recent Annual and Semi-Annual Reports are available without charge upon written request to the Company at 11 Hanover Square, New York, New York 10005, or by calling toll-free 1-800-757-5755.

Table of Contents

|

iii

|

|

|

1

|

|

|

8

|

|

|

Vote Required and the Board’s Recommendation

|

8

|

|

8

|

|

|

12

|

|

|

13

|

|

|

General

|

13

|

|

Investment Strategy

|

14

|

|

Policies

|

14

|

|

Operating Expenses

|

15

|

|

Reports and Annual Meetings

|

15

|

|

16

|

|

|

Board of Directors

|

16

|

|

Executive Officers

|

16

|

|

Committees of the Board of Directors

|

18

|

|

Compensation of Directors and Officers

|

18

|

|

19

|

|

|

20

|

|

|

Changes in Financial Reporting and Accounting

|

20

|

|

Changes to Rights of Shareholders

|

21

|

|

22

|

|

|

Vote Required and the Board’s Recommendation

|

22

|

|

23

|

|

|

25

|

|

|

28

|

|

|

Introduction

|

28

|

i

|

Federal Tax Treatment of the Company’s Proposed Operations as a REIT

|

28

|

|

Federal Taxation of Company Shareholders

|

32

|

|

Federal Income Tax Consequences of the Company’s Change from a RIC to a REIT

|

33

|

|

34

|

|

|

Risks Related to the Company’s Business Following the Consummation of the Business Proposal

|

34

|

|

Risks Related to the Company’s Organization and Structure

|

40

|

|

Risks Related to the Company’s Tax Status as a REIT

|

42

|

|

44

|

|

|

45

|

|

|

Anti-Takeover Provisions

|

45

|

|

Solicitation of Proxies

|

45

|

|

Voting and Quorum

|

46

|

|

Discretionary Authority; Shareholder Proposals

|

47

|

|

Notice to Banks, Broker/Dealers and Voting Trustees and Their Nominees

|

47

|

|

A-1

|

|

|

B-1

|

|

|

Federal Tax Treatment of the Company’s Current Operations as a RIC

|

B-1

|

|

Federal Tax Treatment of the Company’s Proposed Operations as a REIT

|

B-2

|

|

Federal Taxation of Company Shareholders

|

B-5

|

ii

This Proxy Statement contains forward-looking statements relating to, among other things, the goals, plans and projections regarding the Company’s financial position, results of operations and business strategy following consummation of the change to the Company’s business. These statements may be identified by the use of words such as “will,” “may,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “should,” “would,” “could” or the negative of these terms and other terms of similar meaning in connection with any discussion of future operating or financial performance. All forward-looking statements are based on the Company’s current views with respect to future events. All forward-looking statements are based on assumptions and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual outcomes and results to differ materially from current expectations. These factors include the risks and uncertainties described in “Risk Factors” below in this Proxy Statement. Also, these forward-looking statements present the Company’s estimates and assumptions only as of the date of this Proxy Statement. Unless otherwise required by law, the Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

iii

While we strongly encourage you to read the full text of this Proxy Statement, we also are providing the following brief overview of the proposals in “Question and Answer” format. If you have any questions about the proposals or how to vote your shares, please call 1-800-821-8780.

Question: What changes are being proposed?

Answer: The Company proposes to fundamentally change its business from a registered investment company investing primarily in closed-end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities to an operating company that will own, operate, manage, acquire, develop and redevelop professionally managed self storage facilities and will seek to qualify as a real estate investment trust (“REIT”) for federal tax purposes (“Business Proposal”).

As part of the Business Proposal, the Company is seeking shareholder approval to amend its fundamental investment restrictions regarding industry concentration and investing in real estate to permit the Company to pursue its new business.

In connection with implementation of the Business Proposal, shareholders are also being asked to approve an amendment to the Company’s Articles of Incorporation (“Charter”) to add new provisions that would impose certain ownership limits and restrictions on transferability relating to the Company’s capital stock in order to comply with certain federal tax requirements applicable to REITs (“Charter Proposal,” and together with the Business Proposal, “Proposals”).

Question: How does the Board recommend I vote on the Proposals?

Answer: The Board, including all of the Directors who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (“1940 Act”)), of the Company (“Independent Directors”), has unanimously approved the Proposals and recommends that shareholders vote “FOR” the Proposals.

Question: Why is the Board recommending the Proposals?

Answer: The Board believes that adopting the Business Proposal may give the Company the opportunity to deliver potentially better total return for its shareholders over the long term, although it recognizes that there could be no assurance that the Company would achieve such results. Owning and operating self storage facilities may allow the Company to increase its income which, over time, could result in higher distributions to shareholders and stock price appreciation for the Company’s common stock.

For a discussion of the principal considerations taken into account by the Board and the special committee appointed for purposes of considering the Proposals, and a discussion of the potential risks in effecting the Proposals, see “Recommendations of the Board and the Special Committee” and “Risk Factors.”

Question: If the Business Proposal is approved, what will the Company do to effect the proposal?

Answer: If the Business Proposal is approved by shareholders:

|

·

|

The Company will change its fundamental investment restrictions to permit it to pursue its new business.

|

|

·

|

Except as noted below in this bullet point, beginning in late 2011 the Company may begin selling, and in 2012 the Company expects to sell, all assets in its portfolio that are not “Real Estate Assets” (which consist of real property, interests in REITs, interests in mortgages on real property, and other investments in the real estate investment, service and related industries). The timing of those sales will be governed by federal income tax considerations. Thus, for example, if it is not reasonably certain by late December 2011 that a favorable shareholder vote on the Business Proposal will be obtained, the Company will determine whether realizing capital gains in 2011 -- to minimize non-real-estate-related income for 2012 and thus enable the Company to more easily satisfy the REIT Income Requirements (as defined under “Federal Tax Considerations—Federal Tax Treatment of the Company’s Proposed Operations as a REIT—Requirements to Qualify for Treatment as a REIT—REIT Requirements—(2) Annual Source-of-Income Requirements”) in that year -- that, in the absence of the change in business, would not otherwise be taken until 2012 or later is in the best interest of the Company’s shareholders. (See the referenced section.) If the Company determines that deferring realization to 2012 or later is preferable but that realizing gains from the current portfolio in that year would likely prevent the Company from qualifying as a REIT for that year, implementation of the Business Proposal would be delayed until 2013.

|

|

·

|

Immediately after implementation, the Company will begin to pursue its new business with the intention of qualifying for treatment as a REIT for federal tax purposes. Initially, the Company anticipates that it will invest predominantly in other publicly traded REITs. Over time the Company expects to divest its holdings in other REITs and acquire and operate self storage facilities.

|

|

·

|

Once the Company begins to implement the Business Proposal, the Company’s Investment Management Agreement (“Investment Management Agreement”) with CEF Advisers, Inc. (“Investment Manager”), as investment manager and administrator of the Company, will terminate, and thereafter the Company will be internally managed by its newly appointed executive officers and other new employees or agents. (The mailing address for the Investment Manager is 11 Hanover Square, New York, NY 10005.)

|

|

·

|

The Company will change its name to Self Storage Group, Inc. and, sometime before the Company ceases to be a registered investment company, seek to list its common stock on NASDAQ Capital Market (“NASDAQ”). There can be no assurance that the Company’s common stock will be accepted for listing.

|

2

|

·

|

When less than 40% of the value of the Company’s total assets (exclusive of government securities and cash) constitutes “investment securities” (as defined in Section 3(a) of the 1940 Act), the Company will file an application to deregister as an investment company under the 1940 Act. Once the Securities and Exchange Commission (“SEC”) has issued an order declaring that the Company has ceased to be an investment company (“Deregistration Order”), it will become an operating company.

|

|

·

|

If the Company’s common stock is accepted for listing on NASDAQ, as an operating company, the Company will be subject to the reporting obligations of the Securities Exchange Act of 1934, as amended (“1934 Act”), including filing annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports and filings required of listed public companies. If the Company’s common stock is listed on NASDAQ, the Company anticipates holding annual meetings of shareholders.

|

Question: When will the Business Proposal take effect?

Answer: While the Company anticipates that it will begin to implement the Business Proposal as early as late 2011, it will not complete implementing it for at least a year, or longer, from that time. (See the second bullet point under the immediately preceding Answer.) The Company expects that there will be a transition period of up to three months from the date it divests itself of all non-Real Estate Assets before it is fully invested in Real Estate Assets, including publicly traded REITs, and another approximately 12 months before it owns and operates self storage facilities. Distributions to shareholders may decrease during the period when the Company is transitioning from an investment company to a self storage REIT. The Company anticipates it may take several months or longer from the date it files an application to deregister as an investment company to obtain a Deregistration Order. Until the Business Proposal has been completely implemented, the Board has the power to change or modify the proposal if it concludes that doing so would be in the best interests of the Company.

Question: What is a self storage facility?

Answer: A self storage facility is a property that offers storage space rental, generally on a month-to-month basis, for personal or business use. Tenants rent fully enclosed spaces that can vary in size according to their specific needs and to which they have unlimited, exclusive access. Properties generally have on-site managers who supervise and run the day-to-day operations, providing tenants with assistance as needed.

Question: What is a REIT? Will the Company qualify as a REIT?

Answer: A REIT is a corporation, business trust or association that essentially combines the capital of many investors to acquire or provide financing for all forms of real estate. Like a registered closed-end fund, a company that qualifies as a REIT generally is not subject to federal corporate income tax on its net income and net realized gains that it distributes to its shareholders, provided certain tax requirements are satisfied. Inasmuch as REITs are subject to a highly technical and complex set of provisions in the Internal Revenue Code of 1986, as amended (“Code”), however, the Company may fail to qualify to be taxed as a REIT. In the event of any such unexpected failure, the Company would be subject to corporate level taxation, significantly reducing the amount of, or its ability altogether to make, distributions to its shareholders.

3

Question: Will the Business Proposal affect the Company’s investment objective?

Answer: Until the SEC issues a Deregistration Order, the Company will continue to be subject to its fundamental investment objective of providing a high level of income and fundamental investment policies (except that it will then be permitted to invest and concentrate in Real Estate Assets). This fundamental investment objective may not be changed without shareholder approval and the Company is not seeking shareholder approval to change it at this time by voting. The Fund’s secondary investment objective, which may be changed by the Board without shareholder approval, is capital appreciation. After the Company deregisters, it will no longer be subject to its current fundamental investment objective or policies and will no longer be governed by the 1940 Act. Although the fundamental investment objective will no longer be controlling, the Company currently intends to continue to operate to provide a high level of income and capital appreciation.

Question: Will the risk profile of the Company change as a result of the approval of the Business Proposal?

Answer: Yes. Because the Company’s assets will be concentrated in Real Estate Assets, the value of the Company’s common stock may be subject to greater volatility than a company with a portfolio that is less concentrated by industry. If the securities of the real estate industry or self storage facility companies as a group fall out of favor with investors, the Company could underperform other companies that have greater industry diversification. The Company will also change from an investment company into an operating company and will have to comply with the regulatory requirements applicable to REITs. For more information on the risks associated with the change of business, see “Risk Factors.”

Question: Will the Company continue to pay quarterly distributions? Will there be any impact on the nature of the distributions paid by the Company?

Answer: Yes. The Company intends to continue to pay quarterly dividends to shareholders. To qualify as a REIT under the Code, the Company generally will be required each taxable year to distribute at least 90% of its taxable income (other than “net capital gain” (i.e., the excess of net long-term capital gain over net short-term capital loss)). The Company intends to make distributions to its shareholders of amounts that will, at a minimum, enable it to comply with that requirement. The actual amount of those distributions will be determined on a quarterly basis by the Board, taking into account, in addition to the Code’s REIT requirements, the cash needs and net income of the Company, the market price for its common stock and other factors the Board considers relevant. In addition, the Company may distribute substantially all of its net capital gain, if any, in December of each year or may, in any particular year, retain its undistributed net capital gain, with the consequences described in “Annex B—Additional Federal Tax Considerations—Federal Taxation of Company Shareholders—Retained Net Capital Gain.”

A substantial part of the income dividends the Company paid in 2010 and 2009 (1) has been treated as “qualified dividend income” (which is taxed to individual taxpayers at net capital gain rates through 2012) (“QDI”) and (2) has been eligible for the dividends-received deduction available to corporate shareholders (“DRD”). Income dividends payable by the Company as a REIT generally will not be so treated; instead, distributions paid out of the Company’s current and accumulated earnings and profits (“E&P”), except distributions of net capital gain, will be taxable to shareholders (other than those who are tax-exempt or hold Company shares in tax-advantaged accounts) as ordinary income, which likely will increase the taxes those shareholders pay on the distributions they receive. For more information, see “Federal Tax Considerations.”

4

Question: Who will manage the business of the Company if the Business Proposal is approved?

Answer: Once the Investment Management Agreement is terminated, the Company will be internally managed. The following executive officers are expected to serve in the capacities indicated: Mark C. Winmill, President, Chief Executive Officer and Director; Bassett S. Winmill, Executive Chairman; Thomas O’Malley, Chief Financial Officer and Treasurer; Thomas B. Winmill, Esq., General Counsel; Robert J. Mathers, Vice President, Operations; and John F. Ramirez, Vice President, Chief Compliance Officer and Secretary. For more information on the executive officers of the Company, see “Management of the Company—Executive Officers.”

Question: Does management have experience in managing real estate businesses?

Answer: Yes. The proposed executive officers of the Company, in their management capacities at Tuxis Corporation, an affiliated company of the Investment Manager (“Tuxis”), have significant experience in managing and operating real estate businesses, particularly self storage facilities, although not within a REIT structure. Management at Tuxis has experience with both revitalizing older, established but under-performing properties and developing new properties. Tuxis operates Tuxis Self Storage at Heritage Park in Clinton, CT, a 185-unit self storage facility that offers a mix of standard and climate control units, and Tuxis Self Storage at Millbrook Commons in Millbrook, NY, a mixed use facility consisting of 135 climate control self storage units (including wine storage) as well as office/retail space. Management believes that, given the unique characteristics of the predominantly fragmented and non-professional ownership in the self storage industry, it can compete successfully in whatever demographically favorable market it chooses for the Company’s self storage properties.

Question: Are there potential conflicts of interest that could arise because the Company and Tuxis will both engage in the self storage facility business?

Answer: Certain conflicts of interest may arise as a result of the overlapping executive officers and directors of the Company and Tuxis. Mark C. Winmill, who is expected to serve as the Company’s President and Chief Executive Officer soon after the Business Proposal is approved, is also President and Chief Executive Officer of Tuxis. Other members of the Company’s proposed senior management are also involved in Tuxis’ self storage business. These outside business interests could interfere with management’s ability to devote sufficient time to the Company’s business and affairs. In addition, conflicts may arise in connection with the allocation of investment opportunities between the Company and Tuxis. Should the Business Proposal be approved by shareholders, the Board intends to adopt policies governing allocation of investment opportunities between the two entities. Once the Company ceases to be a registered investment company under the 1940 Act, it will be able to engage in transactions with its affiliates that would currently be prohibited by the 1940 Act. Thus, the Company will be permitted to acquire real property and related assets from, and sell real property and related assets to, its affiliates. These transactions may result in terms that are more favorable to the affiliate than would have been obtained on an arm’s length basis and may operate to the detriment of the Company’s shareholders. The Company’s independent directors will review all affiliated and related party transactions. For more information see “Related Parties and Potential Conflicts of Interest.”

5

Question: Will the Company’s expenses be affected by the proposed changes?

Answer: Yes. Instead of paying an investment management fee to the Investment Manager, the Company will pay its executive officers, employees and other agents to manage and operate its business. The overall expenses of the Company will increase. Although expenses are anticipated to rise, if the Business Proposal is fully implemented, the Company anticipates that over the long term the increased revenues as a result of the change to the Company’s business should more than offset any increase in expenses. See “Operation as a Self Storage REIT—Operating Expenses” for more information.

Question: What are the tax consequences of effecting the Business Proposal?

Answer: The Company’s change from a “regulated investment company” (as defined in Part I of Subchapter M of Chapter 1, Subtitle A, of the Code (“Subchapter M”)) (“RIC”) to a REIT likely would not itself be treated as a taxable event -- the same corporation that has existed in 2011 and before as an electing RIC would continue without interruption as an electing REIT in 2012 and thereafter. The change in investment focus, however, could have significant adverse tax consequences, in that it would necessitate the disposition of all of the Company’s portfolio in taxable sales. Those consequences would be affected by the fact that, for the year ended December 31, 2010, the Company had (1) aggregate net unrealized appreciation of more than $5.3 million and (2) over $1.5 million of capital loss carryovers. See “Federal Tax Considerations—Federal Income Tax Consequences of the Company’s Change from a RIC to a REIT.” The Company will also incur material brokerage expenses in connection with the sale and re-investment of the entire portfolio of its investment securities.

Question: Is implementation of one Proposal conditioned upon shareholder approval of the other Proposal?

Answer: If shareholders approve the Business Proposal but not the Charter Proposal, the Company will still implement the Business Proposal and the Company will continue to solicit proxies for approval of the Charter Proposal. There can be no assurance that the Charter Proposal will be approved by shareholders. If, however, the Charter Proposal is approved but the Business Proposal fails to achieve shareholder approval, neither Proposal will be carried out. Thus, implementation of the Charter Proposal is conditioned on the Business Proposal being approved by shareholders.

Question: What will happen if shareholders do not approve the Business Proposal?

Answer: If the Business Proposal is not approved, the Company will not seek a listing on NASDAQ and neither Proposal will be implemented. In that case, (1) the Company’s name will remain Global Income Fund, Inc., (2) its common stock will continue to be quoted on the OTC Bulletin Board (“OTCBB”) under the symbol “GIFD” and on Pink Sheets LLC (“Pink Sheets”) under the symbol “GIFD.PK”, (3) it will not deregister under the 1940 Act and (4) it will continue to operate as a closed-end investment company and will retain its current fundamental investment objective, fundamental policies and restrictions.

6

Question: Are other material changes contemplated by the Company that will not be submitted to shareholders?

Answer: Yes. If the Business Proposal is approved, sometime before the Company ceases to be a registered investment company, the Company will seek to list its common stock on the NASDAQ Capital Market. If necessary in order to satisfy the current $4.00 minimum bid price requirement for current listing on NASDAQ, the Company may amend its Charter to effect a reverse stock split whereby, for example, every two shares of the Company’s issued and outstanding common stock would be combined into one share of common stock and to reduce the common stock’s par value subsequent to the reverse stock split. Currently, the Company has a classified Board divided into five classes. To comply with requirements for listing the Company’s common stock on NASDAQ, the Company anticipates changing the number of classes of Directors from five to three. The Board intends to rely on section 3-803 of the Maryland General Corporation Law (“MGCL”) to change the classification of the Board. By voting to approve the Business Proposal or the Charter Proposal, shareholders will be deemed to have approved these changes. If the Company’s common stock is not accepted for listing on NASDAQ, the Board will continue to be divided into five classes and the shares will continue to be quoted on the OTCBB and on Pink Sheets. See “Management of the Company—Board of Directors” and “Management of the Company—Executive Officers” for more information on the reclassification of the Board.

7

|

TO CHANGE THE COMPANY’S BUSINESS FROM AN INVESTMENT COMPANY TO AN OPERATING COMPANY THAT WILL OWN, OPERATE, MANAGE, ACQUIRE, DEVELOP AND REDEVELOP PROFESSIONALLY MANAGED SELF STORAGE FACILITIES AND, IN CONNECTION THEREWITH, TO AMEND THE COMPANY’S FUNDAMENTAL INVESTMENT RESTRICTIONS TO PERMIT THE COMPANY TO PURSUE ITS NEW BUSINESS.

|

The Board recommends to shareholders that the Company’s business be changed from a registered investment company, which is regulated under the 1940 Act and invests primarily in closed-end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities, to an operating company that will own, operate, manage, acquire, develop and redevelop professionally managed self storage facilities and that will seek to qualify to be taxed as a REIT for federal tax purposes. In connection with this change to the Company’s business, the Company’s fundamental investment restrictions regarding concentration and investment in real estate would also be amended so that the Company may pursue its new business as described in this Proxy Statement. Set forth below is a description of the actions that the Company expects to take and the changes that it expects to make to its investment strategies, management and policies if shareholders approve the Business Proposal.

If shareholders approve the Business Proposal but not the Charter Proposal, the Company will still implement the Business Proposal and the Company will continue to solicit proxies for approval of the Charter Proposal. If the Business Proposal fails to achieve shareholder approval, neither Proposal will be carried out.

Vote Required and the Board’s Recommendation

Under the 1940 Act, the Company may not change its business from an investment company to an operating company without the affirmative vote of the lesser of (a) 67% of the Company’s outstanding voting securities present at the Meeting, if the holders of more than 50% of the Company’s outstanding voting securities are present in person or represented by proxy, or (b) more than 50% of the Company’s outstanding voting securities.

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE BUSINESS PROPOSAL.

If the Business Proposal is approved by shareholders, the Company expects to take the actions described below:

Change the Company’s fundamental investment restrictions to permit the Company to pursue its new business. The Company’s fundamental investment restrictions regarding concentration and investment in real estate will be amended to permit the Company to pursue its new strategy of concentrating and making direct investments in Real Estate Assets, as described in this Proxy Statement. The 1940 Act provides that no registered investment company shall, unless authorized by the vote of a majority of its outstanding voting securities (as defined under the 1940 Act), deviate from its policy in respect of concentration of investments in any particular industry or group of industries as recited in its registration statement, or purchase or sell real estate, except in accordance with the recitals of its policy contained in its registration statement.

8

With respect to concentration, the Company’s investment restrictions currently provide that the Company may not:

|

·

|

Purchase a security, if as a result, 25% or more of the value of the Company’s total assets would be invested in the securities of issuers in a single industry, provided that this limitation does not apply to securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities.

|

The SEC currently defines “concentration” as investing 25% or more of an investment company’s total assets in an industry or group of industries, with certain exceptions. If shareholders approve the Business Proposal, this restriction will be amended so that it provides that the Company may not:

|

·

|

Purchase an investment if, as a result, 25% or more of the value of the Company’s total assets would be invested in the securities of issuers in a single industry, provided that this limitation does not apply to securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities; and, provided further, that the Company may concentrate its investments in real property, interests in REITs, interests in mortgages on real property and other investments in the real estate investment, service and related industries.

|

With respect to real estate, the Company’s investment restrictions currently provide that the Company may not:

|

·

|

Purchase or sell real estate (although it may purchase securities of companies whose business involves the purchase or sale of real estate).

|