8-K: Current report filing

Published on November 19, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): November 19, 2019 (November 19, 2019)

GLOBAL SELF STORAGE, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Maryland

|

001-12681

|

13-3926714

|

|

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number)

|

(IRS Employer Identification No.)

|

11 Hanover Square, 12th Floor

New York, NY 10005

(Address of principal executive offices) (Zip Code)

(212) 785-0900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

◻ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

◻ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

◻ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

◻ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ◻

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ◻

Item 2.01 Completion of Acquisition or Disposition of Assets.

We refer to our Current Report on Form 8-K filed on October 8, 2019 (the “Prior Form 8-K”). As indicated in the Prior Form 8-K, on October 4, 2019, Global Self Storage, Inc. (the “Company”), through a wholly-owned

subsidiary, entered into an agreement with Erie Station Storage, LLC to acquire a self-storage property located in West Henrietta, New York (the “Property”) for the sum of $6,200,000.

On November 19, 2019, the Company completed the acquisition of the Property. The Company funded the purchase price of the Property acquisition using borrowings under the Company’s revolving credit facility.

In connection with the acquisition of the Property, the Company is including the financial statements and pro forma financial information required by Item 9.01 of Form 8-K.

On November 19, 2019, the Company issued a press release in connection with the acquisition of the Property. A copy of the press release is filed as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Company believes that certain statements in the information attached as Exhibit 99.1 may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements are made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made. Actual results may differ materially from those expressed or implied. Information

concerning factors that could cause actual results to differ materially from those in forward-looking statements is contained from time to time in the Company’s filings with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

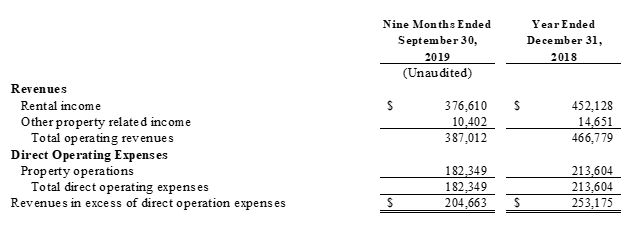

Historical Summaries of Revenue and Direct Operating Expenses of the Property for the Nine Months Ended September 30, 2019 (unaudited) and for the Year Ended December

31, 2018

|

F-2

|

|

Notes to the Historical Summaries of Revenue and Direct Operating Expenses of the Property

|

F-3

|

|

Neither we nor any of our affiliates are related to the seller of the Property. In acquiring the Property described above, the Company evaluated, among other things,

sources of revenue (including, but not limited to, competition in the rental market, comparative rents and occupancy rates) and expense (including, but not limited to, utility rates, ad valorem tax rates, maintenance expenses and anticipated

capital improvements).

The results of the interim period are not necessarily indicative of the results to be obtained for the full fiscal year. However, after reasonable inquiry, management

is not aware of any material factors affecting the Property that would cause the reported financial information not to be necessarily indicative of its future operating results.

|

(b) Pro Forma Financial Information.

|

|

Page

|

|

Unaudited Pro Forma Condensed Consolidated Financial Information

|

F-5

|

|

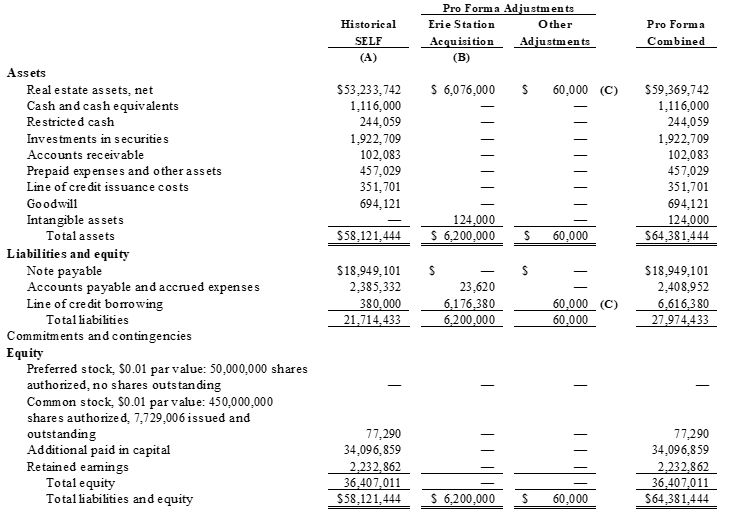

Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2019

|

F-6

|

|

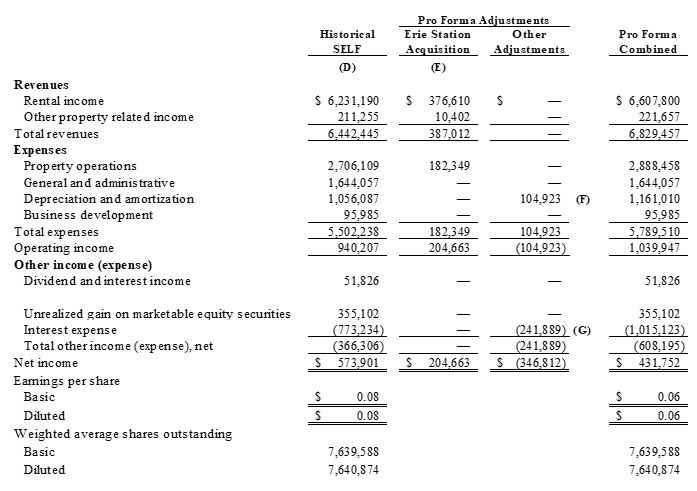

Unaudited Pro Forma Condensed Consolidated Statement of Operations for the Nine Months Ended September 30, 2019

|

F-7

|

|

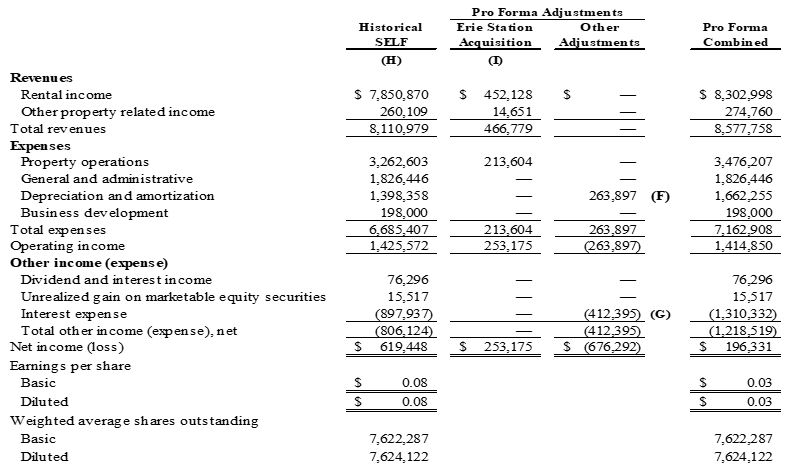

Unaudited Pro Forma Condensed Consolidated Statement of Operations for the Year Ended December 31, 2018

|

F-8

|

|

Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements

|

F-9

|

(c) Not applicable.

(d) Exhibits.

|

Exhibit No.

|

Description

|

|

|

23.1

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

99.1

|

Global Self Storage, Inc. West Henrietta Property Acquisition Press Release, dated November 19, 2019.

|

Report of Independent Registered Public Accounting Firm

To Board of Directors and Shareholders

Global Self Storage, Inc.

New York, New York

Opinion on the Financial Statement

We have audited the accompanying Historical Summary of Revenue and Direct Operating Expenses (the “Historical Summary”) of the self-storage property (the “Erie Station Property”) as described in Note 1 for the year ended December 31, 2018 and the

related notes to the financial statement (collectively referred to as the financial statement). In our opinion, the financial statement presents fairly, in all material respects, the revenue and direct operating expenses described in Note 1 of

the Erie Station Property for the year ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Emphasis of Matter

As described in Note 1 to the Historical Summary, the Historical Summary of Revenue and Direct Operating Expenses has been prepared for the purpose of complying with the rules and regulations

of the Securities and Exchange Commission, and is not intended to be a complete presentation of the Erie Station Property’s revenue and expenses. Our opinion is not modified with respect to this matter.

Basis for Opinion

This financial statement is the responsibility of Erie Station Property’s management. Our responsibility is to express an opinion on this financial

statement based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to Erie Station Property in accordance with the

U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as Erie Station Property’s auditor since 2019.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statement is free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statement, whether due to

error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statement. Our audit also included evaluating the

accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statement. We believe that our audit provides a reasonable basis for our opinion.

/s/ Tait, Weller & Baker LLP

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

November 19, 2019

F-1

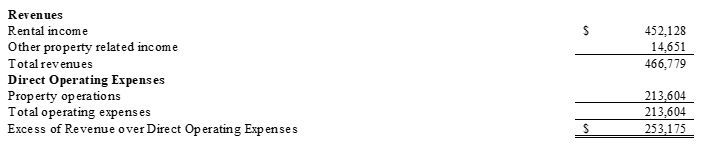

Historical Summaries of Revenue and Direct Operating Expenses of the

Erie Station Property (as described in Note 1)

For the Nine Months Ended September 30, 2019 (unaudited) and the Year Ended December 31, 2018

Erie Station Property (as described in Note 1)

For the Nine Months Ended September 30, 2019 (unaudited) and the Year Ended December 31, 2018

See notes to Historical Summaries of Revenue and Direct Operating Expenses.

F-2

Notes to Historical Summaries of Revenue and Direct Operating Expenses of the

Erie Station Property (as described in Note 1)

Erie Station Property (as described in Note 1)

|

1.

|

Basis of Presentation

|

On November 19, 2019, Global Self Storage, Inc. (the “Company”) completed the acquisition of a self storage facility located in West Henrietta, New York (the “Erie Station Property”) for aggregate cash consideration of

approximately $6,200,000. The property was acquired from Erie Station Storage, LLC.

The accompanying Historical Summaries of Revenue and Direct Operating Expenses (the "Historical Summaries") have been prepared for the purpose of complying with certain rules and regulations of the Securities and

Exchange Commission and are not intended to be a complete presentation of the Erie Station Property revenue and expenses. The Historical Summaries have been prepared on the accrual basis of accounting and as such, requires management to make

estimates and assumptions that affect the reported amounts of the revenues and expenses during the period presented. Actual results may differ from those estimates.

The unaudited interim Historical Summary of Revenue and Direct Operating Expenses for the period January 1, 2019 through September 30, 2019, was prepared on the same basis as the Historical Summary of Revenue and

Direct Operating Expenses for the year ended December 31, 2018, and reflects all adjustments, consisting of only normal recurring adjustments, which are, in the opinion of management necessary for a fair presentation of the results of the unaudited

interim period. The results of the unaudited interim period are not necessarily indicative of the expected results for the entire fiscal year.

|

2.

|

Summary of Significant Accounting Policies

|

Revenue and Expense Recognition: Rental income is recorded when earned.

Property tax expense is based upon actual amounts billed and, in some circumstances, estimates and historical trends when bills or assessments have not been received from the taxing authorities or such bills and

assessments are in dispute. Cost of operations and general and administrative expense are expensed as incurred.

Other Property Related Income: Consists primarily of sales of storage-related merchandise and insurance premiums. Such income is recognized when earned.

Direct Operating Expenses: Direct operating expenses exclude certain costs that may not be comparable to the future operations of the Erie Station Property. Excluded items

primarily consist of interest expense, depreciation and amortization and other expenses not related to the future operations of the Erie Station Property.

Capital Improvements and Repairs and Maintenance: Expenditures for significant renovations or improvements that extend the useful life of assets are capitalized. Repair and

maintenance costs are expensed as incurred.

Income Taxes: The Company qualifies as a real estate investment trust under the Internal Revenue Code of 1986, as amended, and will generally not be subject to corporate income

taxes to the extent it distributes at least 90% of its taxable income to its stockholders and complies with certain other requirements. Accordingly, no provision has been made for federal income taxes in the accompanying Historical Summaries.

F-3

Use of Estimates: The preparation of the Historical Summaries in conformity with U.S. generally accepted accounting principles requires management to make estimates and

assumptions that affect the amounts reported in the Historical Summaries and accompanying notes. Actual results could differ from those estimates.

|

3.

|

Commitments and Contingencies

|

The Company's current practice is to conduct environmental investigations in connection with property acquisitions. At this time, the Company is not aware of any environmental contamination of the Erie Station Property

that individually or in the aggregate would be material to the Company's overall business, financial condition, or results of operations.

|

4.

|

Subsequent Events

|

The Company evaluated subsequent events through November 19, 2019, the date the financial statements were available to be issued.

F-4

Global Self Storage, Inc. Unaudited Pro Forma Condensed Consolidated Financial Information

Global Self Storage, Inc. a Maryland corporation (the “Company,” “we,” “our,” or “us”), is a self-administered and self-managed real estate investment trust (“REIT”) that owns, operates, manages, acquires, develops

and redevelops self storage properties (“stores” or “properties”) in the United States. The Company’s properties are located in the Northeast, Mid-Atlantic and Mid-West regions of the United States. The Company was formerly registered under the

Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, closed end management investment company. The Securities and Exchange Commission’s (“SEC”) order approving the Company’s application to deregister from the 1940 Act

was granted on January 19, 2016. On January 19, 2016, the Company changed its name to Global Self Storage, Inc. from Self Storage Group, Inc., changed its SEC registration from an investment company to an operating company reporting under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and listed its common stock on NASDAQ under the symbol “SELF”.

The Company has elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended (the “IRC”). To the extent the Company continues to qualify as a REIT, it will not be subject to tax, with certain

limited exceptions, on the taxable income that is distributed to its stockholders.

The Company invests in self storage properties by acquiring stores through its wholly owned subsidiaries. At September 30, 2019, the Company owned and operated eleven self storage properties. The Company operates

primarily in one segment: rental operations.

On November 19, 2019, the Company acquired a self storage property located in West Henrietta, New York (“Erie Station”), for a total purchase price of $6.2 million. The Company funded the purchase price of Erie

Station acquisition using borrowings under the Company’s revolving credit facility.

The accompanying unaudited pro forma condensed consolidated financial statements as of and for the nine months ended September 30, 2019 and for the year ended December 31, 2018 are derived from the historical

financial statements of the Company and the statements of revenue and certain expenses of the Erie Station acquisition.

The unaudited pro forma condensed consolidated balance sheet as of September 30, 2019 reflects adjustments to the Company’s unaudited historical financial data to give effect to the Erie Station acquisition as if the

transaction had occurred on September 30, 2019.

The unaudited pro forma condensed consolidated statement of operations for the nine months ended September 30, 2019 and for the year ended December 31, 2018 reflect adjustments to the Company’s historical financial

data to give pro forma effect to the Erie Station acquisition as if the transaction had occurred on January 1, 2018. Additionally, the pro form condensed consolidated statement of operations give effect to (i) an increase in interest expense and

(ii) the estimated incremental depreciation and amortization expense for periods that the Erie Station acquisition is included in the pro forma results but excluded from the Company’s historical statements of operations.

The unaudited pro forma adjustments are based on available information. The unaudited pro forma condensed consolidated financial information is not necessarily indicative of what the Company’s actual financial

position or results of operations for the period would have been as of the date and for the periods indicated, nor does it purport to represent the Company’s future financial position or results of operations. The unaudited pro forma condensed

consolidated financial information should be read, together with the notes thereto, in conjunction with the more detailed information contained in the historical financial statements referenced in this filing.

F-5

GLOBAL SELF STORAGE, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

September 30, 2019

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

September 30, 2019

F-6

GLOBAL SELF STORAGE, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Nine Months Ended September 30, 2019

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Nine Months Ended September 30, 2019

F-7

GLOBAL SELF STORAGE, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended December 31, 2018

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended December 31, 2018

F-8

GLOBAL SELF STORAGE, INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. BASIS OF PRESENTATION

The Company’s financial statements include the Company and its wholly-owned subsidiaries. All material intercompany balances and transactions have been eliminated in consolidation.

2. ADJUSTMENTS TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

(A) Reflects the historical unaudited condensed consolidated balance sheet of the Company as of September 30, 2019.

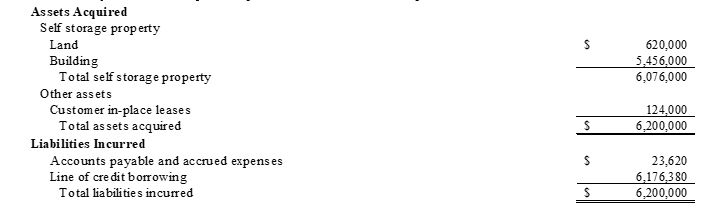

(B) The Company acquired the Erie Station self storage property for an aggregate purchase price of $6,200,000. Presented below is a summary that reflects the purchase price

allocation to the assets acquired and liabilities incurred.

(C) The Erie Station acquisition was accounted for as an asset acquisition and

accordingly approximately $60,000 of transactions costs related to the acquisition was capitalized as part of the basis of the acquired property. These costs will be paid with proceeds from borrowings under the Company’s revolving credit

facility and result in an increase in outstanding indebtedness in the unaudited pro forma condensed consolidated balance sheet at September 30, 2019.

3. ADJUSTMENTS TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(D) Reflects the historical unaudited condensed consolidated statement of operations of the Company for the nine months ended September 30, 2019.

(E) The table below reflects the revenue and certain expenses of the Erie Station acquisition for the nine months ended September 30, 2019. This information is derived from

the unaudited statement of revenue and certain expenses prepared for the purposes of complying with Rule 8-06 of Regulation S-X promulgated under the Securities Act of 1933, as amended (the “Securities Act”). This information reflects

management’s estimate of the revenue and certain expenses of the property prior to the property’s date of acquisition based on accounting and financial information provided by the seller to the Company as part of management’s standard due

diligence process in connection with the acquisition of such property.

F-9

(F) For the nine months ended September 30, 2019 and the year ended December 31, 2018, pro

forma adjustments of $104,923 and $263,897, respectively, are reflected for incremental depreciation and amortization of the Erie Station property.

(G) Pro forma adjustments for interest expense are required to reflect the pro forma debt

structure as if the Erie Station property had been owned for the entirety of the applicable periods. The Company assumed borrowings under the Company’s revolving credit facility for the purchase price of the Erie Station property with an

interest rate equal to 3.00% over the One Month U.S. Dollar London Inter-Bank Offered Rate.

(H) Reflects the historical condensed consolidated statement of operations of the Company

for the year ended December 31, 2018.

(I) The table below reflects the revenue and certain expenses of the Erie Station

acquisition for the year ended December 31, 2018. This information is derived from the statement of revenue and certain expenses prepared for the purposes of complying with Rule 8-06 of Regulation S-X promulgated under the Securities Act.

This information reflects management’s estimate of the revenue and certain expenses of the property prior to the property’s date of acquisition based on accounting and financial information provided by the seller to the Company as part of

management’s standard due diligence process in connection with the acquisition of such property.

F-10

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GLOBAL SELF STORAGE, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Mark C. Winmill

|

|

|

Name:

|

Mark C. Winmill

|

|

|

Title:

|

Chief Executive Officer

|

Date: November 19, 2019

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

23.1

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

99.1

|

Global Self Storage, Inc. West Henrietta Property Acquisition Press Release, dated November 19, 2019.

|