DEF 14A: Definitive proxy statements

Published on April 30, 2019

SCHEDULE 14A

(RULE 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate

box:

☐ Preliminary Proxy Statement

☑ Definitive Proxy

Statement

☐ Definitive

Additional Materials

☐ Soliciting Material

Pursuant to Rule 14a-11(c) or Rule 14a-12

☐ Confidential, For

Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Global Self

Storage, Inc.

(Name of Registrant as Specified in Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing

Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

(5) |

Total fee paid:

|

|

|

|

☐ Fee paid previously

with preliminary materials:

|

|

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1) |

Amount Previously Paid:

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

(3) |

Filing Party:

|

|

|

|

|

|

(4) |

Date Filed:

|

|

|

|

11 Hanover Square

New York, NY 10005

www.GLOBALSELFSTORAGE.us

New York, New York

April 30, 2019

Dear Fellow Stockholders,

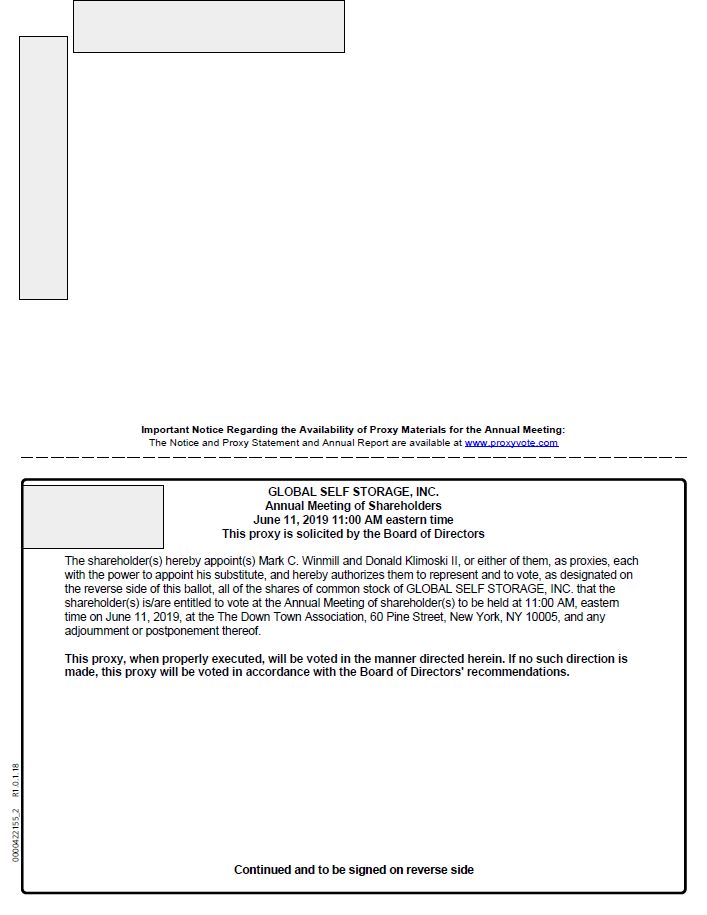

It is our pleasure to invite you to the Annual Meeting (“Meeting”) of Stockholders of Global Self Storage, Inc., a

Maryland corporation (the “Company”), to be held at The Down Town Association, 60 Pine Street, New York, New York 10005 on June 11, 2019. The Meeting will be held at 11:00 a.m. ET. Formal notice of the Meeting appears on the next pages and is

followed by the Proxy Statement for the Meeting.

At the Meeting, you will be asked to: elect four directors (Proposal 1); and ratify the appointment of Tait, Weller & Baker LLP (“TWB”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 (Proposal 2).

THE BOARD OF DIRECTORS, INCLUDING THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND

UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

PROPOSALS 1 AND 2.

Your vote is important. Whether or not you plan to attend the Meeting, I urge you to authorize a proxy to vote your shares

electronically through the Internet, by telephone, or, if you have requested and received a paper copy of the Proxy Statement, by completing, signing, and returning the paper proxy card enclosed with the Proxy Statement according to the

instructions.

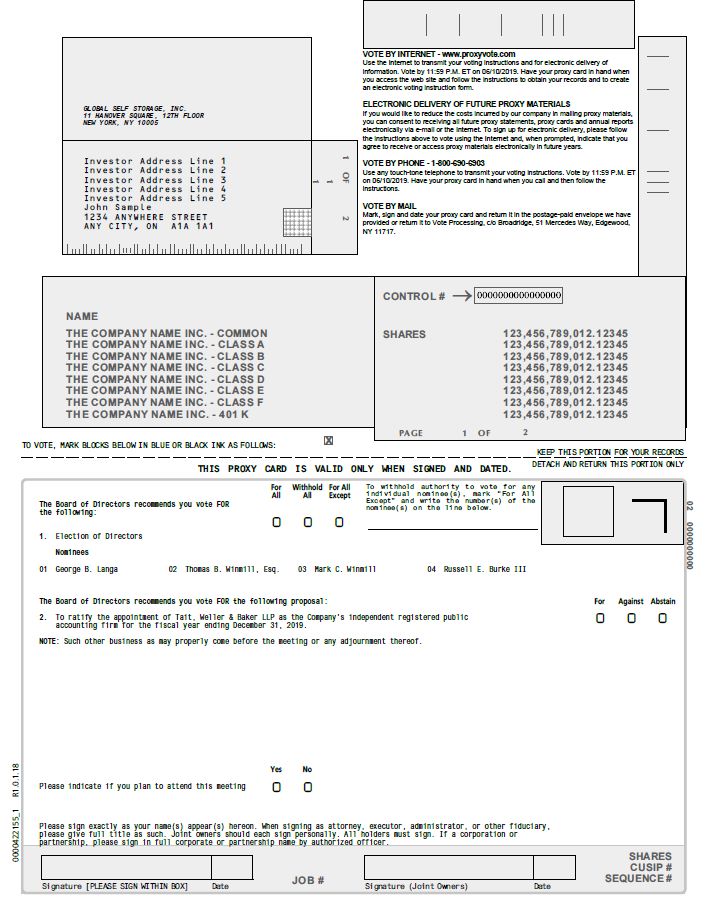

How to Vote

You may authorize a proxy to vote your shares by proxy in one of three ways:

Internet: To submit your voting instructions via the Internet, go to www.proxyvote.com and enter the

control number found on the enclosed proxy card.

| By phone: |

To submit your voting instructions by phone, please call toll-free (800) 690-6903. Use any touch-tone telephone to vote your proxy. Have your proxy card

available when you call.

|

By mail: Complete the enclosed proxy card and return it in the enclosed postage-paid envelope.

On behalf of the board of directors and management of the Company, I thank you for your continued support.

Sincerely,

Mark C. Winmill

President and CEO

Notice of Annual Meeting of Stockholders

To Be Held on June 11, 2019

New York, New York

April 30, 2019

To the Stockholders:

Notice is hereby given that the 2019 Annual Meeting of Stockholders (the “Meeting”)

of Global Self Storage, Inc., a Maryland corporation (the “Company,” “we,” “our,” or “us”), will be held at The Down Town Association, 60 Pine Street, New York, New York 10005 on June 11, 2019 at 11:00 a.m. ET to consider and vote upon the

following matters:

|

1.

|

To elect to the board of directors each of the nominees, Messrs. Thomas B. Winmill, Esq., George B. Langa, Mark C. Winmill, and

Russell E. Burke III, to serve until the 2020 Annual Meeting of Stockholders and until their successors are duly elected and qualify.

|

|

2.

|

To ratify the appointment of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm for the

fiscal year ending December 31, 2019.

|

|

3.

|

To transact any other business as may properly come before the Meeting or any postponement or adjournment thereof.

|

Each of the proposals is discussed in the Proxy Statement attached to this Notice. THE BOARD OF DIRECTORS, INCLUDING THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND UNANIMOUSLY RECOMMENDS THAT YOU

VOTE “FOR” PROPOSALS 1 AND 2. The board of directors of the Company has fixed the close of business on April 22, 2019 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the

Meeting or any postponements or adjournments thereof.

Important Notice regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 11, 2019: This Proxy Statement and our 2018 Annual Report to Stockholders are available at https://ir.globalselfstorage.us/all-sec-filings.

Admittance to the Annual Meeting of Stockholders will be limited to stockholders as

of the record date, or their duly appointed proxies. In the interest of safety, all boxes, handbags and briefcases are subject to inspection. Cameras (including cell phones with photographic capability), recording devices and other electronic

devices are not permitted at the Meeting.

Please complete, sign, and

date the enclosed proxy card. You may use the enclosed postage-paid envelope to mail your proxy card or you may attend the Meeting in person. You may also authorize a proxy to vote your shares by phone by calling toll free at (800) 690-6903. To

authorize a proxy to vote your shares via the Internet, go to www.proxyvote.com and enter the control number found on the enclosed proxy card. Instructions for the proper execution of proxies are set forth inside the Proxy Statement. We ask for your cooperation in completing and returning your proxy promptly. The

enclosed proxy is being solicited on behalf of the board of directors of the Company.

Sincerely,

Donald Klimoski II

Secretary

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid the

time and expense to the Company involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

|

Registration

|

Valid Signature

|

|

Corporate Accounts

|

|

|

(1) ABC Corp.

|

ABC Corp., by [title of authorized officer]

|

|

(2) ABC Corp., c/o John Doe Treasurer

|

John Doe

|

|

(3) ABC Corp. Profit Sharing Plan

|

John Doe, Director

|

|

Trust Accounts

|

|

|

(1) ABC Trust

|

Jane B. Doe, Director

|

|

(2) Jane B. Doe, Director, u/t/d 12/28/78

|

Jane B. Doe

|

|

Custodian or Estate Accounts

|

|

|

(1) John B. Smith, Cust.,

|

John B. Smith

|

|

f/b/o John B. Smith, Jr.

UGMA or UTMA

|

|

|

(2) Estate of John Doe, John B.

Smith, Jr., Executor

|

John B. Smith, Jr., Executor

|

STATEMENT ON FORWARD LOOKING INFORMATION

Certain information presented in this Proxy Statement may contain “forward-looking statements” within

the meaning of the federal securities laws including the Private Securities Litigation Reform Act of 1995. Forward looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or

performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward looking statements can be identified by terminology such as

“believes,” “plans,” “intends,” “expects,” “estimates,” “may,” “will,” “should,” or “anticipates,” or the negative of such terms or other comparable terminology, or by discussions of strategy. All forward-looking statements made by us involve known

and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results to be materially different from those expressed or implied by such statements. We may also make additional forward looking

statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements. All forward-looking statements, including without

limitation, our examination of historical operating trends and estimates of future earnings, are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and our belief

there is a reasonable basis for them, but there can be no assurance that our expectations, beliefs and projections will result or be achieved.

All forward looking statements apply only as of the date made. Except as required by law, we undertake

no obligation to publicly update or revise forward looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially

from the forward-looking statements contained in or contemplated by this Proxy Statement. Any forward-looking statements should be considered in light of the risks referenced in “Item 1A. Risk Factors” included in our most recent annual report on

Form 10-K and in our other filings with the Securities and Exchange Commission (the “SEC”). Such factors include, but are not limited to:

|

|

general risks associated with the ownership and operation of real estate, including changes in

demand, risks related to development of self storage properties, potential liability for environmental contamination, natural disasters and adverse changes in tax, real estate and zoning laws and regulations;

|

|

|

risks associated with downturns in the national and local economies in the markets in which we

operate, including risks related to current economic conditions and the economic health of our customers;

|

|

|

the impact of competition from new and existing self storage and commercial properties and

other storage alternatives;

|

|

|

difficulties in our ability to successfully evaluate, finance, integrate into our existing

operations, and manage acquired and developed properties;

|

|

|

risks related to our development of new properties and/or participation in joint ventures;

|

|

|

risks of ongoing litigation and other legal and regulatory actions, which may divert

management’s time and attention, require us to pay damages and expenses or restrict the operation of our business;

|

|

|

the impact of the regulatory environment as well as national, state, and local laws and

regulations including, without limitation, those governing the environment, taxes and our tenant reinsurance business and real estate investment trusts (“REITs”), and risks related to the impact of new laws and regulations;

|

|

|

risk of increased tax expense associated either with a possible failure by us to qualify as a

REIT, or with challenges to intercompany transactions with our taxable REIT subsidiaries;

|

|

|

changes in federal or state tax laws related to the taxation of REITs, which could impact our

status as a REIT;

|

|

|

increases in taxes, fees and assessments from state and local jurisdictions;

|

|

|

security breaches or a failure of our networks, systems or technology could adversely impact

our business, customer and employee relationships;

|

|

|

our ability to obtain and maintain financing arrangements on favorable terms;

|

|

|

market trends in our industry, interest rates, the debt and lending markets or the general

economy;

|

|

|

the timing of acquisitions and our ability to execute on our acquisition pipeline;

|

|

|

general volatility of the securities markets in which we participate;

|

|

|

changes in the value of our assets;

|

|

|

changes in interest rates and the degree to which our hedging strategies may or may not protect

us from interest rate volatility;

|

|

|

our ability to continue to qualify and maintain our qualification as a REIT for U.S. federal

income tax purposes;

|

|

|

availability of qualified personnel;

|

|

|

difficulties in raising capital at a reasonable cost;

|

|

|

fiscal policies or inaction at the U.S. federal government level, which may lead to federal

government shutdowns or negative impacts on the U.S economy;

|

|

|

estimates relating to our ability to make distributions to our stockholders in the future; and

|

|

|

economic uncertainty due to the impact of terrorism or war.

|

TABLE OF CONTENTS

|

INTRODUCTION

|

1

|

|

QUESTIONS AND ANSWERS REGARDING THE PROPOSALS

|

1

|

|

PROPOSAL 1:TO ELECT TO THE BOARD EACH OF THE NOMINEES, THOMAS B.

WINMILL, ESQ., GEORGE B. LANGA, MARK C. WINMILL, AND RUSSELL E. BURKE III TO SERVE UNTIL THE COMPANY’S 2020 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFY.

|

3

|

|

CURRENT BOARD MEMBERS

|

5

|

|

EXECUTIVE OFFICERS

|

6

|

|

EXECUTIVE COMPENSATION

|

7

|

|

CORPORATE GOVERNANCE

|

12

|

|

PROPOSAL

2:TO RATIFY THE APPOINTMENT OF TAIT, WELLER & BAKER LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.

|

15

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

17

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

18

|

|

ADDITIONAL INFORMATION

|

19

|

_________________________

PROXY STATEMENT

_________________________

Annual Meeting of Stockholders

To Be Held on June

11, 2019

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”)

of Global Self Storage, Inc., a Maryland corporation (the “Company,” “we,” “our,” or “us”), to be voted at the Annual Meeting of Stockholders of the Company to be held at The Down Town Association, 60 Pine Street, New York, New York 10005 on June

11, 2019 at 11:00 a.m. ET (such meeting and any adjournment(s) or postponement(s) thereof are referred to collectively as the “Meeting”).

The Board has fixed the close of business on

April 22, 2019 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting and at any postponements or adjournments thereof (the “Record Date”). It is estimated that proxy materials will be

mailed to stockholders as of the Record Date on or about April 30, 2019.

On the Record Date, 7,733,967 shares of the

Company’s common stock were outstanding. Each outstanding share is entitled to one vote on each of the matters to be voted on at the Meeting. All properly executed and timely received proxies will be voted at the Meeting in accordance with the

directions marked thereon or otherwise provided therein. If you properly execute and return your proxies but do not indicate any voting instructions, your shares will be voted “FOR” Proposals 1 and 2. Any stockholder may revoke a proxy at any

time prior to the exercise thereof by giving written notice to the Secretary of the Company at the Company’s principal executive offices at 11 Hanover Square, 12th Floor, New York, New York 10005, by signing another proxy of a later date, or by personally voting at the Meeting.

A COPY OF OUR ANNUAL REPORT ON FORM 10-K (FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”),

WHICH CONTAINS ADDITIONAL INFORMATION ABOUT US, IS AVAILABLE FREE OF CHARGE TO ANY STOCKHOLDER. REQUESTS SHOULD BE DIRECTED TO THE COMPANY AT 11 HANOVER SQUARE, 12TH FLOOR, NEW YORK, NEW YORK 10005 OR BY TELEPHONE TOLL-FREE AT

1-800-579-1639. OUR ANNUAL REPORT IS NOT TO BE REGARDED AS PROXY SOLICITING MATERIAL.

QUESTIONS AND ANSWERS REGARDING THE PROPOSALS

While we strongly encourage you to read the full text of this Proxy Statement, we also are providing the following brief

overview of the proposals in “Question and Answer” format. If you have any questions about how to vote your shares, please call toll-free (800) 690-6903.

|

Question:

|

What proposals will be acted upon at the Meeting?

|

| A. |

At the Meeting, you will be asked to: elect to the Board each of the nominees, Messrs. Thomas B. Winmill, Esq., George B. Langa, Mark C. Winmill, and Russell E.

Burke III (the “Nominees”), to serve until the Company’s 2020 Annual Meeting of Stockholders and until their successors are duly elected and qualify (Proposal 1); and ratify the appointment of Tait, Weller & Baker LLP (“TWB”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 (Proposal 2).

|

|

Question:

|

How does the Board recommend that I vote?

|

|

A.

|

After careful consideration of the proposals, the Board, including all those members who are nonemployee independent directors, as defined under the Securities

Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder and exemptions granted therefrom, both as amended from time to time (the “Exchange Act”), and The Nasdaq Stock Market LLC (“Nasdaq”) Listing Rules (the

“Independent

|

1

|

|

Directors”), unanimously approved each proposal and recommends that you vote in favor of Proposals 1 and 2. The reasons for the Board’s recommendations are

discussed in more detail in this Proxy Statement.

|

| Question: |

What are stockholders being asked to approve in Proposal 1?

|

|

A.

|

Stockholders are being asked to elect to the Board each of the Nominees, to serve until the Company’s 2020

Annual Meeting of Stockholders and until their successors are duly elected and qualify.

|

Mr. Thomas B. Winmill, Esq. has served on the Board since 1997. He is a member of the New York State

Bar and the SEC Rules Committee and Principal Underwriters Working Group of the Investment Company Institute. He was selected to serve on our Board because of his experience and extensive knowledge of finance, accounting, regulatory, investment,

and board operational matters.

Mr. George B. Langa has served on the Board and as the chairman of the Board’s nominating committee (the “Nominating

Committee”) since 2016. He is also Executive Vice President of Millbrook Real Estate, LLC, licensed real estate brokers in New York and Connecticut. He specializes in premium estates, development, land, commercial and agricultural properties. He

was selected to serve on our Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

Mark C. Winmill has served as a director, Chief Executive Officer, President and Chairman of the Board of the Company and

its subsidiaries since 2012. He manages all aspects of the Company’s self storage facility businesses including, among other things, the formation of business objectives and strategies, identification of potential acquisition targets, development

of project plans, retention of employees, establishment of compensation and compensation incentives, negotiation and closing of property acquisitions, obtaining zoning approvals, overseeing construction, and development of leasing and tenant

acquisition strategies. He was selected to serve on our Board because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations.

Russell E. Burke III has served on the Board and as the chairman of the Board’s compensation committee (the “Compensation

Committee”) since 2016. He is President of Ninigret Trading Corporation, an art investment and appraisal company. He is also a Board Member of the New Britain Museum of American Art. Previously, he served as an auction house president and partner

with responsibility for storage and disposal in connection with large estates. He previously served as a director of Tuxis Corporation from 1997 to 2016. He was selected to serve on our Board because of his prior experience serving on the board of

a self storage company and his experience and extensive knowledge of the self storage industry.

| Question: |

What are stockholders being asked to approve in Proposal 2?

|

|

A.

|

Although the Board has sole authority to appoint, re-appoint, and dismiss the Company’s independent registered

public accounting firm, it is seeking the opinion of the stockholders regarding its appointment of TWB as the independent registered public accounting firm. For this reason, stockholders are being asked to ratify this appointment. If

stockholders ratify the appointment of TWB as the independent registered public accounting firm, the Board will take that fact into consideration, but may, nevertheless, dismiss TWB. If stockholders do not ratify the appointment of TWB as

the Company’s independent registered public accounting firm, the Board will take that fact into consideration, but may, nevertheless, continue to retain TWB.

|

| Question: |

How do I vote?

|

|

A.

|

You may use the enclosed postage-paid envelope to mail your proxy card or you may attend the Meeting in person. You may also authorize a proxy to vote your shares by phone by

calling toll free at (800) 690-6903. To authorize a proxy to vote your shares via the Internet, go to www.proxyvote.com and enter the control number found on the enclosed proxy card.

|

If you are a record holder of one or more of the Company’s shares and plan to attend the Meeting in person, in order to

gain admission, you must show valid photographic identification, such as your driver's license or passport.

If you hold shares of the Company through a bank, broker, or other nominee, and plan to attend the Meeting in person, in

order to gain admission you must show valid photographic identification, such as your driver's

2

license or passport, and satisfactory proof of ownership of shares in the Company, such as your voting instruction form or

a letter from your bank, broker, or other nominee's statement indicating ownership as of the record date for the Meeting.

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, HAS CONSIDERED EACH OF THE PROPOSALS AND UNANIMOUSLY

RECOMMENDS THAT YOU VOTE “FOR” PROPOSALS 1 AND 2.

| PROPOSAL 1: |

TO ELECT TO THE BOARD EACH OF THE NOMINEES, THOMAS B. WINMILL, ESQ., GEORGE B. LANGA, MARK C. WINMILL, AND RUSSELL E. BURKE III TO SERVE

UNTIL THE COMPANY’S 2020 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFY.

|

On October 20, 2017, the Company elected to no longer be subject to Section 3-803 of the Maryland General Corporation Law.

As such, the Company is phasing out Board classes, and all director nominees shall be elected for a one-year term beginning with the 2018 Annual Meeting of Stockholders. The Board is expected to be fully declassified by the completion of the

Company’s 2020 Annual Meeting of Stockholders. The Board was previously divided into three classes: Class I, Class II and Class III. The term of the Class I director shall last until the Company’s 2020 Annual Meeting of Stockholders and until his

successor is elected and qualifies. The term of the Class III and unclassified directors shall last until the Meeting and until their successors are elected and qualify. At each annual meeting of the stockholders of the Company, the successors to

the class of directors whose term expires at that meeting shall cease to be part of a class and be elected to hold office for a term continuing until the annual meeting of stockholders held in the year following the year of their election and until

their successors are elected and qualify.

Upon the recommendation of the Nominating Committee for nomination by the Board as a candidate for election as a director,

with the unanimous approval of the Independent Directors and the Continuing Directors (as defined in the Company’s governing documents), the Board has nominated each of Messrs. Thomas B. Winmill, Esq., George B. Langa, Mark C. Winmill, and Russell

E. Burke III for election as a director to serve until the 2020 Annual Meeting of Stockholders and until their successors are duly elected and qualify. The Nominees currently serve as directors of the Company.

In considering

Mr. Thomas B. Winmill, Esq. for election, the Board evaluated Mr. Winmill’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the

conclusion that Mr. Winmill should be elected as a director, the Board considered and evaluated Mr. Winmill’s relevant knowledge, experience and expertise. Mr. Winmill has served on the Board since 1997. Mr. Winmill was selected as a Nominee

because of his experience and extensive knowledge of finance, accounting, regulatory, investment, and board operational matters. The Board also considered Mr. Winmill’s service as a director on the board of directors of other companies.

In considering Mr.

George B. Langa for election, the Board evaluated Mr. Langa’s background and his oversight and service as a member of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Mr.

Langa should be elected as a director, the Board considered and evaluated Mr. Langa’s relevant knowledge, experience, expertise, and independence. Mr. Langa has served on the Board since 2016. He was selected as a Nominee because of his

experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

In considering Mr.

Mark C. Winmill, Esq. for election, the Board evaluated Mr. Winmill’s background and his oversight and service as Chairman of the Board. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion

that Mr. Winmill should be elected as a director and the Chairman of the Board, the Board considered and evaluated Mr. Winmill’s relevant knowledge, experience and expertise. Mr. Winmill has served as Chief Executive Officer, President

and Chairman of the Board since 2012. Mr. Winmill was selected as a Nominee because of his experience and extensive knowledge of the

self storage industry and matters relating to real estate development, finance, accounting, and board operations.

In considering Mr.

Russell E. Burke III for election, the Board evaluated Mr. Burke’s background and his oversight and service as a member of the Board.

With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that Mr. Burke should be elected as a director, the Board considered and evaluated Mr. Burke’s relevant knowledge, experience, expertise,

and independence. Mr. Burke has served on the Board since 2016. He was selected as a Nominee because of his prior experience serving on the board of a self storage company and his experience and extensive knowledge of the self storage

industry.

The Nominees have consented to being named in

this Proxy Statement and have agreed to serve if elected. The persons named in the accompanying form of proxy intend to vote each such proxy “FOR” the election of the Nominees unless a stockholder specifically indicates on a proxy the

desire to withhold authority to vote for the Nominees. If you properly execute

3

and return your proxy but do not indicate any voting

instructions, your shares will be voted for the election of the Nominees. Should either of the Nominees withdraw or otherwise become unavailable for election due to events not now known or anticipated, it is intended that the proxy holders will

vote for the election of such other person or persons as the Board may recommend. Unless indicated below, the address of record for each of the Nominees is 11 Hanover Square, 12th Floor, New York, New York 10005.

The following is biographical information of the Nominees for director of the Company, based upon information furnished by

such Nominee:

Thomas B. Winmill, Esq.,

59, has served as a director of our Company since 1997. He is also President, Chief Executive Officer, Chief Legal Officer, and a director or trustee of Dividend and Income Fund, Foxby Corp., and Midas Series Trust (collectively, the “Funds”). He

is President, Chief Executive Officer, Chief Legal Officer, and a director of Bexil Advisers LLC and Midas Management Corporation (registered investment advisers and, collectively, the “Advisers”), Bexil Securities LLC and Midas Securities Group,

Inc. (registered broker-dealers and, collectively, the “Broker-Dealers”), and Bexil Corporation (a holding company) (“Bexil”). He is President and Chief Legal Officer of Winmill & Co. Incorporated (a holding company) (“Winco”). He is a director

of Bexil American Mortgage Inc. (“Bexil American”). He is a member of the New York State Bar and the SEC Rules Committee and Principal Underwriters Working Group of the Investment Company Institute. He was selected to serve on our Board because of

his experience and extensive knowledge of finance, accounting, regulatory, investment, and board operational matters. He may be deemed to be an “interested person” of the Company due to his relation to Mr. Mark Winmill. Messrs. Mark and Thomas

Winmill are brothers. The Funds, the Advisers, Winco, the Broker-Dealers, Bexil, and Bexil American may be deemed to be affiliates of the Company.

George B. Langa,

56, has served as a director of the Company and as the chairman of the Nominating Committee since 2016. He is also Executive Vice President of Millbrook Real Estate, LLC, licensed real estate brokers in New York and Connecticut. He specializes in

premium estates, development, land, commercial and agricultural properties. He was selected to serve on our Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management.

Mark C. Winmill,

61, has served as a Class III director, Chief Executive Officer, President and Chairman of the Board of the Company and its subsidiaries since 2012. He is also Chief Executive Officer, President, and a director of Tuxis (a holding company) and its

subsidiaries. He is Vice President of the Funds and Chief Investment Strategist of Midas Management Corporation (a registered investment adviser). He is Executive Vice President and a director of Winco. He is a principal of the Broker-Dealers. He

manages all aspects of the Company’s self storage facility businesses including, among other things, the formation of business objectives and strategies, identification of potential acquisition targets, development of project plans, retention of

employees, establishment of compensation and compensation incentives, negotiation and closing of property acquisitions, obtaining zoning approvals, overseeing construction, and development of leasing and tenant acquisition strategies. He was

selected to serve on our Board because of his experience and extensive knowledge of the self storage industry and matters relating to real estate development, finance, accounting, and board operations. He may be deemed to be an “interested person”

of the Company due to his role as an officer and director of the Company. Messrs. Mark and Thomas Winmill are brothers.

Russell E. Burke III,

72, has served as a Class III director and as the chairman of the Compensation Committee since 2016. He is President of Ninigret Trading Corporation, an art investment and appraisal company. He is also a Board Member of the New Britain Museum of

American Art. Previously, he served as an auction house president and partner with responsibility for storage and disposal in connection with large estates. He previously served as a director of Tuxis Corporation from 1997 to 2016. He was selected

to serve on our Board because of his prior experience serving on the board of a self storage company and his experience and extensive knowledge of the self storage industry.

Vote Required

As set forth in the Company’s bylaws, except as otherwise provided in the Company’s charter and notwithstanding any other

provision of Maryland law, unless all nominees for director are approved by a majority of the Continuing Directors (as such term is defined in the Company’s governing documents), the affirmative vote of the holders of at least two-thirds of the

outstanding shares of all classes of voting stock, voting together, shall be required to elect a director. However, if all nominees for director are approved by a majority of the Continuing Directors, a plurality of all the votes cast at a meeting

at which a quorum is present shall be sufficient to elect a director. Inasmuch as the election of each of the Nominees was approved by a majority of the Continuing Directors, a plurality of all the votes cast at the Meeting at which a quorum is

present shall be sufficient to elect each of the Nominees.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF THE NOMINEES.

4

CURRENT BOARD MEMBERS

In addition to the Nominees to serve as directors set forth above, the Board is comprised of the individuals listed below.

The information relating to each individual was furnished by such individual.

William C. Zachary,

54, has served as a Class I director and as the chairman of the Board’s audit committee (the “Audit Committee”) since 2016. Since 2011, he has been a partner and Director of Municipal Finance at SunLight General Capital, one of the largest owners

of distributed generation solar energy systems in the northeast. Prior to that, he was the head of Municipal Finance at Société Générale, specializing in taxable and tax-exempt bond investments, interest rate derivatives, and other traditional

banking products. He also worked in the Public Finance Department at Smith Barney. Mr. Zachary previously served as a Tuxis Corporation director from 2014 to 2016. He was selected to serve on our Board because of his prior experience serving on the

board of another self storage company and his extensive experience in underwriting and finance.

Board Committees and Board Meetings

Audit Committee.

The Board has an Audit Committee, comprised of Messrs. Zachary (Chair), Burke and Langa. The Board determined that all of the members of the Audit Committee are independent as required by the Nasdaq Listing Rules and SEC rules governing the

qualifications of Audit Committee members. The Board has also determined, based upon its qualitative assessment of their relevant levels of knowledge and business experience, that Messrs. Zachary, Burke and Langa qualify as “audit committee

financial experts” for purposes of, and as defined by, the SEC rules and possess the requisite financial sophistication, as required by the Nasdaq Listing Rules. The purpose of the Audit Committee is to meet with the Company’s independent

registered public accounting firm (“independent registered public accounting firm”) to review its financial reporting, external audit matters, and fees charged by the Company’s independent registered public accounting firm and to evaluate the

independence of the independent registered public accounting firm. The Audit Committee is also responsible for recommending the selection, retention, or termination of the Company’s independent registered public accounting firm, reviews with the

independent registered public accounting firm the plans and results of the audit engagement, reviews the adequacy of the Company’s internal accounting controls, and reviews any other relevant matter to seek to provide integrity and accuracy in the

Company’s financial reporting. The Audit Committee met four times during the fiscal year ended December 31, 2018. A current copy of the Audit Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Compensation Committee. The

Board has a Compensation Committee, comprised of Messrs. Burke (Chair), Langa and Zachary. The Board determined that all of the members of the Compensation Committee are independent as required by the Nasdaq Listing Rules. The role of the

Compensation Committee is to assist the Board by: (i) making decisions on the compensation of the Company’s executive officers; (ii) reviewing and approving corporate

goals and objectives relevant to the Chief Executive Officer’s compensation, evaluating his performance relative to those goals and objectives, and setting his compensation annually; and (iii) assisting the Board with other related tasks,

as assigned from time to time. The Compensation Committee may delegate its responsibilities to subcommittees as it deems appropriate. The Compensation Committee met two times during fiscal year ended December 31, 2018. A current copy of the

Company’s Compensation Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Nominating Committee.

The Board has a Nominating Committee comprised of Messrs. Langa (Chair), Burke and Zachary. The primary purposes and responsibilities of the Nominating Committee are: (i) to identify individuals qualified to become members of the Board in the

event that a position is vacated or created; (ii) to consider all candidates proposed to become members of the Board, subject to the procedures and policies set forth in the Nominating Committee charter, the Company’s bylaws or resolutions of the

Board; (iii) to select and nominate, or recommend for nomination by the Board, candidates for election as Directors; and (iv) to set any necessary standards or qualifications for service on the Board. The Nominating Committee met one time during

fiscal year ended December 31, 2018. A current copy of the Company’s Nominating Committee Charter is available on the Company’s website at www.GlobalSelfStorage.us.

Executive Committee.

The Board has an executive committee (the “Executive Committee”), comprised of Mr. Mark Winmill, which may meet from time to time, the function of which is to exercise the powers of the Board between meetings of the Board to the extent permitted by

law to be delegated and not delegated by the Board to any other committee. The Executive Committee did not meet during the fiscal year ended December 31, 2018.

Committee of Continuing

Directors. The Company has a committee of continuing directors (the “Committee of Continuing Directors”) which may meet from time to time, to take such actions as are required by the governing documents of the Company. The Committee of

Continuing Directors is comprised of Messrs. Burke, Langa, Zachary, Mark Winmill, and Thomas Winmill. The Committee of Continuing Directors did not meet during the fiscal year ended December 31, 2018.

5

For the fiscal year ended December 31, 2018, the Board held two regularly scheduled meetings and one special meeting. For

the fiscal year ended December 31, 2018, each of the directors currently in office attended at least 75% of the total number of meetings of the Board and of all committees of the Board on which such directors served during the period.

Director Compensation

Members of the Board who are not independent receive no compensation for their service as directors.

Currently, the Independent Directors are paid an annual retainer of $2,000, payable semi-annually, a fee of $7,000 for each semi-annual regular Board meeting attended, $250 for each special Board meeting attended, $250 for each committee meeting

attended, $500 per annum per committee chaired, and $500 for attendance at the Company’s annual meeting of stockholders. Each Independent Director is reimbursed for reasonable travel and out-of-pocket expenses associated with attending Board and

committee meetings.

A summary of the compensation and benefits for the Independent Directors for the fiscal year ended

December 31, 2018 is shown in the following table:

2018 Director Compensation

|

Name

|

Fees earned

in

cash

($)

|

All other compensation

($)

|

Total

($)

|

||||||||||||||

|

Russell E. Burke III

|

$

|

18,000

|

$

|

—

|

$

|

18,000

|

|||||||||||

|

George B. Langa

|

$

|

18,000

|

$

|

—

|

$

|

18,000

|

|||||||||||

|

William C. Zachary

|

$

|

18,000

|

$

|

—

|

$

|

18,000

|

|||||||||||

Qualifications of the Board

Each director’s background and his oversight and service as a member of other boards of directors was evaluated in

determining whether he should serve as a director of the Company. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that each person should serve as a director of the Company, each director’s

relevant knowledge, experience, expertise, and independence was considered and evaluated. Mr. Burke was selected to serve on our Board because of his prior experience serving on the board of another self storage company and his experience and

extensive knowledge of the self storage industry. Mr. Langa was selected to serve on our Board because of his experience with and extensive knowledge of commercial real estate transactions, marketing, and management. Mr. Zachary was selected to

serve on our Board because of his prior experience serving on the board of another self storage company and his experience in underwriting finance. Mr. Thomas Winmill, Esq. has experience with finance, accounting, regulatory, investment, and board operational matters as a result of his service as an officer and director for more than 20 years of the Funds. Mr. Mark Winmill was selected to serve on our Board because of his experience and extensive knowledge of the self storage industry and

matters relating to real estate development, finance, accounting, and board operations. Each of the directors has experience with finance,

accounting, regulatory, and board operational matters as a result of his service as a director on our Board and other boards of directors.

EXECUTIVE OFFICERS

The Company’s named executive officers, other than Mr. Mark Winmill who also serves as a director,

and their relevant biographical information are set forth below, based on the information furnished by such executive officer:

Thomas

O’Malley, 60, has served as our Chief Financial Officer, Chief Accounting Officer, Treasurer, and Vice President since 2005. He oversees financial reporting for the Company and assists the Chief Executive Officer in acquiring, developing,

managing, and operating the Company's self storage facility businesses. He is also Chief Financial Officer, Chief Accounting Officer, Treasurer, and Vice President of the Funds, the Advisers, the Broker-Dealers, Bexil, Tuxis, and Winco. He is a

certified public accountant.

Donald

Klimoski II, Esq., 38, has served as our General Counsel, Secretary, Chief Compliance Officer and Vice President since 2017. He oversees Company legal and compliance matters, and assists in acquiring, developing, managing, and operating

the Company’s self storage facility businesses. Mr. Klimoski also serves as General Counsel, Secretary, and Chief Compliance Officer of Winco and Tuxis; and Assistant Secretary, Assistant General Counsel, and Assistant Chief Compliance Officer of

the Funds, the Advisers, and Bexil. Prior to joining the Company, Mr. Klimoski served as the Associate General Counsel of Commvault Systems, Inc. from 2014 to 2017. Prior to leaving private practice, Mr. Klimoski was an associate at Sullivan and

6

Cromwell LLP from 2008 to 2014. Mr. Klimoski began his legal career as a law clerk to the Honorable Freda L. Wolfson of

the United States District Court of New Jersey. He is admitted as a member of the United States Patent and Trademark Office, and the New York and New Jersey State Bars.

EXECUTIVE COMPENSATION

General

Our named executive officers for our 2018 fiscal year are:

|

•

|

Mr. Mark C. Winmill, Chief Executive Officer and President;

|

|

•

|

Mr. Thomas O’Malley, Chief Financial Officer, Treasurer and Vice President; and

|

|

•

|

Mr. Donald Klimoski II, General Counsel, Secretary, Chief Compliance Officer and Vice President.

|

We recognize that the quality, abilities and dedication of our named executive officers are critical

factors that drive the long-term value of the Company. One of the primary objectives of the Compensation Committee is to ensure that the Company provides a competitive and comprehensive compensation program that allows us to attract and retain

qualified and talented individuals who possess the skills and expertise necessary to lead, manage and grow the Company and who are accountable for the performance of the Company. The Compensation Committee, which is comprised entirely of

Independent Directors, has the overall responsibility for monitoring the performance of our named executive officers and evaluating and approving our executive compensation plans, policies and programs.

Historically, the Compensation Committee has designed our compensation program around base salary and

cash bonuses. Base salary is a critical element of executive compensation as it provides such executives with assured monthly cash compensation. Annual cash bonuses are also important to incentivize our executives to achieve short-term corporate

strategic initiatives, to motivate certain desired individual behaviors, and to reward substantial achievement of these objectives and individual goals. In 2017, the Company engaged Willis Towers Watson (“WTW”), a globally recognized compensation

consultant, to advise and provide guidance to the Compensation Committee with respect to its existing executive compensation practices, and also to help develop and implement an executive compensation program for 2018 that incorporates long-term

equity compensation. On March 29, 2018, in consultation with WTW, the Compensation Committee approved initial annual awards under Company’s 2017 Equity Incentive Plan (our “Plan”) to our named executive officers and certain other employees, which

were adjusted on March 27, 2019 to account for the attainment of certain performance goals. On March 27, 2019, in consultation with WTW, the Compensation Committee approved awards under our Plan to our named executive officers and certain other

employees in respect of performance for the fiscal year ending December 31, 2019. See “—Equity Awards” below.

As the Company seeks to implement its growth plan and expand its underlying business, the Compensation

Committee will continue to review and consider our executive compensation program to ensure that the Company provides a compensation program that attracts and retains the best executive talent in a manner that allows us to align the interests of

our named executive officers with those of our stockholders.

Say-on-Pay Voting Results

In connection with our 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”), we conducted extensive outreach

efforts to our stockholders to obtain feedback and seek their support for our proposals. We submitted our executive compensation program to an advisory vote of our stockholders (also known as “Say-on-Pay”). Approximately 90% of voting stockholders

at the 2017 Annual Meeting approved our executive compensation program. In addition, approximately 88% of voting stockholders at the 2017 Annual Meeting approved our Plan. The Compensation Committee considered such strong stockholder support as an

endorsement of the Company’s executive compensation program and policies. The Compensation Committee values the opinions of our stockholders and will continue to consider those opinions when making future executive compensation decisions.

Summary Compensation Table

The following table provides summary information concerning compensation paid or accrued by the Company

to or on behalf of our named executive officers for services provided to the Company during the years ended December 31, 2017 and December 31, 2018. The Company has not granted or paid any option awards, nonequity incentive plan compensation, or

7

nonqualified deferred compensation earnings to any of our named executive officers during the years ended December 31,

2017 and December 31, 2018.

2018 Summary Compensation Table

|

Name and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock Awards (1)

($)

|

All Other

Compensation (2)

($)

|

Total

($)

|

|||||||||||||||||||

|

Mark C. Winmill

|

2018

|

317,000

|

12,192

|

141,992

|

48,580

|

519,764

|

|||||||||||||||||||

|

President and Chief Executive Officer

|

2017

|

297,000

|

11,423

|

—

|

54,366

|

362,789

|

|||||||||||||||||||

|

Thomas O’Malley

|

2018

|

129,066

|

5,512

|

61,438

|

8,162

|

204,178

|

|||||||||||||||||||

|

Chief Financial Officer, Chief Accounting Officer, Treasurer, and Vice President

|

2017

|

126,825

|

5,700

|

—

|

8,079

|

140,604

|

|||||||||||||||||||

|

Donald Klimoski II

|

2018

|

170,610

|

6,888

|

61,438

|

14,801

|

253,737

|

|||||||||||||||||||

|

General Counsel, Secretary, Chief Compliance Officer and Vice President(3)

|

2017

|

53,435

|

1,582

|

—

|

171

|

55,188

|

|||||||||||||||||||

|

(1)

|

Amounts in this column represent the aggregate grant date fair value of such awards computed in accordance with

the Financial Accounting Standards Board Accounting Board’s Accounting Standards Codification Topic 718. The grant date fair values of awards have been determined based on the assumptions and methodologies set forth in our annual report

on Form 10-K for the year ended December 31, 2018 (Note 11, Stock-Based Compensation).

|

|

(2)

|

All Other Compensation for our named executive officers for the year ended December 31, 2018 consisted of:

|

|

Name

|

401 (k)

Match

($)

|

Benefits

($)

|

Auto

Lease and

Insurance

($)

|

Total of

All Other

Compensation

($)

|

||||||||||||

|

Mark C. Winmill

|

6,340

|

22,719

|

19,521

|

48,580

|

||||||||||||

|

Thomas O’Malley

|

7,229

|

933

|

—

|

8,162

|

||||||||||||

|

Donald Klimoski II(3)

|

9,789

|

5,012

|

—

|

14,801

|

||||||||||||

|

(3)

|

Mr. Klimoski’s employment with the

Company commenced on September 5, 2017. Compensation for the year ended December 31, 2017 includes compensation during the period from September 5, 2017 through December 31, 2017.

|

Mr. Mark Winmill’s compensation as Chief Executive Officer and President of the Company is determined

by the Compensation Committee and consists of a salary, bonus, employee benefits, and/or reimbursement of reasonable business expenses. The Compensation Committee reviews and approves corporate goals and objectives relevant to Mr. Winmill’s

compensation, evaluates his performance relative to those goals and objectives, and sets his compensation annually. As of December 31, 2018, Messrs. Winmill, O’Malley, and Klimoski’s compensation plan generally consisted of base salary, employee

benefits plan participation, qualified retirement plan participation, bonuses, stock grants, and certain prerequisites. A portion of Messrs. Winmill, O’Malley, and Klimoski’s compensation may be deferred at their election.

Mr. Mark Winmill’s

compensation is typically determined annually by the Compensation Committee by level of responsibility and tenure at the Company. For 2017 and 2018, the Board directed that non-CEO employee compensation (other than awards under our Plan, which are typically determined annually by the Compensation Committee), including Mr. O’Malley’s and Mr. Klimoski’s, be set based on a general methodology used in

prior years whereby the total level of compensation for each employee that is concurrently employed by the Company and its affiliates is set by Mr. Mark Winmill, as Chief Executive Officer of the Company and Tuxis, and Mr. Thomas Winmill, as

Chief Executive Officer of other affiliates of the Company, and then allocated based on time allocation reports of each such non-CEO employee or other means deemed appropriate by Messrs. Mark and Thomas Winmill.

The primary components of Messrs. Mark Winmill, Thomas O’Malley, and Donald Klimoski’s bonuses are

typically based on, among other things, (i) the number of weeks’ salary paid as bonuses to Company employees generally, and/or (ii) the financial performance of the Company. A subjective component of Messrs. Winmill, O’Malley, and Klimoski’s

bonuses may be based on their overall contribution to management of the Company.

Benefits consist of premiums paid by the Company for medical, dental, vision, life and long term

disability insurances. The Company and its affiliates (as detailed below) participate in a 401(k) retirement savings plan for substantially all qualified

8

employees. A matching expense based upon a percentage of contributions to the plan by eligible employees is incurred and

allocated among the Company and its affiliates. The matching expense is accrued and funded on a current basis and may not exceed the amount permitted as a deductible expense under the Internal Revenue Code of 1986, as amended (the “Code”). The

Company’s allocated matching expense to Messrs. Winmill, O’Malley, and Klimoski under the plan was $6,340, $7,229 and $9,789, respectively, for the year ended December 31, 2018.

The Company currently reimburses monthly automobile expenses of $1,000 per month to its President,

Mark C. Winmill. To the extent that the monthly payment under the Company’s automobile lease exceeds the current monthly reimbursement amount, Mr. Winmill voluntarily reimburses the Company for the excess amount. In this regard, Mr. Winmill has

reimbursed the Company $3,228 for the automobile payments paid and due in 2018.

Equity Awards

On March 29, 2018, in consultation with WTW, the Compensation Committee approved initial annual awards

under our Plan to our named executive officers and certain other employees, which were adjusted on March 27, 2019 to account for the attainment of certain performance goals as further described below. On March 27, 2019, in consultation with WTW,

the Compensation Committee approved awards under our Plan to our named executive officers and certain other employees in respect of performance for the fiscal year ending December 31, 2019, as further described below.

The awards approved on March 29, 2018, consisted of share awards under our Plan in the aggregate amount

of 73,155 shares, of which 15,025 shares were performance-based grants and the remainder of the shares were time-based grants. Mr. Mark Winmill, our Chief Executive Officer and President, Mr. Thomas O’Malley, our Chief Financial Officer, and Mr.

Donald Klimoski II, our General Counsel, received 32,125, 13,900 and 13,900 shares, respectively. With respect to the grants made to Messrs. Winmill, O’Malley and Klimoski, 24,100 of the shares for Mr. Winmill, 10,400 of the shares for Mr. O’Malley

and 10,400 of the shares for Mr. Klimoski vest solely based on continued employment, with 6.25% of the shares eligible to vest on each three-month anniversary of the grant date. These time-based restricted shares entitle the holder to dividends

paid by the Company on shares of its common stock. Further, these time-based restricted share grants were front loaded and represented three years of grants; therefore, no additional time-based grants were made in 2019, and none are currently

expected be made in 2020 to Messrs. Winmill, O’Malley and Klimoski for 2019 and 2020. The remaining 8,025 of the shares for Mr. Winmill, 3,500 of the shares for Mr. O’Malley and 3,500 of the shares for Mr. Klimoski vest based on continued

employment and the achievement of certain adjusted funds from operations (“AFFO”) and same store revenue growth (“SSRG”) goals by the Company during 2018. Between 0% and 200% of these shares were to be earned based on achievement of the AFFO and

SSRG goals in 2018, and the shares which were earned will remain subject to quarterly vesting during the remaining four-year time vesting period. Messrs. Winmill, O’Malley and Klimoski earned a weighted payout percentage of approximately 184% of

such shares based on AFFO and SSRG in 2018. As a result, Mr. Thomas O’Malley, our Chief Financial Officer, and Mr. Donald Klimoski II, our General Counsel, received an additional 6,724, 2,932 and 2,932 shares, respectively, were issued in March

2019 to adjust for such performance attainment. Dividends paid by the Company prior to the determination of how many shares were earned were retained by the Company and released with respect to earned shares.

The awards approved on March 27, 2019, consisted of restricted share awards under our Plan to certain of

our officers and employees in the aggregate amount of 28,755 shares, of which 15,025 shares are performance-based grants and the remainder of the shares are time-based grants. Mr. Mark Winmill, our Chief Executive Officer and President, received

8,025 shares. Mr. Thomas O’Malley, our Chief Financial Officer, and Mr. Donald Klimoski II, our General Counsel, each received 3,500 shares. With respect to the grants made in 2019 to Messrs. Winmill, O’Malley and Klimoski, 8,025 of the shares for

Mr. Winmill and 3,500 of the shares for each of Messrs. O’Malley and Klimoski vest based on continued employment and the achievement of certain AFFO and SSRG goals by the Company during 2019. Between 0% and 200% of these shares will be earned based

on achievement of the AFFO and SSRG goals in 2019, and the shares which are earned will remain subject to quarterly vesting during the remaining four-year time vesting period. Dividends paid by the Company prior to the determination of how many

shares are earned will be retained by the Company and released only with respect to earned shares. If a Change in Control (as defined in our Plan) occurs during 2019, the number of shares earned will equal the greater of the number of shares

granted and the number of shares which would have been earned based on the AFFO and SSRG through the date of the Change in Control.

9

If following a Change in Control, a grantee is terminated by the Company without Cause or by the grantee with Good

Reason (as each is defined in our Plan), all unvested restricted shares will fully vest.

Outstanding Equity Awards at Fiscal Year End 2018

The following table summarizes all outstanding equity awards held by our named executive officers on December 31, 2018.

|

Stock Awards

|

||

|

Name

|

Equity Incentive Plan Awards: Number of Shares or Units of Stock That Have Not Vested (#)

|

Equity Incentive Plan Awards: Market Value of Shares or Units of Stock That Have Not Vested ($)(1)

|

|

Mark C. Winmill

|

||

|

Time Vesting (2)

|

19,581

|

$76,758

|

|

Performance Vesting (3)

|

8,025

|

$31,458

|

|

Thomas O'Malley

|

||

|

Time Vesting (2)

|

8,450

|

$33,124

|

|

Performance Vesting (3)

|

3,500

|

$13,720

|

|

Donald Klimoski II

|

||

|

Time Vesting (2)

|

8,450

|

$33,124

|

|

Performance Vesting (3)

|

3,500

|

$13,720

|

| (1) |

For purposes of this table, the market value of the restricted shares is deemed to be $3.92 per share, the closing price of the common stock reported on

NASDAQ on December 31, 2018 (the last trading day of the year).

|

| (2) |

Represents the unvested restricted shares granted on March 29, 2018 and

outstanding on December 31, 2018, 6.25% of which vest quarterly solely based on the performance of services.

|

| (3) |

Represents the number of unvested restricted shares granted on March 29, 2018 and

outstanding on December 31, 2018 that were eligible to vest at a rate of 6.25% per quarter based on the performances of services and upon attainment of “target” AFFO and SRRG goals in 2018, as described immediately below.

|

The following table sets forth the fiscal year 2018 AFFO and SSRG performance vesting targets for the restricted shares

granted on March 29, 2018 that vest based on continued employment and achievement of AFFO and SSRG goals.

|

Performance Levels

|

|||||||||

|

Performance Measure

|

Weighting

|

Threshold

|

Target

|

Maximum

|

Actual

|

||||

|

AFFO(1)

|

50%

|

$1,601,066

|

$1,728,134

|

$1,855,203

|

$1,982,272

|

$2,109,340

|

$2,236,409

|

$2,363,478

|

$2,281,060

|

|

SSRG(2)

|

50%

|

2.77%

|

3.02%

|

3.27%

|

3.52%

|

3.77%

|

4.02%

|

4.27%

|

7.73%

|

|

Payout Percentage:

|

0%

|

50%

|

75%

|

100%

|

125%

|

150%

|

200%

|

184%(3)

|

|

|

Name

|

Performance Level Share Amounts

|

||||||||

|

Mark C. Winmill

|

0

|

4,013

|

6,019

|

8,025

|

10,031

|

12,038

|

16,050

|

14,749

|

|

|

Thomas O’Malley

|

0

|

1,750

|

2,625

|

3,500

|

4,375

|

5,520

|

7,000

|

6,432

|

|

|

Donald Klimoski II

|

0

|

1,750

|

2,625

|

3,500

|

4,375

|

5,520

|

7,000

|

6,432

|

|

| (1) |

In the event AFFO falls between shown points, the payout percentage for the AFFO shares is determined using a straight line linear interpolation.

|

| (2) |

In the event SSRG falls between shown points, the payout percentage for the SSRG shares is determined using a straight line linear interpolation.

|

| (3) |

Reflects the weighted payout percentage for the AFFO shares and the SSRG shares.

|

For 2018, the Company’s AFFO was $2,281,060 and SSRG was 7.73%, which, with each weighted equally, resulted in vesting of

184% of the target number of performance vesting restricted shares (a total of 14,749, 6,432 and 6,432 shares for Messrs. Winmill, O’Malley and Klimoski, respectively). As of March 31, 2019, twenty-five percent of these shares were vested and the

remainder will vest quarterly in 6.25% increments based on continued employment.

Chief Executive Officer Employment Agreement

On March 29, 2018, the Company entered into an employment agreement with its Chief Executive Officer

and President, Mr. Mark Winmill.

The employment agreement has an initial term of three years and is subject to automatic one-year

extensions thereafter, unless either party provides at least 90 days’ notice of non-renewal.

10

The employment agreement provides for:

|

|

a minimum monthly base salary of $26,416;

|

|

|

eligibility for an annual cash performance bonus based on the satisfaction of performance goals established by the

Board or the Compensation Committee;

|

|

|

participation in benefit plans applicable generally to executive officers; and

|

|

|

reimbursement of reasonable out-of-pocket expenses, such as automobile lease expenses.

|

The employment agreement provides that, if Mr. Winmill’s employment is terminated by the Company

without “cause” or by Mr. Winmill for “good reason” (each as defined in the employment agreement), or as a result of the Company’s notice of non-renewal of the employment term, Mr. Winmill will be entitled to the following severance payments and

benefits, subject to the execution and non-revocation of a general release of claims:

|

|

accrued but unpaid base salary, bonus and other benefits earned and accrued but unpaid prior to the date of

termination;

|

|

|

an amount equal to three times the sum of Mr. Winmill’s annual base salary plus the greater of the average annual

bonus received by Mr. Winmill with respect to the two years prior to the year of termination and Mr. Winmill’s “target” annual bonus; and

|

|

|

continued health benefits (including for Mr. Winmill’s dependents) for twenty-four months following termination.

|

In the event Mr. Winmill’s employment terminates by reason of his death or disability he or his estate

shall receive:

|

|

accrued but unpaid base salary, bonus and other benefits earned and accrued but unpaid prior to the date of

termination;

|

|

|

a prorated annual bonus for the year in which the termination occurs; and

|

|

|

continued health benefits (including for Mr. Winmill’s dependents) for twenty-four months following termination.

|

The employment agreement contains standard confidentiality provisions, which apply indefinitely, and

both non-competition and non-solicitation of employees and customers covenants, which apply during the term of employment and for a period of twelve months thereafter.

Equity Compensation Plan Information

Our Plan is designed to provide equity-based incentives to certain eligible persons, as defined in our Plan, in the form

of options, share appreciation rights, restricted shares, restricted share units, dividend equivalent rights or other forms of equity-based compensation as determined in the discretion of the Board, the Compensation Committee, or other designee

thereof. For additional information about our Plan, see “–2017 Equity Incentive Plan” below.

The following table presents certain equity compensation plan information as of December 31, 2018:

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans

|

||||||||||||

|

Equity compensation plans approved by security holders

|

—

|

—

|

645,502

|

|||||||||||

|

Equity compensation plans not approved by security holders

|

—

|

—

|

—

|

|||||||||||

|

Total

|

—

|

—

|

645,502

|

|||||||||||

2017 Equity Incentive Plan

On October 16, 2017, our stockholders approved our Plan.

11

The purpose of our Plan is to provide us with the flexibility to use stock options and other

equity-based awards to provide a means of performance-based compensation.

Key employees, directors, officers, advisors, consultants, and other personnel of ours and our

subsidiaries, and other persons expected to provide significant services to us or our subsidiaries, are eligible to be granted incentive and nonqualified share options, share appreciation rights, restricted shares, restricted share units, dividend

equivalent rights, and other forms of equity-based compensation under our Plan.

The Compensation Committee has the authority to administer and interpret our Plan, to authorize the

granting of awards to eligible participants, to determine the eligibility of eligible participants to receive an award, to determine the number of shares of common stock to be covered under each award agreement, considering the position and

responsibilities of the eligible participants, the nature and value to us of the eligible participants’ present and potential contribution to our success, whether directly or through our subsidiaries, and such other factors as the Compensation

Committee may deem relevant, to approve the form of award agreement, to determine the terms applicable to each award, which may differ among individual awards and participants, and may include performance goals, to extend at any time the period in

which options or share appreciation rights may be exercised, provided that such awards cannot have a term longer than 10 years, to determine the extent to which the transferability of shares issued or transferred pursuant to an award is restricted,

to decide all disputes arising in connection with our Plan, and to take any other actions, make all other determinations that it deems necessary or appropriate, and otherwise supervise the administration of our Plan.

Our Plan has been administered by a Compensation Committee consisting of two or more non-employee

directors, each of whom is intended to be, to the extent required by Rule 16b-3 under the Exchange Act, a non-employee director and will, at such times as we are subject to Section 162(m) of the Code, qualify as an "outside director" for purposes

of Section 162(m) of the Code.

Subject to adjustment upon certain corporate transactions or events, a maximum of 760,000 shares of

common stock may be subject to share options, share appreciation rights, restricted shares, restricted share units, dividend equivalent rights, and other forms of equity-based compensation awards under our Plan. If an option or other award granted

under our Plan is cancelled, expires or terminates, the shares that expire or terminate without having been exercised or paid, as the case may be, will again become available for the issuance of additional awards. In addition, shares subject to any

restricted share unit, dividend equivalent right or other equity-based award (other than share options and share appreciation rights) that are settled in cash will again become available for the issuance of additional awards. Furthermore, awards

granted in substitution, assumption, continuation or adjustment of awards remaining available for grant under our Plan pursuant to a change in control or other corporate transaction will not count against the number of shares remaining available

for issuance under our Plan. The shares available under a stockholder-approved plan of an entity acquired by us will be available for awards granted to individuals who were not employees of ours immediately before such acquisition, and will not

count against the number of shares remaining available for issuance under our Plan. Unless previously terminated by our Board, no new award may be granted under our Plan after October 16, 2027.

CORPORATE GOVERNANCE

Code of Conduct and Ethics

We have adopted a Code of Conduct and Ethics in compliance with rules of the SEC that applies to all of our personnel,

including our Board, Chief Executive Officer and Chief Financial Officer. The Code of Conduct and Ethics is available free of charge on the “Governance Documents” section of our website at www.GlobalSelfStorage.us. We intend to satisfy any disclosure requirements under Item 5.05 of Form 8-K regarding amendments to, or waivers from, provisions of our Code of Conduct and Ethics by posting such

information on our web site at the address specified above.

Director Independence

The Nasdaq Listing Rules generally require that a majority of the members of a listed company’s board of directors be

independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and governance committees be independent.

Accordingly, the Board has evaluated the independence of its members based upon the rules of Nasdaq and the SEC and the

transactions referenced under “Certain Relationships and Related Party Transactions” in this Proxy Statement. Applying these standards, the Board determined that none of the directors who currently serve, other than Messrs. Mark and Thomas Winmill,

have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that Messrs. Burke, Langa and Zachary are “independent” as that term is defined under Rule 5605(a)(2) of the

Nasdaq Listing Rules. Messrs. Mark and Thomas Winmill are not considered independent because they are officers of the Company and/or its

12

affiliates. The Board also determined that each non-employee director who serves as a member of the Audit, Compensation and Nominating

Committees satisfies the independence standards for such committee established by the SEC and the Nasdaq Listing Rules, as applicable.

Current Board Leadership Structure and Oversight Responsibilities

The Board is responsible for the oversight of the Company’s operations. The Board is currently