FIRST AMENDMENT TO LOAN DOCUMENTS

This First Amendment to Loan

Documents (this “Amendment”), dated as of July 6, 2021 (the “Effective Date”),

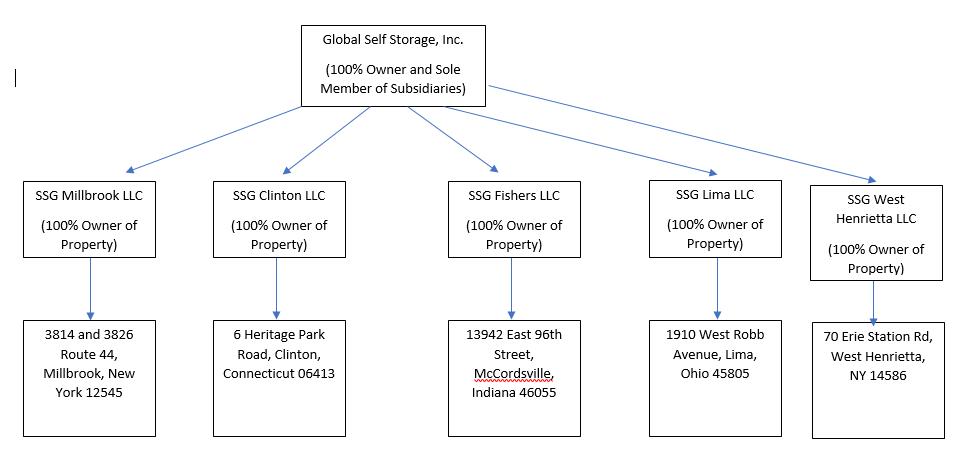

is by and among SSG MILLBROOK LLC, a New York limited liability company (“SSG Millbrook”), SSG CLINTON LLC, a New York limited liability company (“SSG Clinton”), SSG FISHERS LLC, a Delaware limited liability company (“SSG Fishers”), and SSG LIMA LLC, a Delaware limited liability company

(collectively, “Original Borrowers”), SSG WEST HENRIETTA LLC,

a Delaware limited liability company ( “New Borrower”, and together with the Original Borrowers, “Borrower”), GLOBAL SELF STORAGE, INC., a Maryland corporation (“Guarantor”), and THE

HUNTINGTON NATIONAL BANK, successor by merger to TCF National Bank (“Lender”).

RECITALS

A. Original Borrowers obtained a loan from Lender (the “Loan”) pursuant to the terms of a Revolving Credit Loan Agreement dated December 20, 2018 (the “Loan Agreement”).

The Loan is evidenced by a Promissory Note dated December 20, 2018 in the maximum principal amount of $10,000,000.00 (the “Note”) and secured by certain Mortgages encumbering the Property.

B. Original Borrowers’ obligations under the Loan Documents are guaranteed by Guarantor pursuant to a Guaranty of Payment dated December 20, 2018 (the “Guaranty”).

C. Original Borrowers and Guarantor are also parties to an Environmental Indemnity Agreement dated December 20, 2018 with respect to the Property (the “Environmental Indemnity”).

D. The Loan Agreement, the Note, the Mortgages, the Guaranty, the Environmental Indemnity, and all other documents evidencing, securing, or otherwise governing the Loan, as they

may have been amended or modified, are referred to herein collectively as the “Loan Documents.”

E. New Borrower owns real property and Improvements thereon commonly known as 70 Erie Station Road, West Henrietta, New York 14586 and desires to join in and assume the Loan as a

co-borrower and pledge the same as additional collateral for the Loan, on the terms and conditions set forth in this Amendment.

F. To accommodate this request, Borrower, Guarantor and Lender desire to modify the Loan on the terms and conditions set forth in this Amendment.

AGREEMENTS

In consideration of the mutual promises, covenants, and conditions set forth herein, the parties hereto hereby

agree as follows:

1. TERMINOLOGY. The terms used in this Amendment

shall have the same meanings as in the Loan Agreement, unless a different meaning is assigned herein or is required by the context hereof.

2. NEW BORROWER ASSUMPTION AND JOINDER. New

Borrower hereby (a) joins in and assumes the Loan as a co-borrower with Original Borrowers and agrees to pay the unpaid balance due and owing under the Loan Documents, together with interest thereon, all in accordance with the terms of the Loan

Documents, and (b) agrees to perform all of the other obligations of Original Borrowers under the Loan Agreement, the Note and the Environmental Indemnity Agreement, and be bound by, comply with and perform each and every other covenant, condition,

agreement, representation, warranty, waiver, consent, acknowledgment and obligation of Original Borrowers under the Loan Agreement, the Note and the Environmental Indemnity Agreement with the same force and effect as if New Borrower itself had

jointly executed and delivered the Loan Agreement, the Note and the Environmental Indemnity Agreement with Original Borrowers. The execution and delivery hereof shall not constitute a novation of the indebtedness evidenced by the Loan Documents or

a modification or amendment of any covenant of the Original Borrowers under the Loan Documents. The foregoing assumption by New Borrower is absolute and unconditional.

3. AMENDMENTS TO LOAN DOCUMENTS. Upon satisfaction of all of the Conditions of Effectiveness (defined below), the following amendments shall take effect:

3.1 Loan Amount. The Loan Agreement shall be

amended and modified to increase the Loan Amount to $15,000,000.00. Any and all references in the Loan Documents to the maximum principal amount of the Loan shall be and mean $15,000,000.00. As of the Effective Date, the Principal Balance equals

$5,144,000.00, which leaves $9,856,000.00 of Loan Proceeds available for disbursement in accordance with Section 4 of the Loan Agreement and as limited by Section 2.7(c) of the Loan Agreement as modified by Section 3.4 of this Amendment.

3.2 New Defined Terms. The following definitions

are hereby added to Section 1.2 of the Loan Agreement:

“Indemnified Party” means each of Lender and its officers, members, directors, officials, employees, attorneys, agents, successors and assigns.

“SSG West Henrietta” means SSG WEST HENRIETTA LLC, a Delaware limited liability company.

“West Henrietta Land” means the real estate legally described on Exhibit A-1 attached hereto and commonly known as

70 Erie Station Road, West Henrietta, New York 14586.

3.3 Revised Defined Terms. The following

definitions contained in Section 1.2 of the Loan Agreement, and all references to such terms in the Loan Agreement, the Guaranty, and the Environmental Indemnity are hereby deleted in their entirety and replaced with the following:

“Assignment of Leases” means collectively the (i) Assignment of Rents and Leases with respect to Leases of the Connecticut Land and any applicable Improvements (the “Connecticut ALR”), (ii) Assignment of Rents and Leases with respect to Leases of the Indiana Land and any applicable

2

Improvements (the “Indiana ALR”),

(iii) Assignment of Rents and Leases with respect to Leases of the New York Land and any applicable Improvements (the “New York ALR”), (iv) Assignment of Rents

and Leases with respect to Leases of the Ohio Land and any applicable Improvements (the “Ohio ALR”), all dated December 20, 2018, and (v) Assignment of Rents

and Leases with respect to Leases of the West Henrietta Land and any applicable Improvements (the “West Henrietta ALR”), dated as of July 6, 2021, all of which

have been executed by the applicable Borrower in favor of Lender.

“Borrower” means, individually and collectively, SSG MILLBROOK, LLC and SSG CLINTON, LLC, each a New York limited liability company, SSG FISHERS LLC, SSG LIMA LLC and SSG West HENRIETTA LLC, each a Delaware limited liability

company.

“Connecticut Land” means the real estate legally described on Exhibit A attached hereto and commonly known as 6

Heritage Park Road, Clinton, Connecticut 06413.

“Guarantor’s Financial Covenants” means the requirement that until the Loan is repaid in full:

(a) the Guarantor owns solely in its own name Liquid Assets having a

value of not less than $1,000,000.00, determined annually on December 31, 2021 and thereafter semi-annually on June 30 and December 31;

(b) the Guarantor maintains a Total Liabilities to Total Equity Ratio

of not greater than 1.00 to 1.00, determined annually on December 31; and

(c) the Guarantor maintains an Interest Coverage Ratio of not less than

1.75 to 1.00, determined annually on December 31.

“Guaranty” means, collectively, all guaranties required pursuant to this Agreement and all guaranties pursuant to which any Person now or hereafter partially or fully guarantees the payment or performance of any Obligations to

Lender under any Loan Document, and currently means the Amended and Restated Guaranty of Payment dated as of even date herewith given by Guarantor in favor of Lender.

“Indiana Land” means the real estate legally described on Exhibit A attached hereto and commonly known as 13942 E.

96th Street, McCordsville, Indiana 46055.

“Land” means collectively the Connecticut Land, the Indiana Land, the New York Land, the Ohio Land and the West Henrietta Land.

“Loan Amount” means up to $15,000,000.00.

3

“Maturity Date” means July 6, 2024.

“Mortgage” means collectively the (i) Open-End Mortgage, Security Agreement, Fixture Filing and Assignment of Leases and Rents with respect to the Connecticut Land and any applicable Improvements (the “Connecticut Mortgage”), (ii) Mortgage, Security Agreement, Fixture Filing and Assignment of Leases and Rents with respect to the Indiana Land and any applicable Improvements (the “Indiana Mortgage”), (iii) Mortgage, Security Agreement, Fixture Filing and Assignment of Leases and Rents with respect to the New York Land and any applicable

Improvements (the “New York Mortgage”), (iv) Open-End Mortgage, Security Agreement, Fixture Filing and Assignment of Leases and Rents with respect to the Ohio

Land and any applicable Improvements (the “Ohio Mortgage”), all dated December 20, 2018, and (v) Mortgage, Security Agreement, Fixture Filing and Assignment of

Leases and Rents with respect to the West Henrietta Land and any applicable Improvements dated as of July 6, 2021 (the “West Henrietta Mortgage”), all of which

have been executed by the applicable Borrower in favor of Lender.

“New York Land” means the real estate legally described on Exhibit A attached hereto and commonly known as 3814

Route 44 and 3826 Route 44, Millbrook, New York 12545.

“Note” means that certain Amended and Restated Promissory Note in the stated aggregate principal amount of $15,000,000.00 dated as of July 6, 2021, made by Borrower and payable to the order of Lender.

“Ohio Land” means the real estate legally described on Exhibit A attached hereto and commonly known as Tax Parcel

36-2311-01-022.000 (Tracts I – III only), Lima, Ohio 45805.

“Operating Agreement” means collectively that certain (i) Operating Agreement with respect to SSG Millbrook, dated as of April 5, 2017, (ii) Operating Agreement with respect to SSG Clinton, dated as of April 5, 2017, (iii)

Operating Agreement with respect to SSG Fishers, dated as of December 30, 2016, (iv) Operating Agreement with respect to SSG Lima, dated as of December 30, 2016, and (v) Operating Agreement with respect to SSG West Henrietta, dated as of October 15,

2019, as each of the same may be amended from time to time.”

3.4 Loan Reduction. Section 2.7(c) of the Loan

Agreement is hereby deleted in its entirety and replaced with the following:

“(c) Notwithstanding anything to the contrary herein or in any of the other Loan Documents, if, on July 6, 2022 (the “First Reduction Date”), the Principal Balance is in excess of $14,750,000.00, Borrower shall, within five (5) days after notice from Lender sent following the

First Reduction

4

Date, make a payment to Lender or authorize Lender to make a withdrawal from

Borrower’s account in an amount sufficient to reduce the Principal Balance to no more than $14,750,000.00. Thereafter, the amount of Loan Proceeds shall not exceed $14,750,000.00. Notwithstanding anything to the contrary herein or in any of the

other Loan Documents, if, on July 6, 2023 (the “Second Reduction Date”), the Principal Balance is in excess of $14,500,000.00, Borrower shall, within five

(5) days after notice from Lender sent following the Second Reduction Date, make a payment to Lender or authorize Lender to make a withdrawal from Borrower’s account in an amount sufficient to reduce the Principal Balance to no more than

$14,500,000.00. Thereafter, the amount of Loan Proceeds shall not exceed $14,500,000.00.”

3.5 Permitted Uses. Section 2.10(a) of the Loan

Agreement is hereby deleted in its entirety and replaced with the following:

“(a) Loan Proceeds may be used for the following lawful purposes, (i) to satisfy costs related

to the acquisition of self-storage properties by any Guarantor subsidiary, including, but not limited to earnest money deposits, environmental reports, property condition

reports, appraisals, attorney fees (associated with such acquisitions), and acquisition price (collectively “Self-Storage Property Acquisition Costs”), (ii) to satisfy construction costs incurred to (A) convert to self-storage any non-self storage portions of the Property and other real property owned by Guarantor’s

wholly-owned subsidiaries, or (B) expand the Property (as further set forth in Section 11 below) and other real property owned by Guarantor’s wholly-owned subsidiaries, provided, however, that Loan Proceeds used for construction costs as set forth in this subsection (ii) shall not exceed $7,500,000.00 at any

time, or (iii) to make equity contributions necessary to fulfill the co-invest requirements or pay organizational and transactional costs of any joint ventures entered into with respect to the acquisition of self-storage properties.

Notwithstanding anything herein to the contrary, Loan Proceeds shall not be used to fund dividends, operating losses, stock buy-backs, executive or employee compensation, other capital maneuvers, or any other expenses not expressly permitted under

this Section 2.10(a).”

3.6 Organization and Existence. Section 5.1(a) of

the Loan Agreement is hereby deleted in its entirety and replaced with the following:

“(a) Organization and Existence. Each

Borrower is duly organized and validly existing as a limited liability company in good standing under the laws of the State of (i) New York, with respect to SSG Millbrook and SSG Clinton, and (ii) Delaware, with respect to SSG Fishers, SSG Lima and

SSG West Henrietta, and is qualified to do business in the state of its formation and in all other jurisdictions in which such Borrower is transacting business, as applicable.”

5

3.7 Existence and Control. Section 7.1 of the Loan

Agreement is hereby deleted in its entirety and replaced with the following:

“7.1 Existence and Control. Each Borrower

shall maintain its existence as a limited liability company in good standing under the laws of the State of (i) New York, with respect to SSG Millbrook and SSG Clinton, and (ii) Delaware, with respect to SSG Fishers, SSG Lima and SSG West

Henrietta. Each Borrower shall at all times be qualified to do business in the State of (w) New York, with respect to SSG Millbrook and SSG West Henrietta, (x) Connecticut with respect to SSG Clinton, (y) Indiana, with respect to SSG Fishers, and

(z) Ohio, with respect to SSG Lima, and in all other jurisdictions in which Borrower is transacting business, as applicable. At all times prior to the repayment of the Loan, Mark C. Winmill and Thomas O’Malley shall collectively constitute the

Manager of Borrower unless and until one or both of the foregoing shall cease to serve as a Manager under the applicable Operating Agreement(s).”

3.8 West Henrietta Land Legal Description. Exhibit A-1 attached to this Amendment shall be incorporated into and become a part of Exhibit A to the Loan Agreement.

3.9 Environmental Indemnity. Exhibit A-1 attached to this Amendment shall be incorporated into and become a part of Exhibit A to the Environmental Indemnity. The West Henrietta Land shall be deemed part of the “Real Property” as defined in the Environmental Indemnity, and all collateral covered by the

West Henrietta Mortgage shall be deemed to be part of the “Property” as defined in the Environmental Indemnity. Beginning on the Effective Date, Borrower, Guarantor and Lender intend for the West Henrietta Land and Improvements thereon to be

covered under the Environmental Indemnity, to the full extent as the other Real Property and Property defined in the Environmental Indemnity at Closing. The following environmental study regarding the West Henrietta Land is hereby added to Exhibit B of the Environmental Indemnity: Phase I Environmental Site Assessment dated May, 2021, prepared by Leader Professional Services,

Inc., Project No. 1055.001 (the “Environmental Report”).

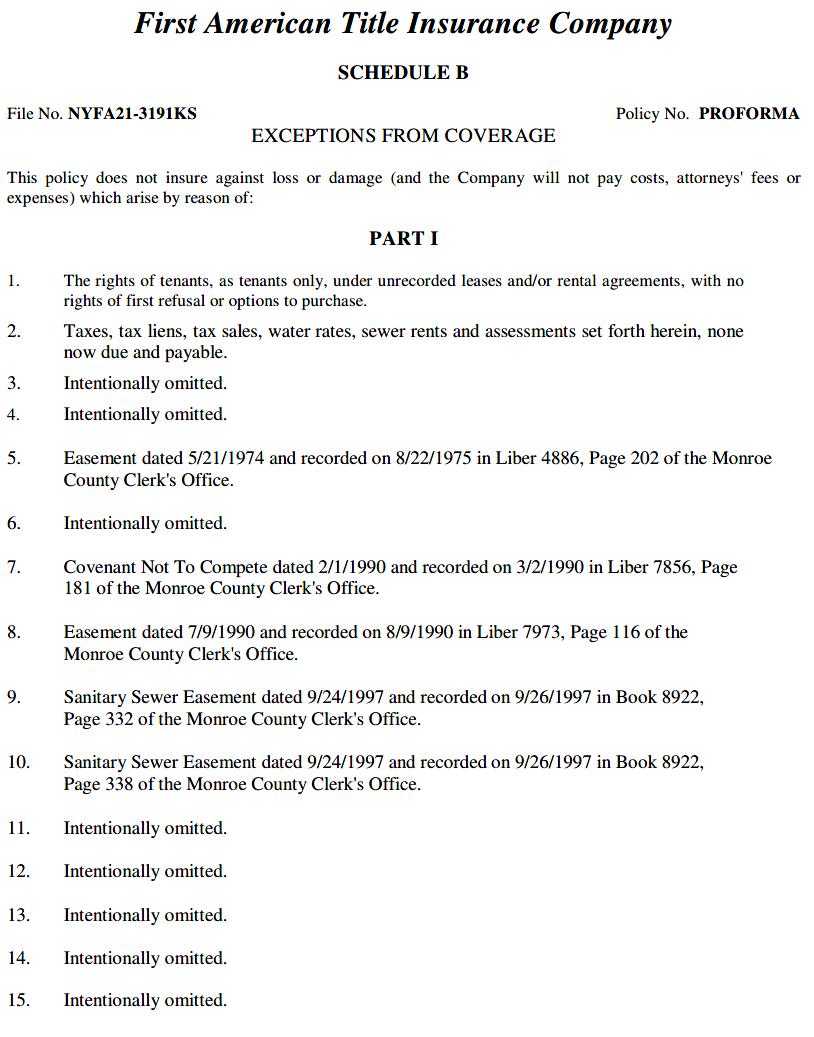

3.10 Permitted Encumbrances. Exhibit B-1 attached to this Amendment shall be incorporated into and become a part of Exhibit B to the Loan Agreement

3.11 Loan Documents. Exhibit C to the Loan Agreement is hereby deleted in its entirety and replaced with Replacement Exhibit C to this Amendment.

3.12 Compliance Certificates. Exhibit E and Exhibit F to the

Loan Agreement are hereby deleted in their entireties and replaced with Replacement Exhibit E and Replacement Exhibit F to this Amendment, respectively.

3.13 Organizational Chart. Exhibit H to the Loan Agreement is hereby deleted in its entirety and replaced with Replacement Exhibit H to this Amendment.

3.14 Address. Borrower’s principal place of

business and notice address for the purposes of Section 5.10 and Section 12.5 of the Loan Agreement, as well as the notice address for Borrower and Guarantor set forth in any other Loan Document, is hereby updated as follows

6

“Global Self Storage, Inc.

3814 Route 44

Millbrook, NY 12545

Attn: Mark C. Winmill”

Any “With copy to” address set forth in the Loan Documents shall remain unchanged.

4. NEW NOTE. Concurrently herewith, Borrower will

execute an Amended and Restated Promissory Note payable to Lender in the amount of $15,000,000.00 (the “New Note”). Any and all references in the Loan

Documents to the “Note” shall be and mean the New Note.

5. NEW GUARANTY. Concurrently herewith, Guarantor

will execute an Amended and Restated Guaranty of Payment for the benefit of Lender (the “New Guaranty”). Any and all references in the Loan Documents to the

“Guaranty” shall be and mean the New Guaranty.

6. AMENDMENTS TO MORTGAGES. Concurrently herewith,

Borrower will execute a first amendment to each of the Mortgages, other than the West Henrietta Mortgage, modifying those instruments to secure Borrower’s obligations under the Loan Documents, as amended hereby (the “Amendments to the Mortgages”).

7. CONDITIONS OF EFFECTIVENESS.

7.1 Notwithstanding its execution by all parties, the foregoing amendments shall become effective only upon satisfaction of all of the following “Conditions of Effectiveness”:

7.1.1 No Defaults. Borrower and Guarantor are in

full compliance with all of their covenants and agreements under the Loan Documents, and there is no Default or Event of Default under the Loan Documents.

7.1.2 Modification Fee. Borrower shall have paid

to Lender a modification and origination fee in the amount of $45,000.00.

7.1.3 Title Updates. Lender has obtained, at

Borrower’s expense, such new title policy or modification, date down, or other endorsements to Lender’s existing Title Policy as Lender may require to insure the continued validity of each Mortgage and its first lien priority on the Property over

all encumbrances other than the Permitted Encumbrances and other exceptions approved by Lender in writing. Borrower and Guarantor understand that the amendments set forth herein shall not be effective or binding upon Lender in any respect until the

required policy or endorsements have been issued in a form satisfactory to Lender.

7.1.4 Resolutions. Borrower and Guarantor shall

have delivered to Lender resolutions certified by an appropriate representative authorizing the execution and delivery of the this Amendment, the New Note, the New Guaranty, the Amendments to the Mortgages and any and all documents necessary to

effectuate this Amendment or otherwise required by Lender.

7.1.5 Good Standings. Borrower shall have

delivered to Lender updated certificates of good standing for each Borrower and Guarantor from their respective states of

7

formation and a certificate of good standing or existence for each Borrower from the state in which the Land owned by

such Borrower is located.

7.1.6 Execution and Recording of Documents.

Borrower and Guarantor, as applicable, have executed any and all documents necessary to effectuate this Amendment or otherwise reasonably required by Lender, including the Amendments to the Mortgages, the New Note, the New Guaranty and a UCC

financing statement for New Borrower, and such documents have been filed or recorded, where necessary.

7.1.7 West Henrietta Documents. New Borrower

shall have executed and/or delivered to Lender those of the following documents and other items required to be executed and/or delivered by New Borrower with respect to the West Henrietta Land, and shall cause to be executed and/or delivered to

Lender those of the following documents and other items required to be executed and/or delivered by others, all of which documents and other items shall contain such provisions as shall be required to conform to the Loan Documents and this

Amendment and otherwise shall be reasonably satisfactory in form and substance to Lender:

7.1.7.1 Loan Documents. Fully executed, if necessary, original copies of each of the following

Loan Documents: (i) West Henrietta Mortgage; (ii) Assignment of Rents and Leases; and (iii) UCC-1 Financing Statement.

7.1.7.2 Title Insurance Policy. A Title Policy issued by the Title Company in the full amount

of the Loan naming Lender as the insured party and New Borrower as the owner and fee simple title holder of the West Henrietta Land, in each case subject only to the Permitted Encumbrances, and insuring the lien of the applicable Mortgage as a

first and prior lien upon the West Henrietta Land, subject to no exceptions other than the Permitted Encumbrances and other exceptions approved by Lender in writing. The Title Policy must specifically insure Lender for claims and questions related

to claims for mechanics’ or materialmen’s liens and shall include such available endorsements as are reasonably satisfactory to Lender.

7.1.7.3 Survey. A Survey of the West Henrietta Land no older than ninety (90) days, which

Survey must be prepared by a registered land surveyor in accordance with the 2016 survey standards of the American Land Title Association and National Society of Professional Surveyors. The Survey shall be certified to Borrower, Lender and the

Title Company. The Survey shall include such information as may be required by the Title Company to provide survey coverage in the Title Policy.

7.1.7.4 Insurance Policies. Certificates of insurance for all insurance policies required

pursuant to Section 9 of the Loan Agreement, or at Lender’s request copies of the insurance policies.

7.1.7.5 Environmental Report. The Environmental Report described in Section 3.9 above.

7.1.7.6 Appraisal. An “as is” Appraisal showing that the Loan Amount, as increased by this

Amendment, does not exceed sixty percent (60%) of the “as-is” value of the Property, including the West Henrietta Land and Improvements thereon.

8

7.1.7.7 Documents of Record. Copies of all covenants, conditions, restrictions, easements and

matters of record which affect the West Henrietta Land.

7.1.7.8 Searches. Current Uniform Commercial Code, federal and state tax lien and judgment

searches, pending suit and litigation searches and bankruptcy court filings searches covering the New Borrower and disclosing no matters objectionable to Lender.

7.1.7.9 Flood Plain. Evidence that (i) adequate flood insurance is in effect for the West

Henrietta Land; and (ii) no portion of the West Henrietta Land is located in a federally, state or locally designated wetland or other type of government protected area.

7.1.7.10 Attorney’s Opinion. An opinion of one or more counsel for New Borrower.

7.1.7.11 Organizational Documents. A certified copy (certified, where applicable, by the state

office in which such documents were filed, and in all other cases by an appropriate representative of the entity) of the following documents for the New Borrower: (i) the duly executed Limited Liability Company Agreement; (ii) the Certificate of

Formation; (iii) resolutions authorizing the execution and delivery of the Loan Documents by New Borrower, certified by an appropriate representative; (iv) an incumbency certificate, including specimen signatures for all individuals executing any

of the Loan Documents, certified by the secretary or other appropriate representative; (v) certificates of good standing from the States of Delaware and New York; and (vi) all other instruments and documents concerning the formation and existence

of New Borrower, and the execution and delivery of the Loan Documents by the New Borrower and Guarantor, reasonably required by the Lender.

7.1.7.12 Real Estate Taxes. Evidence that real estate taxes due and payable with respect to the

West Henrietta Land, if any, have been paid in full. In connection therewith, Borrower shall deliver to Lender copies of the most recent real estate tax bills for the West Henrietta Land.

7.1.7.13 Financial Statements. All financial information reasonably requested by Lender with

respect to Borrower, including New Borrower, and Guarantor, including but not limited to the most recent annual financial statements for Guarantor.

7.1.7.14 Property Reports. If available, inspection and zoning reports on the Improvements

located on the West Henrietta Land.

7.1.7.15 Leasing Documentation. A certified Occupancy Report and Standard Lease Form with

respect to the West Henrietta Land.

7.1.7.16 Additional Documents. Such other papers and documents regarding Borrower, Guarantor

and the Property as Lender may reasonably require, including, without limitation, an updated Survey of the New York Land and Improvements thereon and a true, correct and complete copy of Guarantor’s current bylaws.

7.2 The Conditions of Effectiveness are intended solely for Lender’s benefit and may, at Lender’s election and in its sole discretion be enforced, fully

or partially waived, or

9

transformed into covenants of Borrower to be performed following effectiveness of the foregoing amendments upon Lender’s

subsequent written notice and demand.

8. LIEN PRIORITY. The Property shall remain and

continue in all respects subject to the Security Instruments and nothing in this Amendment or done pursuant to this Amendment or the Amendments to the Mortgages shall affect or be construed to affect Lender’s first-lien priority with respect to the

Property.

9. REPRESENTATIONS AND WARRANTIES. Borrower and

Guarantor hereby acknowledge, represent, warrant, and agree as follows:

9.1 The Recitals set forth above are true and accurate.

9.2 New Borrower is the fee simple owner of the West Henrietta Land, and Lender has not assumed, and does not hereby assume, control of the West Henrietta

Land.

9.3 To the actual knowledge of Borrower and Guarantor, there is no Default or Event of Default under the Loan Documents.

9.4 All necessary steps required by Lender have been taken to perfect Lender’s interest in the Property as security for the Loan, and the Mortgages are,

and shall continue to be, a first and paramount lien against the Property securing Borrower’s obligations under the Loan Documents, as amended hereby and by any related documents executed by Borrower in connection herewith. To the actual knowledge

of Borrower and Guarantor, there are no liens, charges, or encumbrances against the Property that are now or may hereafter become prior to the Mortgages.

9.5 All information provided in New Borrower’s beneficial ownership certification is true, complete, and correct in all material respects as of the date

thereof.

9.6 All documents and other information requested by Lender from Borrower and Guarantor as a condition to entering into this Amendment are, to Borrower’s

actual knowledge, true, complete, and accurate in all material respects.

9.7 The New Guaranty is and shall remain fully binding and enforceable in accordance with its terms as to Borrower’s obligations under the Loan, as

amended hereby. Guarantor’s obligations under the New Guaranty are and shall continue to be entirely separate and independent from the obligations of Borrower under the Loan Documents.

9.8 Borrower and Guarantor acknowledge that Lender is relying on the warranties, representations, releases, and agreements of Borrower and Guarantor in

this Amendment, and would not enter into this Amendment or agree to modify the Loan Documents without such warranties, representations, releases, and agreements.

10. RELEASE. Borrower and Guarantor agree that

Lender has not breached any of its obligations under the Loan Documents, and Borrower and Guarantor have no claims against Lender, its predecessors, successors, assigns, or participants, or any of their officers, directors, agents, employees, and

other affiliates (collectively, the “Released Parties”) for fraud, misrepresentation, lender misconduct, lender liability, breach of alleged fiduciary duty,

or other

10

tort or wrongdoing. Borrower and Guarantor hereby release and forever discharge the Released Parties of and from any and all claims, causes

of action, rights of offset, and rights to damages that Borrower or Guarantor has or may have, or may be entitled to assert, against the Released Parties for any reason whatsoever by reason of any actions, events, or occurrences prior to the date

of this Amendment, except for Borrower’s rights to enforce Lender’s further obligations under the Loan Documents, as amended hereby. The provisions, waivers, and releases set forth in this section are binding upon Borrower and Guarantor and their

respective agents, employees, representatives, officers, directors, partners, members, joint venturers, affiliates, assigns, heirs, successors-in-interest and shareholders. Neither Borrower nor Guarantor have any claims, defenses, counterclaims, or

rights of offset against any of the Released Parties arising out of or in any way connected with the Loan.

11. PAYMENT OF LENDER’S EXPENSES. In addition to

Borrower’s payment of the modification fee set forth above, Borrower agrees to reimburse Lender for all reasonable out-of-pocket expenses incurred by Lender in connection with the drafting, negotiation, execution, and delivery of this Amendment and

all related documents, including, without limitation, reasonable attorneys’ fees and costs incurred by Lender, premiums for any new Title Policy or endorsements to Lender’s existing Title Policy, appraisal fees, recording charges, escrow fees, and

any other reasonable costs.

12. EFFECT ON LOAN DOCUMENTS. This Amendment shall

be sufficient to serve as an amendment to all of the Loan Documents, as appropriate. This Amendment supersedes and shall control over any inconsistent provisions of the Loan Documents, or any previous extensions or other amendments of the Loan

Documents. Except as amended herein, the Loan Documents shall remain in full force and effect as written, and the provisions of the Loan Documents shall remain unaffected, unchanged, and unimpaired hereby.

13. AUTHORIZATION/BINDING EFFECT. Each of Borrower

and Guarantor warrants and represents that the execution and delivery of this Amendment by Borrower and Guarantor, respectively, was duly authorized by all individuals or entities whose authorization was required for this Amendment to be effective.

This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, personal representatives, successors, and assigns.

14. APPLICABLE LAW. This Amendment shall be

construed in all respects and enforced according to the laws of the State of Illinois, without regard to that state’s choice of law rules.

15. WAIVER OF CONSEQUENTIAL DAMAGES. To the

fullest extent permitted by applicable law, no Party shall assert, and each Party hereby waives, any claim against any Indemnified Party, on any theory of liability, for special, indirect, consequential or punitive damages (as opposed to direct or

actual damages) arising out of, in connection with, or as a result of, this Agreement, any other Loan Document or any agreement or instrument contemplated hereby, the transactions contemplated hereby or thereby, any Loan or the use of the proceeds

thereof.

11

16. COUNTERPARTS. The parties may execute this

Amendment in any number of counterparts, each of which shall be deemed an original instrument but all of which together shall constitute one and the same instrument.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

12

IN WITNESS WHEREOF, Borrower, Guarantor and Lender have executed this Amendment as of the day and year first above

written.

BORROWER:

SSG MILLBROOK LLC,

a New York limited liability company

By:/s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

SSG CLINTON LLC,

a New York limited liability company

By: /s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

SSG FISHERS LLC,

a Delaware limited liability company

By: /s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

SSG LIMA LLC,

a Delaware limited liability company

By: /s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

SSG WEST HENRIETTA LLC,

a Delaware limited liability company

By: /s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

GUARANTOR:

GLOBAL SELF STORAGE, INC.,

a Maryland corporation

By: /s/ Donald Klimoski II

Name: Donald Klimoski II

Title: General Counsel

(Signatures continue on the following page)

LENDER:

THE HUNTINGTON NATIONAL BANK,

successor by merger to TCF National Bank

| By: |

/s/ James Straka

James Straka, Assistant Vice President |

(End of signatures)

EXHIBIT A-1

WEST HENRIETTA LAND LEGAL DESCRIPTION

ALL that tract or parcel of land, situate in Town Lot 24, 6th Range of Lots, Township 12, Range 7, Phelps and Gorham Purchase, Town of

Henrietta, County of Monroe, State of New York, and being more particularly bounded and described as follows:

Commencing at a point on the easterly highway boundary of East River Road, County Road 84, as established by N.Y.S.D.P.W. Appropriation

Map No. 708, Parcel No. 709 for the Ontario Thruway, Monroe County, District No. 4, dated June 18, 1951; said point being at the intersection with the common line dividing lands now or formerly of John and Rhonda Ernst on the north and lands now or

formerly of Riverton Plaza Associates on the south; thence,

A. N 86° 38’ 27” E, along said common line, a distance of 293.89 feet to a point; thence,

B. N 87° 32’ 35” E, along the common line dividing lands now or formerly of 150 Erie Station Road, LLC on the north and the

aforementioned lands of Riverton Plaza Associates on the south, a distance of 282.68 feet to the POINT OF BEGINNING of the hereinafter described parcel; thence,

1. N 87° 32’ 35” E, along the common line dividing said lands of 150 Erie Station Road, LLC on the north and lands now or formerly of

Conifer Riverton Associates on the south, a distance of 347.84 feet to a point; thence,

2. S 02° 31’ 17” E, along the common line dividing lands now or formerly of Richard J. Szustakowski on the east and said lands of Conifer

Riverton Associates on the west, a distance of 626.84 feet to the point of intersection with the northerly Right-of-Way line of Erie Station Road, N.Y.S. Route 253; thence,

3. S 87° 28’ 43” W, along said northerly Right-of-Way line of Erie Station Road, a distance of 405.41 feet to a point; thence,

4. N 16° 28’ 43” E, along the common line dividing lands now or formerly of the Martin/Brinnenstool Cemetery on the west and the

aforementioned lands of Conifer Riverton Associates on the east, a distance of 435.82 feet to a point; thence,

5. S 87° 28’ 43” W, along the last mentioned common line, a distance of 158.40 feet to a point; thence,

6. N 16° 28’ 43” E, along the common line dividing the aforementioned lands of Riverton Plaza Associates on the west and the

aforementioned lands of Conifer Riverton Associates on the east, a distance of 227.55 feet to the POINT OF BEGINNING.

Intending to describe lands contained in Lot 2 of the Riverton Plaza Subdivision filed in the Monroe County Clerk’s Office in Liber 263

of Maps at Page 6

A-1

EXHIBIT B-1

WEST HENRIETTA PERMITTED ENCUMBRANCES

B-1

REPLACEMENT EXHIBIT C

LOAN DOCUMENTS

The instruments and documents required to be executed, acknowledged (if necessary for recording) and delivered to

Lender, in each case in form and content satisfactory to Lender, as conditions precedent to Closing and modifying the Loan pursuant to that certain First Amendment to Loan Documents, are as follows:

|

1.

|

Loan Agreement

|

|

2.

|

First Amendment to Loan Documents

|

|

3.

|

Amended and Restated Promissory Note

|

|

4.

|

New York Mortgage, and First Amendment thereto

|

|

5.

|

Connecticut Mortgage, and First Amendment thereto

|

|

6.

|

Indiana Mortgage, and First Amendment thereto

|

|

7.

|

Ohio Mortgage, and First Amendment thereto

|

|

8.

|

West Henrietta Mortgage

|

|

9.

|

New York ALR

|

|

10.

|

Connecticut ALR

|

|

11.

|

Indiana ALR

|

|

12.

|

Ohio ALR

|

|

13.

|

West Henrietta ALR

|

|

14.

|

Amended and Restated Guaranty of Payment

|

|

15.

|

Environmental Indemnity Agreement

|

|

16.

|

UCC-1 Financing Statement with respect to SSG Millbrook

|

|

17.

|

UCC-1 Financing Statement with respect to SSG Clinton

|

|

18.

|

UCC-1 Financing Statement with respect to SSG Fishers

|

|

19.

|

UCC-1 Financing Statement with respect to SSG Lima

|

|

20.

|

UCC-1 Financing Statement with respect to SSG West Henrietta

|

Replacement Exhibit C

REPLACEMENT EXHIBIT E

FORM OF BORROWER COVENANT COMPLIANCE CERTIFICATE

THIS BORROWER

COVENANT COMPLIANCE CERTIFICATE (this “Certificate”) is executed and delivered pursuant to and in accordance with Section 7.5(e) of that certain Revolving Credit Loan Agreement (as amended, modified, extended or restated from time to time, the “Loan Agreement”) dated as of December 20, 2018, as amended by a First Amendment to Loan Documents dated July 6, 2021, among SSG MILLBROOK LLC, a New York limited liability company (“SSG Millbrook”), SSG CLINTON LLC, a New York limited liability company (“SSG Clinton”), SSG FISHERS LLC, a Delaware limited liability company (“SSG Fishers”), SSG LIMA LLC, a Delaware limited liability company (“SSG Lima”),

and SSG WEST HENRIETTA LLC, a Delaware limited liability company (“SSG

West Henrietta”; SSG Millbrook, SSG Clinton, SSG Fishers, SSG Lima and SSG West Henrietta are individually, collectively, jointly and severally and together with each of their permitted successors and assigns referred to herein as “Borrower”) and THE HUNTINGTON NATIONAL BANK, successor by

merger to TCF National Bank (the “Lender”). All capitalized terms used in this Certificate, if not otherwise defined herein, shall have the respective

meanings assigned to such terms under the Loan Agreement.

The undersigned hereby represents and warrants to Lender as follows:

1. Authority. The undersigned is a duly authorized officer of Borrower.

2. Review. The undersigned has reviewed (a) the activities of Borrower during the

calendar period ending __________________, 20______ (the “Subject Fiscal Period”), (b) the financial condition of Borrower as of the last day of the Subject

Fiscal Period, and (c) the Loan Agreement and all of the other documents, instruments and agreements executed by Borrower in connection with the Loan Agreement (collectively, the “Loan Documents”).

3. Compliance. Based upon my review of the financial condition of Borrower, the Loan

Documents, and the other information and documents described in Paragraph 2 above, (a) Borrower has observed, performed and fulfilled the obligations and covenants, and Borrower and the Property each is in full and complete compliance with the

requirements, contained in the Loan Agreement and the other Loan Documents, and (b) as of the end of the Subject Fiscal Period and of the date hereof, no Default or Event of Default has occurred.

4. Financial Statements. The financial statements of the Borrower delivered herewith (i)

were prepared in accordance with GAAP applied on a consistent basis or in accordance with such other principles or methods as are reasonably acceptable to Lender, (ii) fairly present Borrower’s financial condition, (iii) show all material

liabilities, direct and contingent, (iv) fairly present the results of Borrower’s operations, and (v) disclose the existence of any hedge and/or off-balance sheet transactions.

5. Financial Condition. The financial information of Borrower

that the undersigned has attached hereto as Schedule 1 demonstrates Borrower’s compliance with the financial covenants set forth in Section 8.9 of the Loan Agreement. All of such financial information is true

Replacement Exhibit E

and correct as of the last day of the Subject Fiscal Period (unless another date or a specific time period is stated).

[remainder of page left blank]

Replacement Exhibit E

Dated: _____________________, 20____

BORROWER:

SSG MILLBROOK LLC,

a New York limited liability company

By:

Name:

Title:

SSG CLINTON LLC,

a New York limited liability company

By:

Name:

Title:

SSG FISHERS LLC,

a Delaware limited liability company

By:

Name:

Title:

SSG LIMA LLC,

a Delaware limited liability company

By:

Name:

Title:

SSG WEST HENRIETTA LLC,

a Delaware limited liability company

By:

Name:

Title:

Replacement Exhibit E

SCHEDULE 1 TO BORROWER COVENANT COMPLIANCE CERTIFICATE

ACTUAL DEBT SERVICE COVERAGE RATIO (SECTION 8.9):

|

1.

|

NOI: $__________________

|

|

(a)

|

Operating Revenues: $_________________

|

|

(b)

|

Operating Expenses: $________________

|

|

2.

|

Applied Debt Service: $________________

|

|

3.

|

Debt Service Coverage Ratio: ________ to 1.00

|

All information required in support of such calculation is attached hereto.

Replacement Exhibit E

REPLACEMENT EXHIBIT F

FORM OF GUARANTOR COVENANT COMPLIANCE CERTIFICATE

THIS GUARANTOR

COVENANT COMPLIANCE CERTIFICATE (this “Certificate”) is executed and delivered pursuant to and in accordance with (a) Section 7.5(e) of that certain Loan Agreement (as amended, modified, extended or restated from time to time, the “Loan Agreement”) dated as of December 20, 2018, as amended by a First Amendment to Loan Documents dated July 6, 2021, among SSG

MILLBROOK LLC, a New York limited liability company (“SSG Millbrook”), SSG CLINTON LLC, a New York limited liability company (“SSG Clinton”), SSG FISHERS LLC, a Delaware Indiana limited liability company (“SSG Fishers”), SSG LIMA LLC, a Delaware limited liability company (“SSG Lima”), and SSG WEST HENRIETTA LLC, a Delaware limited

liability company (“SSG West Henrietta”; SSG Millbrook, SSG Clinton, SSG Fishers, SSG Lima and SSG West Henrietta are individually, collectively, jointly and

severally and together with each of their permitted successors and assigns referred to herein as “Borrower”), and THE HUNTINGTON NATIONAL BANK, successor by merger to TCF National Bank (“Lender”), and (b) that

certain Amended and Restated Guaranty of Payment dated as of July 6, 2021 by Guarantor in favor of Lender (the “Guaranty”). All capitalized terms used in this

Certificate, if not otherwise defined herein, shall have the respective meanings assigned to such terms in the Guaranty.

The undersigned hereby represents and warrants to Lender as follows:

1. Authority. The undersigned is a duly authorized officer of the Guarantor.

2. Review. The undersigned has reviewed (a) the financial condition of Borrower and

Guarantor during the calendar period ending December 31, 20__ (the “Subject Fiscal Period”), and (b) the Guaranties, the Loan Agreement, and the other Loan

Documents.

3. Financial Statements. The financial statements of each Guarantor (1) were prepared in

accordance with GAAP applied on a consistent basis or in accordance with such other principles or methods as are reasonably acceptable to Lender, (2) fairly present such Guarantor’s financial condition, (3) show all material liabilities, direct and

contingent, (4) fairly present the results of such Guarantor’s operations, and (5) disclose the existence of any hedge and/or off-balance sheet transactions. All of such financial information is true and correct as of the last day of the Subject

Fiscal Period (unless another date or a specific time period is stated).

4. Compliance. Based upon my review of the financial condition of the Guarantor, the

Loan Agreement, Guaranties and other Loan Documents, and the other information and documents described in Paragraph 2 above, Guarantor has observed, performed and fulfilled the obligations and covenants of Guarantor contained in the Guaranties, the

Loan Agreement and the other Loan Documents through the date hereof, and Guarantor is in compliance with Guarantor’s Financial Covenants set forth in the Loan Agreement and the Guaranties with respect to the Subject Fiscal Period, including, but

not limited to, the following:

|

(a)

|

the Guarantor owns solely in its own name Liquid Assets having a value of not less than $1,000,000.00,

determined annually on December 31, 2021 and thereafter semi-annually on June 30 and December 31;

|

Replacement Exhibit F

|

(b)

|

the Guarantor maintains a Total Liabilities to Total Equity Ratio of not greater than 1.00 to 1.00,

determined annually on December 31; and

|

|

(c)

|

the Guarantor maintains an Interest Coverage Ratio of not less than 1.75 to 1.00, determined annually on

December 31.

|

All information required in support of such calculation is attached

hereto.

Replacement Exhibit F

Dated: _____________________, 20____

GUARANTOR:

GLOBAL SELF STORAGE, INC.,

a Maryland corporation

By:

Name:

Title:

Replacement Exhibit F

REPLACEMENT EXHIBIT H

ORGANIZATIONAL CHART