|

*

|

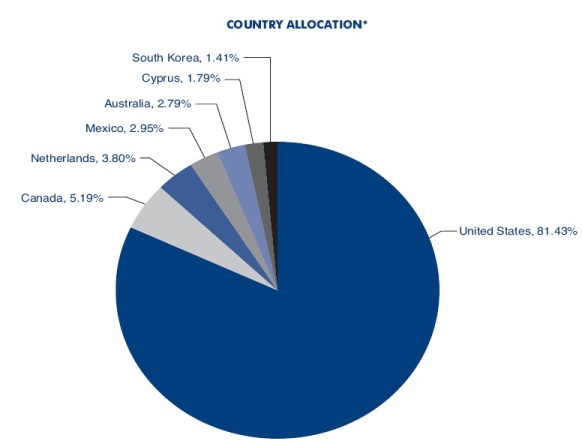

Country allocation and portfolio analysis use approximate percentages of net assets and may not add up to 100% due to leverage or other assets, rounding, and other factors. Ratings are not a guarantee of credit quality and may change. U.S. allocation may include closed end funds that may invest in foreign securities.

|

|

**

|

May include allocation to closed end funds that may invest in securities denominated in foreign currencies.

|

|

***

|

Non-bond investments include closed end funds that may invest in bonds, including non-investment grade “junk bonds” rated <BBB. |

| |

|

|

GLOBAL INCOME

|

|

|

FUND

|

Ticker: GIFD

|

| |

|

|

11 Hanover Square, New York, NY 10005

www.GlobalIncomeFund.net

|

|

July 21, 2011

Dear Shareholders:

It is a pleasure to submit this 2011 Semi-Annual Report for Global Income Fund and to welcome our new shareholders who find the Fund’s quality approach attractive. As a reminder, the primary and fundamental objective of the Fund is to provide a high level of income. The Fund’s secondary, non-fundamental investment objective is capital appreciation. The Fund currently pursues its investment objectives by investing primarily in closed end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities.

Global Economic Report

While the global economy is no longer in crisis, according to a recent report of the World Bank, economic activity in developing countries has recently slowed due to the earthquake and tsunami in Japan and political turmoil in the Middle East and North Africa. Possibly, economic activity has further dampened by uncertainty over the ongoing sovereign debt crisis in Europe and the debt ceiling impasse in the United States. Interestingly, the World Bank forecasts global growth to remain strong from 2011 through 2013, strengthening from 3.2% in 2011 to a 3.6% pace in each of 2012 and 2013.

In the United States, economic activity in the manufacturing sector expanded in June for the 23rd consecutive month, but non-manufacturing declined, indicating a slowing of service sector growth, according to the Institute of Supply Management. In keeping its target rate to a range of between 0% and 0.25% -- which has been in effect since December 2008 -- the U.S. Federal Reserve Open Market Committee (FOMC) noted at its June meeting that recent economic data had been weaker than expected and expressed caution about the likely pace of improvement in the economy over coming quarters. Specific concerns of the FOMC were recent increases in the prices of food and energy (with annualized general inflation recently over 3%), damped consumer spending and sentiment, the pace of business investment and hiring, unemployment, and the depressed housing sector. Slowing growth appears to be leading to a jobless recovery in the United States. In the recent quarter, real personal income and spending weakened and the number of Americans working in full time jobs is actually down slightly from June 2010. Other economic indicators in the second quarter also generally weakened, and the Federal Reserve recently reduced current and future quarterly GDP estimates.

In contrast, China’s GDP was reported by the National Bureau of Statistics to have grown 9.5% in the second quarter of 2011 over the same quarter last year. China’s industrial production growth in June was likewise reported to have risen at a blistering 15.1% rate from a year earlier, but inflation has apparently exceeded a 6% annualized rate. European growth is more subdued, according to Eurostat. In May 2011, compared with May 2010, industrial production increased by 4.0% in the Euro area, while annual inflation was a modest 2.7% in June 2011. Japan has been decidedly lagging, as its GDP actually contracted 0.9% in the first quarter of 2011 over the previous quarter. Indeed, from 1980 until 2010, Japan's average quarterly GDP growth has been estimated at only 0.55%.

Global Allocation Strategy

Given this slowing economic environment, the Fund’s strategy in the first half of 2011 included investing its assets primarily in closed end funds that invest significantly in income producing securities and a global portfolio of investment grade fixed income securities denominated in major world currencies and issued by organizations across many countries. At June 30, 2011, holdings of closed end funds and closed end fund business development companies comprised approximately 76% of the Fund’s investments. In its global portfolio of fixed income securities, the Fund held securities of sovereign nations, corporations, and other organizations based in the United States, Canada, Netherlands, Mexico, Australia, Cyprus, and South Korea.

Of the Fund’s net assets, approximately 86% were denominated in U.S. dollars, 6% in euros, 6% in Australian dollars, and 1% in Canadian dollars (adding up to 99% due to leverage), although it should be noted that some of the closed end funds owned by Global Income Fund may own securities denominated in foreign currencies. In the first six months of 2011, the Fund had a net asset value return per share of 7.42% on a market price return per share for the period of 4.07%, reflecting an increased market price discount to net asset value. Recently, the Fund’s net asset value per share was $5.26 and its share closing market price was $4.30. While investment return and value will vary and shares of the Fund may subsequently be worth more or less than their original cost, this represents an opportunity for investors to purchase the Fund’s shares at a discount to their underlying net asset value.

Distribution Policy

Under the current managed distribution policy, distributions of approximately 5% of the Fund’s net asset value per share on an annual basis are paid primarily from net investment income and any net realized capital gains, with the balance representing return of capital. In the first six months of 2011, distributions paid totaled $0.13 per share. As of the date of this letter, the majority, and possibly all, of these distributions are comprised of net investment income and represent net income earned by the Fund in fiscal 2011 and 2010. This is an estimate based on information available at this time and is subject to change. Actual amounts may be re-characterized for tax purposes after the Fund’s fiscal year end. In the beginning of the year, shareholders should receive information concerning the taxable status of the dividend distributions that were paid to shareholders of record in the 12 months ended December 31. The estimated components of each quarterly distribution that include a potential return of capital are provided to shareholders of record in a notice accompanying the distributions. For those shareholders currently receiving the Fund’s quarterly dividends in cash but are interested in adding to their account through the Fund’s Dividend Reinvestment Plan, we encourage you to review the Plan set forth later in this document and contact the Transfer Agent, who will be pleased to assist you with no obligation on your part.

Long Term Strategies

Our review of the markets indicates that the Fund has benefited from its quality portfolio strategy of investing in closed end funds that invest significantly in income producing securities and income producing investments in multiple currencies. A long term strategy for investors seeking income and, secondarily, capital appreciation may include the consideration income in other types of asset classes, however, when appropriate in view of and proportional to the perceived and acceptable risks. As always, we are grateful to the Fund’s long standing shareholders for their continuing support.

| |

Sincerely, |

| |

|

| |

Thomas B. Winmill

President

|

SCHEDULE OF PORTFOLIO INVESTMENTS (UNAUDITED)

JUNE 30, 2011

|

Shares

|

|

|

|

Cost

|

|

|

Value

|

|

| |

|

CLOSED END FUNDS (57.99%)

|

|

|

|

|

|

|

| |

|

United States

|

|

|

|

|

|

|

| |

135,000 |

|

AllianceBernstein Income Fund, Inc

|

|

$ |

1,061,384 |

|

|

$ |

1,065,150 |

|

| |

118,418 |

|

Alpine Global Premier Properties Fund

|

|

|

733,054 |

|

|

|

851,426 |

|

| |

100,000 |

|

BlackRock Credit Allocation Income Trust I, Inc

|

|

|

908,295 |

|

|

|

938,000 |

|

| |

90,000 |

|

BlackRock Credit Allocation Income Trust III, Inc

|

|

|

1,019,233 |

|

|

|

975,600 |

|

| |

104,900 |

|

BlackRock Income Trust, Inc

|

|

|

609,177 |

|

|

|

738,496 |

|

| |

120,932 |

|

Calamos Strategic Total Return Fund

|

|

|

1,070,518 |

|

|

|

1,157,319 |

|

| |

74,325 |

|

Cohen & Steers Infrastructure Fund, Inc

|

|

|

1,010,410 |

|

|

|

1,322,985 |

|

| |

618,268 |

|

DCA Total Return Fund

|

|

|

1,639,933 |

|

|

|

2,349,418 |

|

| |

217,521 |

|

First Trust Strategic High Income Fund III

|

|

|

941,176 |

|

|

|

983,195 |

|

| |

54,000 |

|

Gabelli Dividend & Income Trust (a)

|

|

|

898,496 |

|

|

|

898,020 |

|

| |

151,547 |

|

Helios Advantage Income Fund, Inc

|

|

|

940,921 |

|

|

|

1,256,325 |

|

| |

66,801 |

|

Lazard World Dividend & Income Fund, Inc.

|

|

|

761,833 |

|

|

|

922,522 |

|

| |

28,964 |

|

LMP Capital & Income Fund Inc.

|

|

|

291,440 |

|

|

|

397,386 |

|

| |

94,045 |

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend

|

|

|

|

|

|

|

|

|

| |

|

|

& Income Fund

|

|

|

1,112,892 |

|

|

|

1,503,780 |

|

| |

64,646 |

|

Macquarie Global Infrastructure Total Return Fund Inc

|

|

|

1,054,415 |

|

|

|

1,200,476 |

|

| |

62,000 |

|

Nuveen Diversified Dividend and Income Fund

|

|

|

618,254 |

|

|

|

708,040 |

|

| |

93,000 |

|

Nuveen Multi-Strategy Income & Growth Fund 2

|

|

|

830,218 |

|

|

|

850,020 |

|

| |

59,477 |

|

RMR Real Estate Fund

|

|

|

808,673 |

|

|

|

1,969,878 |

|

| |

20,000 |

|

Source Capital, Inc.

|

|

|

1,088,630 |

|

|

|

1,148,800 |

|

| |

62,159 |

|

Western Asset Global Corporate Defined Opportunity Fund Inc

|

|

|

1,110,759 |

|

|

|

1,167,346 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total closed end funds

|

|

|

18,509,711 |

|

|

|

22,404,182 |

|

|

Principal

|

|

|

|

|

|

|

|

|

|

Amount (b)

|

|

|

|

|

|

|

|

|

| |

|

DEBT SECURITIES (18.28%)

|

|

|

|

|

|

|

| |

|

Australia (2.79%)

|

|

|

|

|

|

|

| $ |

A500,000 |

|

Telstra Corp. Ltd., 6.25% Senior Notes, due 4/15/15

|

|

|

365,869 |

|

|

|

531,463 |

|

| $ |

A500,000 |

|

Telstra Corp. Ltd., 7.25% Senior Notes, due 11/15/12 (a)

|

|

|

380,969 |

|

|

|

547,175 |

|

| |

|

|

|

|

|

746,838 |

|

|

|

1,078,638 |

|

| |

|

|

Canada (5.19%)

|

|

|

|

|

|

|

|

|

| $ |

C500,000 |

|

Molson Coors Capital Finance, 5.00% Guaranteed Notes,

|

|

|

|

|

|

|

|

|

| |

|

|

due 9/22/15 (a)

|

|

|

447,996 |

|

|

|

549,865 |

|

| $ |

A1,350,000 |

|

Province of Ontario, 5.50% Euro Medium Term Notes, due 7/13/12 (a)

|

|

|

1,040,992 |

|

|

|

1,453,370 |

|

| |

|

|

|

|

|

1,488,988 |

|

|

|

2,003,235 |

|

| |

|

|

Cyprus (1.79%)

|

|

|

|

|

|

|

|

|

| |

€500,000 |

|

Republic of Cyprus, 4.375% Euro Medium Term Notes, due 7/15/14

|

|

|

619,481 |

|

|

|

689,977 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Mexico (2.95%)

|

|

|

|

|

|

|

|

|

| |

1,000,000 |

|

United Mexican States, 5.625% Notes, due 1/15/17 (a)

|

|

|

986,170 |

|

|

|

1,141,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Netherlands (3.80%)

|

|

|

|

|

|

|

|

|

| |

€1,000,000 |

|

ING Bank N.V., 5.50% Euro Medium Term Notes, due 1/04/12

|

|

|

1,294,671 |

|

|

|

1,468,742 |

|

|

See notes to financial statements.

|

|

GLOBAL INCOME FUND, INC.

|

SCHEDULE OF PORTFOLIO INVESTMENTS (UNAUDITED) (CONTINUED)

|

Principal

|

|

|

|

|

|

|

|

|

|

Amount

|

|

|

|

Cost

|

|

|

Value

|

|

| |

|

DEBT SECURITIES (continued)

|

|

|

|

|

|

|

| |

|

South Korea (1.41%)

|

|

|

|

|

|

|

| |

500,000 |

|

Korea Development Bank, 5.75% Notes, due 9/10/13 (a)

|

|

$ |

504,120 |

|

|

$ |

545,096 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

United States (0.35%)

|

|

|

|

|

|

|

|

|

| |

169,405 |

|

CIT RV Trust 1998-A B 6.29% Subordinated Bonds, due 1/15/17 (a)

|

|

|

171,953 |

|

|

|

136,277 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total debt securities

|

|

|

5,812,221 |

|

|

|

7,063,465 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

CLOSED END FUND BUSINESS DEVELOPMENT

|

|

|

|

|

|

|

|

|

|

Shares

|

|

COMPANIES (17.25%)

|

|

|

|

|

|

|

|

|

| |

|

|

United States

|

|

|

|

|

|

|

|

|

| |

116,000 |

|

American Capital, Ltd

|

|

|

1,146,277 |

|

|

|

1,151,880 |

|

| |

12,500 |

|

Capital Southwest Corp

|

|

|

1,165,713 |

|

|

|

1,153,375 |

|

| |

110,000 |

|

MCG Capital Corp

|

|

|

662,176 |

|

|

|

668,800 |

|

| |

101,500 |

|

MVC Capital, Inc

|

|

|

980,236 |

|

|

|

1,342,845 |

|

| |

134,232 |

|

NGP Capital Resources Co

|

|

|

966,581 |

|

|

|

1,100,702 |

|

| |

60,598 |

|

Saratoga Investment Corp

|

|

|

1,270,962 |

|

|

|

1,248,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total closed end fund business development companies

|

|

|

6,191,945 |

|

|

|

6,665,921 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

PREFERRED STOCKS (1.93%)

|

|

|

|

|

|

|

|

|

| |

|

|

United States

|

|

|

|

|

|

|

|

|

| |

4,000 |

|

BAC Capital Trust II, 7.00%

|

|

|

100,000 |

|

|

|

100,520 |

|

| |

25,000 |

|

Corporate-Backed Trust Certificates, 8.20% (Motorola)

|

|

|

625,000 |

|

|

|

645,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total preferred stocks

|

|

|

725,000 |

|

|

|

746,020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

MONEY MARKET FUND (3.91%)

|

|

|

|

|

|

|

|

|

| |

|

|

United States

|

|

|

|

|

|

|

|

|

| |

1,511,409 |

|

SSgA Money Market Fund, 7 day annualized yield 0.01%

|

|

|

1,511,409 |

|

|

|

1,511,409 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total investments (99.36%)

|

|

$ |

32,750,286 |

|

|

|

38,390,997 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Other assets in excess of liabilities (0.64%)

|

|

|

|

|

|

|

244,259 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Net assets (100.00%)

|

|

|

|

|

|

$ |

38,635,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Fully or partially pledged as collateral on bank credit facility. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

The principal amount is stated in U.S. dollars unless otherwise indicated. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Currency Symbols |

|

|

|

|

|

|

|

|

| |

|

|

A$ Australian Dollar |

|

|

|

|

|

|

|

|

| |

|

|

C$ Canadian Dollar |

|

|

|

|

|

|

|

|

| |

|

|

€ Euro |

|

|

|

|

|

|

|

|

|

GLOBAL INCOME FUND, INC.

|

|

See notes to financial statements.

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

|

|

STATEMENT OF OPERATIONS |

|

|

|

| June 30, 2011 (Unaudited) |

|

|

|

Six Months Ended June 30, 2011 (Unaudited)

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

INVESTMENT INCOME

|

|

|

|

|

Investments, at value (cost: $32,750,286 )

|

|

$ |

38,390,997 |

|

Dividends

|

|

$ |

921,562 |

|

|

Cash

|

|

|

5,030 |

|

Interest

|

|

|

168,680 |

|

|

Receivables

|

|

|

|

|

Total investment income |

|

|

1,090,242 |

|

|

Interest.

|

|

|

200,719 |

|

|

|

|

|

|

|

Dividends

|

|

|

162,602 |

|

|

|

|

|

|

|

Other assets

|

|

|

4,779 |

|

EXPENSES

|

|

|

|

|

|

Total assets

|

|

|

38,764,127 |

|

Investment management

|

|

|

132,451 |

|

| |

|

|

|

|

Legal

|

|

|

54,018 |

|

| |

|

|

|

|

Administrative services

|

|

|

23,775 |

|

|

LIABILITIES

|

|

|

|

|

Bookkeeping and pricing

|

|

|

20,690 |

|

|

Payables

|

|

|

|

|

Auditing

|

|

|

11,635 |

|

|

Accrued expenses

|

|

|

97,881 |

|

Shareholder communications

|

|

|

11,429 |

|

|

Investment management

|

|

|

21,896 |

|

Directors

|

|

|

7,835 |

|

|

Administrative services

|

|

|

9,094 |

|

Custodian

|

|

|

4,485 |

|

|

Total liabilities

|

|

|

128,871 |

|

Insurance

|

|

|

4,344 |

|

| |

|

|

|

|

Transfer agent

|

|

|

3,000 |

|

| |

|

|

|

|

Interest and fees on bank credit facility

|

|

|

2,054 |

|

|

NET ASSETS

|

|

$ |

38,635,256 |

|

Other

|

|

|

1,418 |

|

| |

|

|

|

|

Total expenses |

|

|

277,134 |

|

|

NET ASSET VALUE PER SHARE

|

|

|

|

|

Net investment income

|

|

|

813,108 |

|

|

(applicable to 7,413,974 shares

|

|

|

|

|

|

|

|

|

|

|

outstanding: 20,000,000 shares of $.01

|

|

|

|

|

|

|

|

|

|

|

par value authorized)

|

|

$ |

5.21 |

|

|

|

|

|

|

| |

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

|

|

|

|

|

|

NET ASSETS CONSIST OF

|

|

|

|

|

Net realized gain (loss)

|

|

|

|

|

|

Paid in capital

|

|

$ |

33,279,379 |

|

Investments

|

|

|

1,300,807 |

|

|

Accumulated undistributed net investments

|

|

|

|

|

Foreign currencies

|

|

|

(25,764 |

) |

|

income

|

|

|

(20,846 |

) |

Net unrealized appreciation (depreciation)

|

|

|

|

|

|

Accumulated net realized loss on

|

|

|

|

|

Inve stments

|

|

|

434,720 |

|

|

investments and foreign currencies

|

|

|

(272,597 |

) |

Translation of assets and liabilities

|

|

|

|

|

|

Net unrealized depreciation on

|

|

|

|

|

in foreign currencies

|

|

|

(3,081 |

) |

|

investments and foreign currencies

|

|

|

5,649,320 |

|

Net realized and unrealized gain |

|

|

1,706,682 |

|

| |

|

$ |

38,635,256 |

|

Net change in net assets

|

|

|

|

|

| |

|

|

|

|

resulting from operations

|

|

$ |

2,519,790 |

|

|

See notes to financial statements.

|

|

GLOBAL INCOME FUND, INC.

|

STATEMENTS OF CHANGES IN NET ASSETS

(Unaudited)

| |

|

Six Months

Ended

June 30, 2011

|

|

|

Year

Ended

December 31,

2010

|

|

|

OPERATIONS

|

|

|

|

|

|

|

|

Net investment income

|

|

$ |

813,108 |

|

|

$ |

1,470,996 |

|

|

Net realized gain

|

|

|

1,275,043 |

|

|

|

2,459,454 |

|

|

Change in unrealized appreciation

|

|

|

431,639 |

|

|

|

1,945,253 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase in net assets resulting from operations

|

|

|

2,519,790 |

|

|

|

5,875,703 |

|

| |

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS

|

|

|

|

|

|

|

|

|

|

Distributions from ordinary income ($0.13 and $0.22 per share, respectively)

|

|

|

(963,634 |

) |

|

|

(1,630,219 |

) |

| |

|

|

|

|

|

|

|

|

|

CAPITAL SHARE TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

Reinvestment of distributions to shareholders (1,879 and 3,212 shares, respectively)

|

|

|

7,981 |

|

|

|

12,144 |

|

| |

|

|

|

|

|

|

|

|

|

Total increase in net assets

|

|

|

1,564,137 |

|

|

|

4,257,628 |

|

| |

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

|

|

|

|

|

|

|

|

Beginning of period

|

|

|

37,071,119 |

|

|

|

32,813,491 |

|

| |

|

|

|

|

|

|

|

|

|

End of period

|

|

$ |

38,635,256 |

|

|

$ |

37,071,119 |

|

| |

|

|

|

|

|

|

|

|

|

End of period net assets include undistributed net investment income (loss)

|

|

$ |

(20,846 |

) |

|

$ |

129,680 |

|

| |

|

|

O |

|

|

|

|

|

|

See notes to financial statements.

|

|

GLOBAL INCOME FUND, INC.

|

STATEMENT OF CASH FLOWS

Six Months Ended June 30, 2011 (Unaudited)

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

Net increase in net assets resulting from operations

|

|

$ |

2,519,790 |

|

|

Adjustments to reconcile change in net assets resulting from

|

|

|

|

|

|

operations to net cash provided by (used in) operating activities:

|

|

|

|

|

|

Proceeds from sales of long term investments

|

|

|

7,048,430 |

|

|

Purchase of long term investments

|

|

|

(5,074,804 |

) |

|

Purchases net of sales of short term investment

|

|

|

(1,537,980 |

) |

|

Unrealized appreciation of investments and foreign currencies

|

|

|

(431,639 |

) |

|

Net realized gain on sales of investments and foreign currencies

|

|

|

(1,275,043 |

) |

|

Amortization of premium net of accretion of discount of investments

|

|

|

20,195 |

|

|

Decrease in receivable for investments sold

|

|

|

198,669 |

|

|

Decrease in interest receivable

|

|

|

42,784 |

|

|

Decrease in dividends receivable

|

|

|

54,021 |

|

|

Decrease in other assets

|

|

|

7,692 |

|

|

Increase in accrued expenses

|

|

|

25,682 |

|

|

Increase in investment management fee payable

|

|

|

316 |

|

|

Decrease in administrative services payable

|

|

|

(1,312 |

) |

| |

|

|

|

|

|

Net cash provided by operating activities

|

|

|

1,596,831 |

|

| |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

Cash distributions paid

|

|

|

(955,653 |

) |

|

Repayment of bank line of credit

|

|

|

(854,520 |

) |

| |

|

|

|

|

|

Net cash used in financing activities

|

|

|

(1,810,173 |

) |

| |

|

|

|

|

|

Net change in cash

|

|

|

(213,342 |

) |

| |

|

|

|

|

|

CASH

|

|

|

|

|

|

Beginning of period

|

|

|

218,342 |

|

| |

|

|

|

|

|

End of period

|

|

$ |

5,030 |

|

| |

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

|

|

|

|

|

Cash paid for interest and fees on bank credit facility

|

|

$ |

2,488 |

|

|

Non-cash financing activities not included herein consisted

|

|

|

|

|

|

of reinvestment of distributions

|

|

$ |

7,981 |

|

|

See notes to financial statements.

|

|

GLOBAL INCOME FUND, INC.

|

NOTES TO FINANCIAL STATEMENTS - JUNE 30, 2011 (UNAUDITED)

1. Organization and Significant Accounting Policies

Global Income Fund, Inc., a Maryland corporation registered under the Investment Company Act of 1940, as amended (the “Act”), is a non-diversified, closed end management investment company, whose shares are quoted over the counter under the ticker symbol GIFD. The Fund’s investment objectives are primarily to provide a high level of income and, secondarily, capital appreciation. The Fund retains CEF Advisers, Inc. as its Investment Manager.

The following is a summary of the Fund’s significant accounting policies:

Valuation of Investments – Portfolio securities are valued by various methods depending on the primary market or exchange on which they trade. Most equity securities for which the primary market is in the United States are valued at the official closing price, last sale price or, if no sale has occurred, at the closing bid price. Most equity securities for which the primary market is outside the United States are valued using the official closing price or the last sale price in the principal market in which they are traded. If the last sale price on the local exchange is unavailable, the last evaluated quote or closing bid price normally is used. Debt obligations with remaining maturities of 60 days or less are valued at cost adjusted for amortization of premiums and accretion of discounts. Certain of the securities in which the Fund may invest are priced through pricing services that may utilize a matrix pricing system which takes into consideration factors such as yields, prices, maturities, call features, and ratings on comparable securities. Bonds may be valued according to prices quoted by a bond dealer that offers pricing services. Open end investment companies are valued at their net asset value. Foreign securities markets may be open on days when the U.S. markets are closed. For this reason, the value of any foreign securities owned by the Fund could change on a day when stockholders cannot buy or sell shares of the Fund. Securities for which market quotations are not readily available or reliable and other assets may be valued as determined in good faith by the Investment Manager under the direction of or pursuant to procedures established by the Fund’s Board of Directors, called “fair value pricing.” Due to the inherent uncertainty of valuation, fair value pricing values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. A security’s valuation may differ depending on the method used for determining value. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ from the net asset value that would be calculated using market prices.

Foreign Currency Translation – Securities denominated in foreign currencies are translated into U.S. dollars at prevailing exchange rates. Realized gain or loss on sales of such investments in local currency terms is reported separately from gain or loss attributable to a change in foreign exchange rates for those investments.

Foreign Currency Contracts – Forward foreign currency contracts are marked to market and the change in market value is recorded by the Fund as an unrealized gain or loss. When a contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably.

Investments in Other Investment Companies – The Fund may invest in shares of other investment companies (the “Acquired Funds”) in accordance with the Act and related rules. Shareholders in the Fund bear the pro rata portion of the fees and expenses of the Acquired Funds in addition to the Fund’s expenses. Expenses incurred by the Fund that are disclosed in the Statement of Operations do not include fees and expenses incurred by the Acquired Funds. The fees and expenses of the Acquired Funds are reflected in the Fund’s total returns.

Short Sales – The Fund may sell a security it does not own in anticipation of a decline in the value of the security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker/dealer through which it made the short sale. The Fund is liable for any dividends or interest paid on securities sold short. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale. Securities sold short result in off balance sheet risk as the Fund’s ultimate obligation to satisfy the terms of the sale of securities sold short may exceed the amount recognized in the Statement of Assets and Liabilities.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (CONTINUED)

Investment Transactions – Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Realized gains or losses are determined by specifically identifying the cost basis of the investment sold.

Investment Income – Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is notified. Taxes withheld on income from foreign securities have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Expenses – Expenses deemed by the Investment Manager to have been incurred solely by the Fund are charged to the Fund. Expenses deemed by the Investment Manager to have been incurred jointly by the Fund and one or more of the other investment companies for which the Investment Manager and its affiliates serve as investment manager (the “Fund Complex”) or other entities are allocated on the basis of relative net assets, except where a more appropriate allocation can be made fairly in the judgement of the Investment Manager.

Expense Reduction Arrangement – Through arrangements with the Fund’s custodian and cash management bank, credits realized as a result of uninvested cash balances are used to reduce custodian expenses. No credits were realized by the Fund during the period covered by this report.

Distributions to Shareholders – Distributions to shareholders are determined in accordance with income tax regulations and recorded on the ex-dividend date.

Income Taxes – No provision has been made for U.S. income taxes because the Fund’s current intention is to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute to its shareholders substantially all of its taxable income and net realized gains. Foreign securities held by the Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has reviewed its tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on federal, state, and local income tax returns for open tax years (2008 – 2010), or expected to be taken in the Fund’s 2011 tax returns.

Use of Estimates – In preparing financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”), management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

2. Fees and Transactions with Related Parties

The Fund retains the Investment Manager pursuant to an Investment Management Agreement (“IMA”). Under the terms of the IMA, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at an annual rate of 7/10 of 1% of the first $50 million, 5/8 of 1% over $50 million to $150 million, and 1/2 of 1% over $150 million. Certain officers and directors of the Fund are officers and directors of the Investment Manager. Pursuant to the IMA, the Fund reimburses the Investment Manager for providing at cost certain administrative services comprised of compliance and accounting services. For the six months ended June 30, 2011, the Fund incurred total administrative costs of $23,775, comprised of $15,525 and $8,250 for compliance and accounting services, respectively.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (CONTINUED)

3. Distributions to Shareholders and Distributable Earnings

The tax character of distributions paid to shareholders for the year ended December 31, 2010 in the amount of $1,630,219 was comprised of ordinary income.

The Fund paid distributions totaling $963,634 for the six months ended June 30, 2011. The classification of these distributions for federal income tax purposes will be determined after the Fund’s fiscal year ending December 31, 2011.

As of December 31, 2010, the components of distributable earnings on a tax basis were as follows:

|

Undistributed net investment income

|

|

$ |

34,368 |

|

|

Unrealized appreciation on investments and foreign currencies

|

|

|

5,311,261 |

|

|

Capital loss carryovers

|

|

|

(1,545,908 |

) |

| |

|

$ |

3,799,721 |

|

Federal income tax regulations permit post-October net capital losses, if any, to be deferred and recognized on the tax return of the next succeeding taxable year.

GAAP requires certain components of net assets to be classified differently for financial reporting than for tax reporting purposes. These differences have no effect on net assets or net asset value per share. These differences, which may result in distribution reclassifications, are primarily due to differences in treatment of foreign currency transactions. As of December 31, 2010, the Fund recorded the following financial reporting adjustments to the identified accounts to reflect those differences.

|

Increase in

|

|

|

Increase in

|

|

|

|

|

|

Undistributed

|

|

|

Net Realized Loss on

|

|

|

Increase in

|

|

|

Net Investment Income

|

|

|

Investments and Foreign Currencies

|

|

|

Paid in Capital

|

|

| $ |

7,677 |

|

|

$ |

(7,677 |

) |

|

$ |

0 |

|

At December 31, 2010, the Fund had a net capital loss carryover of $1,545,908 which expires in 2017, that may be used to offset future realized capital gains for federal income tax purposes.

4. Fair Value Measurements

GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

• Level 1 – unadjusted quoted prices in active markets for identical assets or liabilities including securities actively traded on a securities exchange.

• Level 2 – observable inputs other than quoted prices included in level 1 that are observable for the asset or liability which may include quoted prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

• Level 3 – unobservable inputs for the asset or liability including the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for investments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (CONTINUED)

The inputs or methodology used for valuing investments are not an indication of the risk associated with investing in those securities.

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows:

Equity securities (common and preferred stock). Equity securities traded on a national securities exchange or market are stated normally at the official closing price, last sale price or, if no sale has occurred, at the closing bid price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they may be categorized in level 1 of the fair value hierarchy. Preferred stock and other equities on inactive markets or valued by reference to similar instruments may be categorized in level 2.

Debt securities. The fair value of debt securities is estimated using various techniques, which may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Although most debt securities may be categorized in level 2 of the fair value hierarchy, in instances where lower relative weight is place on transaction prices, quotations, or similar observable inputs, they may be categorized in level 3.

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund’s assets. Refer to the Schedule of Portfolio Investments for detailed information on specific investments.

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closed end funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

$ |

22,404,182 |

|

|

$ |

--- |

|

|

$ |

--- |

|

|

$ |

22,404,182 |

|

|

Debt securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia

|

|

|

--- |

|

|

|

1,078,638 |

|

|

|

--- |

|

|

|

1,078,638 |

|

|

Canada

|

|

|

--- |

|

|

|

2,003,235 |

|

|

|

--- |

|

|

|

2,003,235 |

|

|

Cyprus

|

|

|

--- |

|

|

|

689,977 |

|

|

|

--- |

|

|

|

689,977 |

|

|

Mexico

|

|

|

--- |

|

|

|

1,141,500 |

|

|

|

--- |

|

|

|

1,141,500 |

|

|

Netherlands

|

|

|

--- |

|

|

|

1,468,742 |

|

|

|

--- |

|

|

|

1,468,742 |

|

|

South Korea

|

|

|

--- |

|

|

|

545,096 |

|

|

|

--- |

|

|

|

545,096 |

|

|

United States

|

|

|

--- |

|

|

|

136,277 |

|

|

|

--- |

|

|

|

136,277 |

|

|

Closed end fund business development companies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

6,665,921 |

|

|

|

--- |

|

|

|

--- |

|

|

|

6,665,921 |

|

|

Preferred stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

746,020 |

|

|

|

--- |

|

|

|

--- |

|

|

|

746,020 |

|

|

Money market fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

1,511,409 |

|

|

|

--- |

|

|

|

--- |

|

|

|

1,511,409 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments, at value

|

|

$ |

31,327,532 |

|

|

$ |

7,063,465 |

|

|

$ |

--- |

|

|

$ |

38,390,997 |

|

There were no transfers between level 1 and level 2 during the six months ended June 30, 2011.

5. Investment Transactions

Purchases and proceeds from sales/repayments/maturities of investment securities, excluding short term securities, aggregated $5,074,084 and $7,048,430, respectively, for the six months ended June 30, 2011. At June 30, 2011, for federal income tax purposes, the aggregate cost of securities was $32,750,286 and net unrealized appreciation was $5,640,711, comprised of gross unrealized appreciation of $5,755,477 and gross unrealized depreciation of $114,766.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED) (CONTINUED)

6. Bank Credit Facility

Effective April 1, 2011, the Fund and certain other funds in the Fund Complex (the “Borrowers”) entered into a committed secured line of credit facility, which is subject to annual renewal, with State Street Bank and Trust Company (“SSB”), the Fund’s custodian. The aggregate amount of the credit facility is $30,000,000. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. SSB will make revolving loans to a Borrower not to exceed in the aggregate outstanding at any time with respect to any one Borrower the least of 30% of the total net assets (as defined in the line of credit facility) of a Borrower, the maximum amount permitted pursuant to each Borrower’s investment policies, or as permitted under the Act. The commitment fee on this facility is 0.15% per annum on the unused portion of the commitment, based on a 360 day year. All loans under this facility will be available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days), each as in effect from time to time, plus 1.10% per annum, calculated on the basis of actual days elapsed for a 360 day year. Prior to April 1, 2011, the aggregate amount of the credit facility was $10,000,000 and all the loans under this facility was available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days) plus 1.50% per annum. At June 30, 2011, there were investment securities pledged as collateral with a value of $5,271,303 and there were no outstanding borrowings under the credit facility. For the six months ended June 30, 2011, the Fund’s weighted average interest rate under the credit facility was 1.74% based on its balances outstanding during the period and the Fund’s average daily amount outstanding during the period was $27,986.

7. Foreign Securities Risk

Investments in the securities of foreign issuers involve special risks, including changes in foreign exchange rates and the possibility of future adverse political and economic developments, which could adversely affect the value of such securities. Moreover, securities in foreign issuers and markets may be less liquid and their prices more volatile than those of U.S. issuers and markets.

8. Capital Stock

At June 30, 2011, there were 7,413,974 shares of $.01 par value common stock outstanding (20,000,000 shares authorized). The shares issued and resulting increase in paid in capital in connection with reinvestment of distributions for the six months ended June 30, 2011 and the year ended December 31, 2010 were as follows:

| |

|

2011

|

|

|

2010

|

|

|

Shares issued

|

|

|

1,879 |

|

|

|

3,212 |

|

|

Increase in paid in capital

|

|

$ |

7,981 |

|

|

$ |

12,144 |

|

9. Share Repurchase Program

In accordance with Section 23(c) of the Act, the Fund may from time to time repurchase its shares in the open market at the discretion of and upon such terms as the Board of Directors shall determine. During the six months ended June 30, 2011 and the year ended December 31, 2010, the Fund did not repurchase any of its shares.

10. Contingencies

The Fund indemnifies its officers and directors from certain liabilities that might arise from their performance of their duties for the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as it involves future claims that may be made against the Fund under circumstances that have not occurred.

The Fund may at times raise cash for investment by issuing shares through one or more offerings, including rights offerings. Proceeds from any such offerings will be invested in accordance with the investment objectives and policies of the Fund.

12. Subsequent Events

The Fund has evaluated subsequent events through the date the financial statements were issued and determined that no subsequent events have occurred that require additional disclosure in the financial statements.

FINANCIAL HIGHLIGHTS (UNAUDITED)

| |

|

Six Months

|

|

|

|

|

| |

|

Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Operating Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(for a share outstanding throughout each period)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period

|

|

$ |

5.00 |

|

|

$ |

4.43 |

|

|

$ |

3.64 |

|

|

$ |

4.60 |

|

|

$ |

4.38 |

|

|

$ |

4.33 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (1)

|

|

|

.11 |

|

|

|

.20 |

|

|

|

.21 |

|

|

|

.19 |

|

|

|

.13 |

|

|

|

.13 |

|

|

Net realized and unrealized gain (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on investments

|

|

|

.23 |

|

|

|

.59 |

|

|

|

.82 |

|

|

|

(.91 |

) |

|

|

.31 |

|

|

|

.20 |

|

|

Total income from investment operations

|

|

|

.34 |

|

|

|

.79 |

|

|

|

1.03 |

|

|

|

(.72 |

) |

|

|

.44 |

|

|

|

.33 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less distributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

(.13 |

) |

|

|

(.22 |

) |

|

|

(.24 |

) |

|

|

(.24 |

) |

|

|

(.17 |

) |

|

|

(.13 |

) |

|

Return of capital

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

- |

|

|

|

(.05 |

) |

|

|

(.15 |

) |

|

Total distributions

|

|

|

(.13 |

) |

|

|

(.22 |

) |

|

|

(.24 |

) |

|

|

(.24 |

) |

|

|

(.22 |

) |

|

|

(.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of period

|

|

$ |

5.21 |

|

|

$ |

5.00 |

|

|

$ |

4.43 |

|

|

$ |

3.64 |

|

|

$ |

4.60 |

|

|

$ |

4.38 |

|

|

Market value, end of period

|

|

$ |

4.21 |

|

|

$ |

4.17 |

|

|

$ |

3.65 |

|

|

$ |

2.70 |

|

|

$ |

3.90 |

|

|

$ |

4.18 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on net asset value

|

|

|

7.42 |

% |

|

|

19.60 |

% |

|

|

31.03 |

% |

|

|

(14.94 |

)% |

|

|

11.00 |

% |

|

|

8.43 |

% |

|

Based on market price

|

|

|

4.07 |

% |

|

|

21.07 |

% |

|

|

45.55 |

% |

|

|

(25.58 |

)% |

|

|

(1.39 |

)% |

|

|

13.43 |

% |

|

Ratios/Supplemental Data (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (000’s omitted)

|

|

$ |

38,635 |

|

|

$ |

37,071 |

|

|

$ |

32,813 |

|

|

$ |

26,979 |

|

|

$ |

34,057 |

|

|

$ |

32,362 |

|

|

Ratio of total expenses to average net assets

|

|

|

1.45 |

%* |

|

|

2.00 |

% |

|

|

1.62 |

% |

|

|

1.68 |

% |

|

|

1.77 |

% |

|

|

1.89 |

% |

|

Ratio of net expenses to average net assets

|

|

|

1.45 |

%* |

|

|

2.00 |

% |

|

|

1.62 |

% |

|

|

1.68 |

% |

|

|

1.77 |

% |

|

|

1.89 |

% |

|

Ratio of net expenses excluding loan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest and fees to average net assets

|

|

|

1.44 |

%* |

|

|

1.96 |

% |

|

|

1.56 |

% |

|

|

1.66 |

% |

|

|

1.75 |

% |

|

|

1.87 |

% |

|

Ratio of net investment income to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

average net assets

|

|

|

4.26 |

%* |

|

|

4.33 |

% |

|

|

5.23 |

% |

|

|

4.31 |

% |

|

|

2.91 |

% |

|

|

2.71 |

% |

|

Portfolio turnover rate

|

|

|

14 |

% |

|

|

55 |

% |

|

|

48 |

% |

|

|

21 |

% |

|

|

10 |

% |

|

|

17 |

% |

|

(1)

|

The per share amounts were calculated using the average number of common shares outstanding during the period.

|

|

(2)

|

Total return on a market value basis is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Generally, total return on a net asset value basis will be higher than total return on a market value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return on a net asset value basis will be lower than total return on a market value basis in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total return calculated for a period of less than one year is not annualized. The calculation does not reflect brokerage commissions, if any.

|

|

(3)

|

Expense and income ratios for 2008, 2009, 2010, and 2011 do not include expenses incurred by the Acquired Funds in which the Fund invests.

|

* Annualized.

|

GLOBAL INCOME FUND, INC.

|

|

See notes to financial statements.

|

| The additional information below and on the following pages is supplemental and not part of the unaudited financial statements of the Fund. |

BOARD OF DIRECTORS’ ANNUAL APPROVAL OF THE INVESTMENT MANAGEMENT AGREEMENT

The investment management agreement (the “Agreement”) between Global Income Fund, Inc. (the “Fund”) and the investment manager, CEF Advisers, Inc. (the “Investment Manager”), generally provides that the Agreement shall continue automatically for successive periods of twelve months each, provided that such continuance is specifically approved at least annually (i) by a vote of a majority of the Directors of the Fund who are not parties to the Agreement, or interested persons of any such party and (ii) by the Board of Directors of the Fund or by the vote of the holders of a majority of the outstanding voting securities of the Fund.

In considering the annual approval of the Agreement, the Board of Directors considered all relevant factors, including, among other things, information that had been provided at other Board meetings, as well as information furnished to the Board for the meeting held on March 8, 2011 to specifically consider the continuance of the Agreement. Such information included, among other things, the following: information comparing the management fees of the Fund with those of a peer group of broadly comparable funds; information regarding Fund investment performance in comparison to a relevant peer group of funds; the economic outlook and the general investment outlook in relevant investment markets; the Investment Manager’s results and financial condition and the overall organization of the Investment Manager; the allocation of brokerage and the benefits received by the Investment Manager as a result of brokerage allocation; the Investment Manager’s trading practices, including soft dollars; the Investment Manager’s management of relationships with custodians, transfer agents, pricing agents, brokers, and other service providers; the resources devoted to the Investment Manager’s compliance efforts undertaken on behalf of the Fund and the record of compliance with the compliance programs of the Fund and the Investment Manager, and their relevant affiliates; the quality, nature, cost, and character of the administrative and other non-investment management services provided by the Investment Manager and its affiliates; the terms of the Agreement; the Investment Manager’s gifts and entertainment log; and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein. The Board of Directors concluded that the Investment Manager is using soft dollars for the benefit of the Fund and its shareholders. The directors further concluded that the Investment Manager is using the Fund’s assets for the benefit of the Fund and its shareholders and is acting in the best interests of the Fund.

The Board of Directors also considered the nature, extent, and quality of the management services provided by the Investment Manager. In so doing, the Board considered the Investment Manager’s management capabilities with respect to the types of investments held by the Fund, including information relating to the education, experience, and number of investment professionals and other personnel who provide services under the Agreement. The Board also took into account the time and attention to be devoted by management to the Fund. The Board evaluated the level of skill required to manage the Fund and concluded that the resources available at the Investment Manager were appropriate to fulfill effectively its duties on behalf of the Fund. The directors also noted that the Investment Manager has managed the Fund for several years and indicated their belief that during the long relationship the Investment Manager had demonstrated being conscientious and capable in the best interests of the Fund.

The Board then received information concerning the investment philosophy and investment process applied by the Investment Manager in managing the Fund. In this regard, the Board considered the Investment Manager’s in-house research capabilities as well as other resources available to the Investment Manager’s personnel, including research services that may be available to the Investment Manager as a result of securities transactions effected for the Fund. The Board concluded that the Investment Manager’s investment process, research capabilities, and philosophy were well suited to the Fund, given the Fund’s investment objective and policies.

In their review of comparative information with respect to Fund investment performance, the Board received comparative information, comparing the Fund’s performance to that of a peer group of investment companies pursuing broadly similar strategies.

|

Additional Information (Unaudited)

|

|

GLOBAL INCOME FUND, INC.

|

With respect to their review of the fee payable under the Agreement, the Board considered information comparing the Fund’s management fee and expense ratio to those of a peer group of broadly comparable funds. The Board considered the mean and median of the management fees and expense ratios of the peer group. The Board also considered the profitability of the Investment Manager from its association with the Fund. In reviewing the information regarding the expense ratio of the Fund, the Board noted that its expense ratio was lower than its peer group median, and competitive with comparable funds in light of the quality of services received and the assets managed. The Board also evaluated any apparent or anticipated economies of scale in relation to the services the Investment Manager provides to the Fund. The Board considered that the Fund is a closed end fund that does not continuously offer shares and that, without daily inflows and outflows of capital, there are limited opportunities for significant economies of scale to be realized by the Investment Manager in managing the Fund’s assets.

In addition to the factors mentioned above, the Board considered the fiduciary duty assumed by the Investment Manager in connection with the services rendered to the Fund and the business reputation of the Investment Manager and its financial resources. The Board also considered information regarding the character and amount of other incidental benefits received by the Investment Manager and its affiliates from their association with the Fund. The Board concluded that potential “fall-out” benefits that the Investment Manager and its affiliates may receive, such as greater name recognition, affiliated brokerage commissions, or increased ability to obtain research services, appear to be reasonable, and may, in some cases, benefit the Fund. The Board concluded that in light of the services rendered, the profits realized by the Investment Manager are not unreasonable.

The Board considered all relevant factors and did not consider any single factor as controlling in determining whether or not to renew the Agreement. In assessing the information provided by the Investment Manager and its affiliates, the Board also noted that they were taking into consideration the benefits to shareholders of investing in a fund that is part of a fund complex which provides a variety of shareholder services.

Based on their consideration of the foregoing factors and conclusions, and such other factors and conclusions as they deemed relevant, and assisted by counsel, the Board concluded that the approval of the Agreement, including the fee structure, is in the best interests of the Fund.

|

GLOBAL INCOME FUND, INC.

|

|

Additional Information (Unaudited)

|

INVESTMENT OBJECTIVES AND POLICIES

The Fund’s primary investment objective of providing a high level of income is fundamental and may not be changed without shareholder approval. The Fund is also subject to certain investment restrictions, set forth in its most recently effective Statement of Additional Information, that are fundamental and cannot be changed without shareholder approval. The Fund’s secondary investment objective of capital appreciation and the other investment policies described herein, unless otherwise stated, are not fundamental and may be changed by the Board of Directors without shareholder approval. Notice to shareholders of any change in the Fund’s secondary investment objective will be provided as required by law.

PROXY VOTING

The Fund’s Proxy Voting Guidelines, as well as its voting record for the most recent 12 months ended June 30, are available without charge by calling the Fund collect at 1-212-344-6310, on the Securities and Exchange Commission (“SEC”) website at www.sec.gov, and on the Fund’s website at www.GlobalIncomefund.net.

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund makes the Forms N-Q available on its website at www.GlobalIncomeFund.net.

GLOBALINCOMEFUND.NET

Visit us on the web at www.GlobalIncomeFund.net. The site provides information about the Fund, including market performance, net asset value, dividends, press releases, and shareholder reports. For further information, please email us at info@GlobalIncomeFund.net.

MANAGED DISTRIBUTIONS